Subaru Didn't Plan to Sell Many Ascents, but Subaru's Expectations Were Far Too Modest

Subaru didn’t believe the Ascent would add much to the brand’s monthly U.S. sales totals.

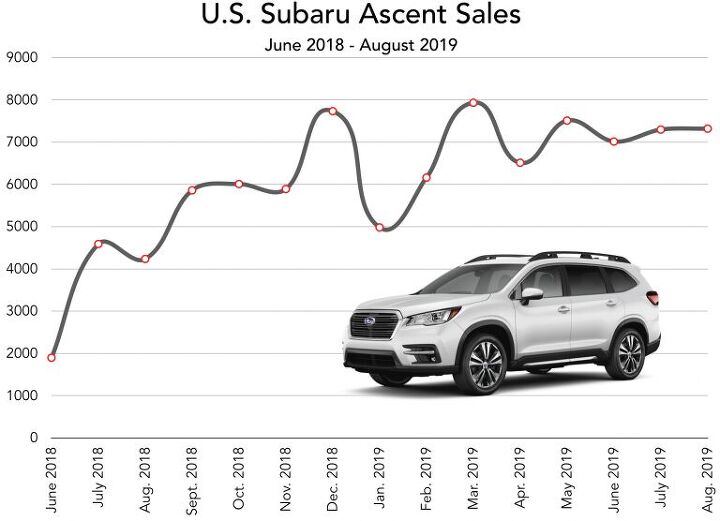

A year ago, it looked like Subaru’s forecasts were right on target. Roughly 5,000 U.S. sales per month? Check. Incremental brand-wide growth? Of course. Negligible impact on competitors? Indeed.

But the Ascent’s early capacity for helping Subaru keep its loyal customers loyal has evolved into something quite a bit more useful for the constantly-growing Japanese brand. Ascent volume is rising, rapidly so, and Subaru’s unparalleled streak of year-over-year sales growth – now at 93 consecutive months – now appears in little danger of collapsing.

That’s not to say the Ascent isn’t still pulling buyers over from the Outback and Forester. It was, after all, always Subaru’s intention that the Ascent do just that. Then CEO Yasuyuki Yoshinaga said in April 2017 that the Ascent wasn’t going to be a conquest vehicle; it would instead be a vehicle that kept growing families from leaving the Subaru brand when they began their hunt for a three-row vehicle.

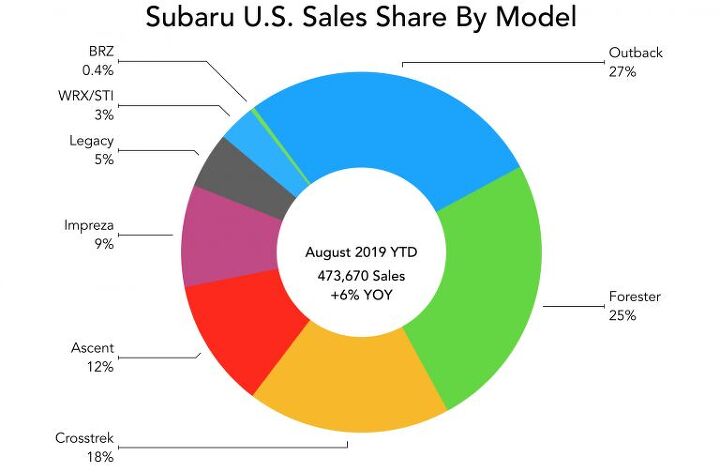

Excluding the Ascent, Subaru’s U.S. volume so far this year is actually down 4 percent, a loss of nearly 17,000 sales compared with the first two-thirds of 2018. But suggesting that Subaru’s non-Ascent downturn clarifies its cannibalizing nature ignores three factors.

First, Subaru’s supply is weak. “We’ll also be starting September with historically low inventory levels,” says Jeff Walters, Subaru’s senior vice president of sales. Second, the brand’s best-selling Outback is in a generational transition. Third, the Outback and Forester, the two Subarus most likely to lose buyers to their new big brother, both reported sales improvements in 2019’s first eight months. The Ascent seems to be causing no harm to Subaru’s two top sellers.

So, it’s a hit? By Subaru’s standard, the one that counts, yes. Subaru expected the Ascent to find the majority of its buyers in-house; generating around 60,000 annual U.S. sales.

Instead, the Ascent is not raining on the Outback’s parade. Better yet, Subaru will smash through that 60,000-annual sales mark any day now on its way to a year of potentially 80,000 Ascent sales. Subaru is certainly not letting off the Ascent throttle, either. August, with 7,319 sales, was the Ascent’s fourth consecutive month above 7,000 units; its fifth 7K+ month in the last half-year; its sixth since launching. These are welcome achievements for a vehicle that was believed to track around 5,000 sales per month.

Of course, it could go without saying that the Ascent remains relatively uncommon by the standards of top-tier competitors. The Toyota Highlander attracted nearly as many sales in August, 28,364, as the Ascent has in the last four months combined. Not even factoring in the Police Interceptor, Ford can sell more Explorers in half a year than Subaru can sell Ascents during a 12-month span. In August 2019, American Honda’s best month ever, Pilot volume actually took a 6-percent hit, yet the Pilot still virtually doubled the Ascent’s output. The Chevrolet Traverse and GMC Acadia both put up much bigger numbers, too.

