Midsize Sedan Deathwatch #14: July 2017 Sales Plunge by a Fifth, Everybody Falls Except the Dodge Avenger

Every midsize car on sale in the United States reported declining year-over-year volume in July 2017. Every car except the Dodge Avenger, which came back from the dead with 10 reported sales after a nine-month hiatus. 2014 was the Avenger’s last model year.

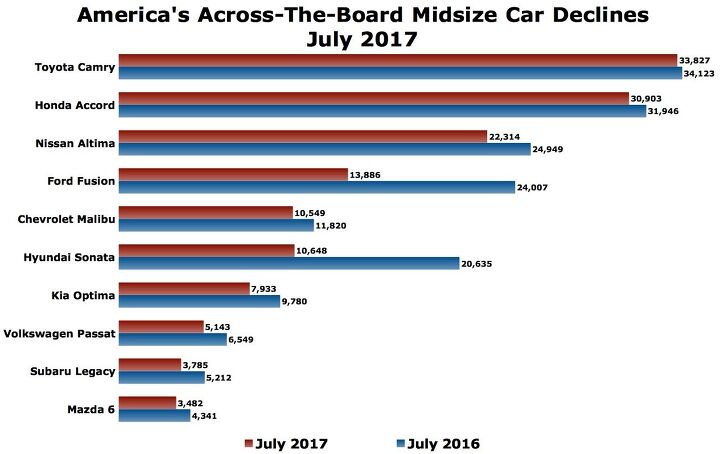

But forget that sales stat quirk — Pentastar Avenger Blacktop Edition, be still my soul. Every other midsize nameplate generated fewer sales in July 2017 than July 2016, with losses piling up fastest at Ford and Hyundai, with the Fusion and Sonata, respectively.

Between major Fusion and Sonata losses and decreased volume everywhere else, U.S. midsize car volume fell by a fifth in July 2017 — a 36,000-unit decline.

This is the fourteenth edition of TTAC’s Midsize Sedan Deathwatch. The midsize sedan as we know it — “midsizedus sedanicus” in the original latin — isn’t going anywhere any time soon, but the ongoing sales contraction will result in a reduction of mainstream intermediate sedans in the U.S. market.

How do we know? It already has.

As automakers claim, en masse, to be resisting the appeal of easy fleet volume, the midsize segment that has historically helped fill rental car lots is suffering particularly sharp losses in 2017’s retail-only quest. Consider that in the 2016 calendar year, Ford Motor Company, Fiat Chrysler Automobiles, and General Motors generated 29 percent, 24 percent, and 20 percent of their U.S. sales via fleet. In July 2017, those figures fell to 20 percent, 10 percent, and 11 percent, respectively.

Pair reduced fleet efforts with reduced retail demand — and at Hyundai, a transition phase into a refreshed model — and the result is a 48 percent drop to only 10,648 sales for the Sonata. Hyundai’s share of the midsize market fell to 7.3 percent in July 2017 and is down to 8.2 percent (from 9.7 percent in 2016) so far this year.

The Ford Fusion’s July decline was similarly harsh. The 42 percent drop to 13,886 sales represented the lowest-volume month for the Fusion since October 2012. Fusion sales are down by nearly a third so far this year, which means Fusion sales are 50,000-units weaker this year than last.

Incidentally, the most inconsequential decline in the midsize category in July 2017 belonged to the best-selling midsize car: Toyota’s Camry. With the launch of the all-new 2018 Camry underway, Toyota sold 33,827 Camrys in July 2017, a modest 1-percent decrease compared to July 2016. Unfortunately for Toyota, that wasn’t enough for the Camry to be America’s best-selling car last month. The best seller’s crown was worn by the Honda Civic, sales of which jumped 11 percent.

Yes, while every midsize car in America reported declining sales in July, there were cars, such as the Civic, that managed to report improvements, even as the U.S. auto industry slid 7 percent. The midsize segment’s 20-percent slide was substantially worse than the car sector’s 15-percent drop. Indeed, if midsize cars are excluded, the U.S. passenger car sector was down “only” 13 percent. Compact car volume, meanwhile, was down just 5 percent in July and year-to-date.

According to Kelley Blue Book, midsize car average transaction prices slid 0.4 percent, year-over-year, to $24,852 in July 2017. Compact car ATPs rose 1.3 percent to $20,403.

[Image: Fiat Chrysler Automobiles]

Timothy Cain is a contributing analyst at The Truth About Cars and Autofocus.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Redapple2 I retract my comments and apologize.

- Flashindapan I always thought these look nice. I was working at a Land Rover dealership at the time the LR3 came out and we were all impressed how much better it was then the Discovery in just about every measurable way.

- Bd2 If I were going to spend $ on a ticking time bomb, it wouldn't be for an LR4 (the least interesting of Land Rovers).

- Spectator Wild to me the US sent like $100B overseas for other peoples wars while we clammer over .1% of that money being used to promote EVs in our country.

- Spectator got a pic of that 27 inch screen? That sounds massive!

Comments

Join the conversation

There is not doubt that these cars are declining in popularity. The popular explanation is the rise of crossovers which is too obvious to mention. (Although it would be worth some investigating as to how much of this is real consumer preference and how much is the tail wagging the dog as automakers are happier with the CAFE implications of selling more "trucks.") Regarding mid-size sedans in particular, it's also worth noting how large these cars have become over the years. A 2017 Civic is probably a more useful family car than a 1997 Accord. Some families used to need a mid-sizer whereas, now many families can get by with a "compact" sedan.

At some point we need to adjust our vocabulary. The small SUV or CUV is now the default "family sedan". What we now call a "sedan" is a specialty vehicle, a low to the ground sporty version of a family sedan, maybe a "sport sedan".