The Auto Bailout Explained

While some have questioned why TARP was used to support the automotive industry, both the Bush and Obama Administrations determined that Treasury’s investments in the auto companies were

Translation: credit dependence killed the car companies. And from the 0% Red Toe Tag Sales to GM Daewoo’s $2b currency gambling loss, the glove fits. It’s a lesson that isn’t brought up often enough, and it’s one of the only passages of note in the Auto Industry Financing Program section of Treasury’s two-year TARP retrospective [ PDF here]. Otherwise, the document is swallowed up in accounting for the billions spent on banks, despite the fact that

We now have recovered most of the investments we made in the banks. Taxpayers will likely earn a profit on the investments the government made in banks and AIG, with TARP losses limited to

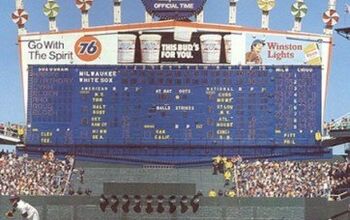

So, why not explain why projected auto rescue losses were reduced to $17b with more than just a footnote? [#2 on Figure 2-B shown above]

More by Edward Niedermeyer

Comments

Join the conversation

picard234: When self-interest comes up against ideology, do you really need to be reminded of the usual winner?

I'm still on the fence about the Fed bailout of any industry. I believe in the free market to right the wrongs - punish those who lied, cheated and stole (and most importantly those who knew it and looked the other way) in the system. Unfortunately we threw money at them in droves to save them. Consumers irresponsibly in the chase "material possessions" spent way more money than they made and borrowed against their homes and other property. We built up this system and we bailed it out meaning it will then gain steam again and go this route. However, if we did not bail them out - our recession likely would have be so much worse it would have become a true depression. No other Presidents (Bush and Obama) have had to deal with a market like this since the late 20's. I'm still on the fence about whether we should have gone this route. It seems that we are slightly better off in the short run with the bailouts to help stable the system - but we need to weed out the corruption in the financial system (let alone our Congress).