Yet the very fact that we now look at Subaru results to see how they measure up in the mass-market tells you a lot about the brand’s new era. Subaru wants to sell 700,000 vehicles in the United States this year. Subaru only topped the 500,000-unit mark for the first time five years ago, crested the 400K barrier first in 2013, and as recently as 2008 held less than 2-percent market share.

Gone are the quaint days in which Subaru only sold Outbacks to your college professor’s aunt in Vermont. Oh, Subaru still sells her and everyone else in New Hampshire an Outback. But now the brand also sells Crosstreks to your neighbors and Foresters to your family members.

2019 is the year Subaru’s market share climbs beyond 4 percent. And Subaru has the Ascent to thank for pushing the brand over the edge.

[Image: Subaru]

Timothy Cain is a contributing analyst at The Truth About Cars and Driving.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jalop1991 In a manner similar to PHEV being the correct answer, I declare RPVs to be the correct answer here.We're doing it with certain aircraft; why not with cars on the ground, using hardware and tools like Telsa's "FSD" or GM's "SuperCruise" as the base?Take the local Uber driver out of the car, and put him in a professional centralized environment from where he drives me around. The system and the individual car can have awareness as well as gates, but he's responsible for the driving.Put the tech into my car, and let me buy it as needed. I need someone else to drive me home; hit the button and voila, I've hired a driver for the moment. I don't want to drive 11 hours to my vacation spot; hire the remote pilot for that. When I get there, I have my car and he's still at his normal location, piloting cars for other people.The system would allow for driver rest period, like what's required for truckers, so I might end up with multiple people driving me to the coast. I don't care. And they don't have to be physically with me, therefore they can be way cheaper.Charge taxi-type per-mile rates. For long drives, offer per-trip rates. Offer subscriptions, including miles/hours. Whatever.(And for grins, dress the remote pilots all as Johnnie.)Start this out with big rigs. Take the trucker away from the long haul driving, and let him be there for emergencies and the short haul parts of the trip.And in a manner similar to PHEVs being discredited, I fully expect to be razzed for this brilliant idea (not unlike how Alan Kay wasn't recognized until many many years later for his Dynabook vision).

- B-BodyBuick84 Not afraid of AV's as I highly doubt they will ever be %100 viable for our roads. Stop-and-go downtown city or rush hour highway traffic? I can see that, but otherwise there's simply too many variables. Bad weather conditions, faded road lines or markings, reflective surfaces with glare, etc. There's also the issue of cultural norms. About a decade ago there was actually an online test called 'The Morality Machine' one could do online where you were in control of an AV and choose what action to take when a crash was inevitable. I think something like 2.5 million people across the world participated? For example, do you hit and most likely kill the elderly couple strolling across the crosswalk or crash the vehicle into a cement barrier and almost certainly cause the death of the vehicle occupants? What if it's a parent and child? In N. America 98% of people choose to hit the elderly couple and save themselves while in Asia, the exact opposite happened where 98% choose to hit the parent and child. Why? Cultural differences. Asia puts a lot of emphasis on respecting their elderly while N. America has a culture of 'save/ protect the children'. Are these AV's going to respect that culture? Is a VW Jetta or Buick Envision AV going to have different programming depending on whether it's sold in Canada or Taiwan? how's that going to effect legislation and legal battles when a crash inevitibly does happen? These are the true barriers to mass AV adoption, and in the 10 years since that test came out, there has been zero answers or progress on this matter. So no, I'm not afraid of AV's simply because with the exception of a few specific situations, most avenues are going to prove to be a dead-end for automakers.

- Mike Bradley Autonomous cars were developed in Silicon Valley. For new products there, the standard business plan is to put a barely-functioning product on the market right away and wait for the early-adopter customers to find the flaws. That's exactly what's happened. Detroit's plan is pretty much the opposite, but Detroit isn't developing this product. That's why dealers, for instance, haven't been trained in the cars.

- Dartman https://apnews.com/article/artificial-intelligence-fighter-jets-air-force-6a1100c96a73ca9b7f41cbd6a2753fdaAutonomous/Ai is here now. The question is implementation and acceptance.

- FreedMike If Dodge were smart - and I don't think they are - they'd spend their money refreshing and reworking the Durango (which I think is entering model year 3,221), versus going down the same "stuff 'em full of motor and give 'em cool new paint options" path. That's the approach they used with the Charger and Challenger, and both those models are dead. The Durango is still a strong product in a strong market; why not keep it fresher?

Comments

Join the conversation

Two weeks ago, I test drove a 2020 Outback XT Onyx and liked it. Then I drove the 2020 Ascent Limited and LOVED it. I unloaded my 2018 Honda Odyssey Touring on the spot. My Honda's trade-in value was impressive, and I hope the same for the Ascent, at some point.

My sister-in-law has a new Highlander, as does her niece. But if a prospective buyer is trying to avoid FWD vehicles like the poor-handling plague that it is, the Subaru lineup offers one of the extremely few (and thankfully not unpleasant) choices remaining. No wonder buyers are flooding to Subaru, 40% torque to the rear wheels under normal driving conditions is a sight better than the zip, zero, zilch, nada, offered in all other Japanese "AWD" SUVs and most small German SUVs!