#BailoutWatch

Ford Takes the Gloves Off About the Bailouts

Wow. I don’t know if Ford is broadcasting this particular commercial [Ed: They are, although possibly not in the Detroit area], but it’s part of a series of ads that Fred Goss directed for Company Productions. The ads were set up by recruiting recent Ford buyers to come in and answer some market research questions. Those Ford owners did not know that they would be walking into a press conference with, apparently, real journalists [Ed: Huh?] asking them about their purchase. Company Productions released a video on the making of the ads. In this particular case Ford got lucky when a F-150 owner named Chris sat behind the microphone. Answering a reporter’s question, “Was buying American important to you?” Chris came up with something that advertising copy writers dream of writing.

Lipstick On A Bailout, 2.0

The U.S. jobless rate just rose to 9.1 percent. Employers added the fewest workers in eight months during May. The housing market is double-dipping. Only 16 month to go until the next presidential election. It’s the economy, stupid. The President has to do something. What does he do?

“President Obama’s visit to a Chrysler plant in Toledo, Ohio, on Friday was the culmination of a campaign to portray the auto bailouts as a brilliant success with no unpleasant side effects. “The industry is back on its feet,” the president said, “repaying its debt, gaining ground.”

If the government hadn’t stepped in and dictated the terms of the restructuring, the story goes, General Motors and Chrysler would have collapsed, and at least a million jobs would have been lost. The bailouts averted disaster, and they did so at remarkably little cost.”

He’s wrong, writes David Skeel, a professor of law at the University of Pennsylvania, in his op-ed piece in the Wall Street Journal.

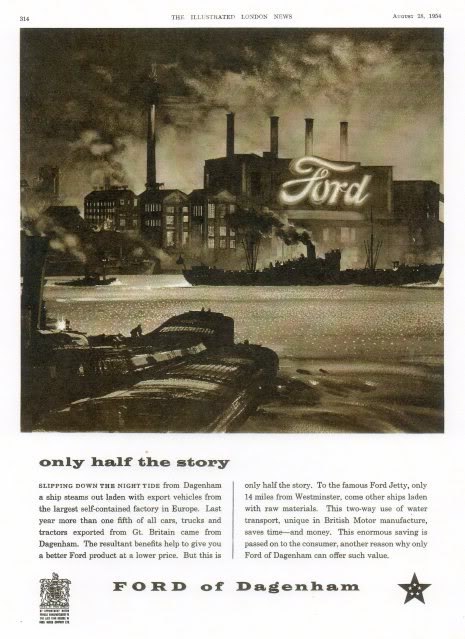

Blue Ops: The Clandestine Bailout Of Ford

One of the many reasons for Ford’s surging market share are Americans who refuse to buy a car from a company that has been bailed-out with their tax dollars. In survey after survey after survey, Americans took issue with the bailouts. The backlash was so severe that one of the first measures Joel Ewanick implemented at GM was to get rid of GM. He replaced “General Motors” with “the parent company.” Smart move: You can be against Government Motors. But who dares to be against parenthood?

Ford meanwhile rode high on the perception that they didn’t accept a single dollar. “Ford did not seek a government bailout,” says a very recent Rasmussen Report, “and 55 percent of Americans say they are more likely to buy a Ford car for that reason.”

Americans (and possibly GM and Chrysler) are the victims of a big lie, says Wall Street insider Eric Fry. And he has the numbers to back it up.

Majority Of Americans No Longer Oppose Auto Bailouts

Orion Workers To Picket UAW Over "Innovative" Labor Deal

I took some flack from TTAC’s Best and Brightest on Monday when I suggested that the UAW’s deal to give 40 percent of Orion Assemblys returning workers a 50 percent pay cut was “cowardly and despicable.” What I didn’t make clear enough was that I have no problem with the UAW working for a lower wage as long as the burden was spread evenly. Instead, the union has arbitrarily divided its existing workforce into the old guard “haves” and the relatively-recently-hired “have nots” as a ploy to make the union seem capable of profitably building subcompact cars in America. It’s bad enough to prop up the old guard by paying new hires less, but cramming down recalled Tier One workers is totally contrary to the very concept of a union. And I’m not the only one who finds the lack of solidarity and shared responsibility within the union troubling.

The Auto Bailout Explained

Ford Scores More European Aid

SEC Seeks Three-Year Securities Work Ban On Rattner

Somewhere under a “Mission Accomplished” banner on an aircraft carrier, former car czar Steve Rattner is starting to get a bit lonely. Reuters reports that the Securities and Exchange Commission is seeking a three year ban on Rattner that would prevent him from working in the securities field. The ban stems from a recently-settled investigation into kickback allegations at Rattner’s former investment firm Quadrangle Group (involving a distribution deal for his brother’s low-budget movie “Chooch,” no less).

Opel Aid Headed For Failure Again?

Technical experts analyzing GM’s request for $1.35b in Opel aid from the German government have reported back, and the signs aren’t looking good. According to the Financial Times, the experts advising a political committee that will rule on Opel aid next week returned a negative outlook on The General’s request. German officials tell the newspaper that

the technical experts’ stance was “formally not a complete No” but that it “meant No in practice”

GM is requesting €1.9b in loans for its €3.7b restructuring of Opel. Though it looks like the €1.2b ($1.35b) it is requesting from Germany will be turned down, some portion of that amount might still be awarded by local German state governments. If that scenario plays out though, more employment cuts could be in order for Opel’s German production staff.

Treasury Hires Lazard As GM Moves Towards IPO

The Detroit News reports that the Treasury Department has hired Lazard Frères & Co. as an advisor to GM’s forthcoming IPO sale. And with news of the hiring comes confirmation that GM’s IPO really is coming soon: the investment bank will receive half a million dollars, according to the DetN, but that amount will drop to $250,000 if the IPO isn’t completed within one year. If you’re one of the GM boosters who believes that an IPO will repay all or most of the government’s investment in GM, it’s time to start saving those pennies. You have less than a year now to put your money where your mouth has been.

GM Lost $4.3b In The Second Half Of 2009

GM has announced its “fresh-start” post-bankruptcy accounting results, and between July and December of last year, the bailed-out automaker lost $4.3b [press release here, full numbers here, in PDF format]. The loss comes despite $57.5b in global revenue, and $1b in “net cash provided by operating activities.” According to GM’s release:

The $4.3 billion net loss includes the pre-tax impact of a $2.6 billion settlement loss related to the UAW retiree medical plan and a $1.3 billion foreign currency re-measurement loss.

Of course, you have to dig into the numbers to find the bad news, like the $56.4b in “cost of sales,” or the $700m interest cost, or the 48 percent North American capacity utilization in 2009, or the 16.3 percent US car market share. Which is why we’ve included the consolidated statement of operations, consolidated balance sheets and more, for your no-download-necessary perusal, after the jump.

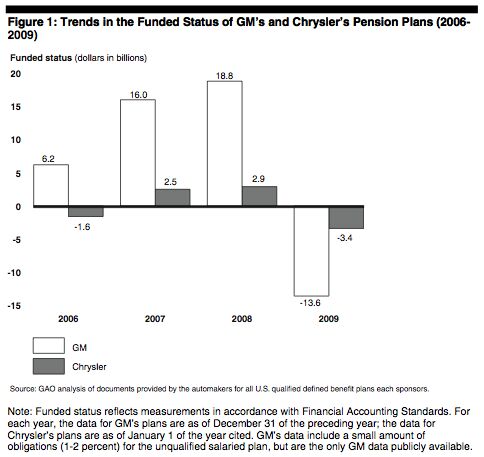

GAO: Pension Plans Will Kill Detroit. Again.

It would be impossible to blame Detroit’s decades-long decline on a single factor, but if one were to make a list, defined pension obligations to workers would be somewhere very near the top. Thanks in large part to the unionization of America’s auto industry, Detroit has groaned under the weight of crushing pension obligations since time immemorial. And, according to a new report by the Goveernment Accountability Office [ full report in PDF format available here], last year’s bailout of GM and Chrysler has not eliminated the existential threat that these obligations pose to the industry. In fact, the taxpayer’s “investment” in GM and Chrysler appears only to have exposed the public to even an greater risk of catastrophic pension plan failure.

GM, GMAC Go Their Own Ways

In their latest report, the Congressional Oversight Panel suggested that GM’s formerly captive finance arm GMAC shouldn’t have been split from the automaker it still supports. If this led you to believe that GM would take the troubled finance firm back under its corporate wing, you have another thought coming. The WSJ [sub] reports that

The idea appealed to GM, in part because auto maker would have more control over lending practices. GMAC’s move in 2008 to dramatically restrict leasing amid the U.S. financial crisis helped trigger the spiral that sent GM into bankruptcy the last year… But taking over GMAC would have many complications. GM sold a majority stake in GMAC in 2006 as a way to buck up the auto maker’s credit standing and its access to capital. As it turned out, GM still remains largely cut off from the markets.

Congress: The GMAC Bailout Might Have Been A Bad Idea

After three separate bailouts totaling over $17b, Congress is beginning to wonder if keeping auto-finance giant GMAC alive was worth it. Forbes reports that the Congressional Oversight Panel reckons at least $6.3b of that money could be gone forever, as GMAC flounders towards barely breaking even. And like the rest of the bailouts, the fundamental problem is that the influx of federal cash has allowed GMAC to pretend like it’s not struggling for survival. The panel report [ full document in PDF format here] notes [via Automotive News [sub]]

Treasury’s previous and current support is not underpinned by a mature business plan. Although GMAC and Treasury are working to produce a business plan, Treasury has already been supporting GMAC for over a year despite the plan’s absence. Given industry skepticism about GMAC’s path to profitability and the newness of the non-captive financing company model, it is critical that Treasury be given an opportunity to review concrete plans from GMAC as soon as possible.

Sound familiar?

Congressional Oversight Panel: Why Did We Bail Out GMAC Again?

The TARP bailout of GM finance partner GMAC is being criticized by a congressional oversight panel [full report in PDF format here], reports the Detroit Free Press. The panel alleges that the Treasury

has not yet articulated a specific and convincing reason to support the company… It has never stated that a GMAC failure would result in substantial negative consequences for the national economy. If Treasury has made such a determination, then it should say so publicly.

Recent Comments