Midsize Sedan Deathwatch #10: In April 2017, Cannibal Camry Feeds as Others Cede

Reaching the end of the line before an all-new 2018 model launches, the outgoing Toyota Camry is — quite predictably — losing sales. After all, the auto industry’s total sales volume is shrinking. Passenger cars, in particular, are paying a price. And the midsize segment is stumbling all the more so. With all these factors contributing, of course the Camry is shedding volume.

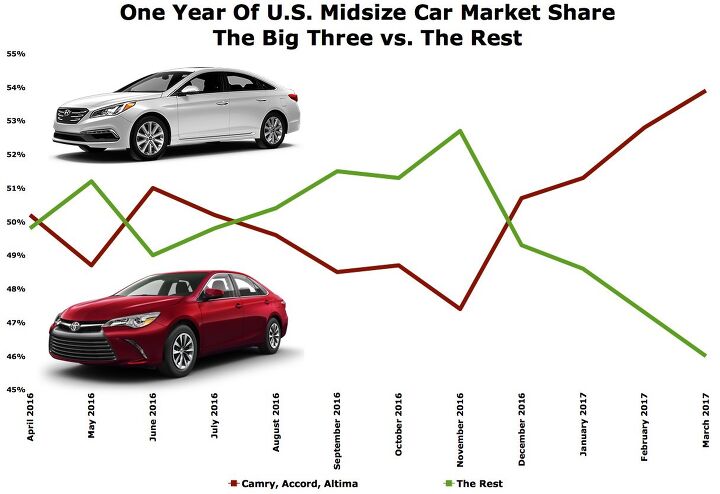

Aged, outdated, and antiquated, the Toyota Camry seemingly has the most to lose. Yet despite a 4-percent year-over-year U.S. sales loss in March 2017 and a 13-percent decline through the first-quarter of 2017, the Toyota Camry is gaining heaps of market share in America’s midsize sedan segment, not losing it.

That’s because the cars that are most to blame for the midsize sedan segment’s rapid decline don’t sit at the top of the leaderboard, but rather hail from the JV squad.

This is the tenth edition of TTAC’s Midsize Sedan Deathwatch. The midsize sedan as we know it — “midsizedus sedanicus” in the original latin — isn’t going anywhere any time soon, but the ongoing sales contraction will result in a reduction of mainstream intermediate sedans in the U.S. market.

How do we know? It already has.

March 2017 was the 13th consecutive month in which U.S. sales of midsize cars declined on a year-over-year basis. The 22-percent drop was the worst decline since last August. After claiming 14 percent of all new vehicle sales in March 2016, midsize cars claimed just 11 percent of the overall market in the same period this year. And after owning fully one-third of America’s passenger car market in March 2016, the midsize sector’s share of the car market slid to just 29 percent last month.

Yet in this turmoil, the all-conquering Toyota Camry posted a modest 4-percent, 1,343-unit drop in March 2017 and grew its share of its segment to 21.1 percent from 17.0 percent one year ago.

Indeed, even over the course of the entire first quarter of 2017, Camry market share in the midsize category grew to 19.4 percent from 17.7 percent in Q1 2016. The Camry’s relative stability has repercussions, not as keenly felt by podium finishers (Nissan Altima and Honda Accord) as by formerly high-volume midsize cars that are now faced with rapidly disappearing demand.

The first quarter of 2017’s performance by the Ford Fusion, skewed by heavy fleet emphasis in the first-quarter of 2016, is down 32 percent year-over-year, a loss of more than 24,000 sales.

The fifth-ranked Hyundai Sonata (down 38 percent so far this year, a loss of nearly 24,000 sales) plunged 47 percent to only 15,357 sales in March 2017, the Sonata’s worst March since the doldrums of 2009.

The sixth-ranked Chevrolet Malibu, all-new for 2016, is not even remotely benefiting from its status as the freshest midsize car on the block, nor from the idea that “Real People” confuse the Malibu with Audis and BMWs and celebrate its keyless entry. Malibu volume is nosediving, plunging 36 percent in March and 40 percent so far this year. That’s a loss of more than 23,000 sales compared to the first quarter of 2016. Chevrolet had more than four months of Malibu supply heading into March; 17,000 more Malibus in dealer inventory than Ford had Fusions in stock.

It’s an uncomfortable situation for this trio of high-volume cars that are increasingly not producing such high volume. It’s also disconcerting for cars nearer the bottom of the heap that can’t make headway, either.

March 2017 represented the Kia Optima’s 15th consecutive month of declining sales. The Volkswagen Passat’s 3-percent year-over-year uptick involves a comparison with March 2016, when sales had fallen 22 percent. Compared with the Passat’s five-year March average, sales last month were 30 percent lower in March 2017. The Subaru Legacy and Mazda 6 were jointly down 10 percent last month, a loss of roughly 1,000 sales for a duo that produces only 1 out of every 20 midsize car sales.

While all of this is uncomfortable and disconcerting for some, Toyota is excited to see what the next Camry can do. The Camry will be a segment leader, but will it be strong enough to see more rivals disappear just as the Chrysler 200, Dodge Avenger, Mitsubishi Galant, Pontiac G6, and Suzuki Kizashi already have? Be prepared to see a distinct lack of investment in future midsize sedans as total volume shrinks and the Camry exerts even greater control.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy If these guys opened a hotel outside Cincinnati I would go there to sleep, and to dream.

- ToolGuy Michelin's price increases mean that my relationship with them as a customer is not sustainable. 🙁

- Kwik_Shift_Pro4X I wonder if Fiat would pull off old world Italian charm full of well intentioned stereotypes.

- Chelsea I actually used to work for this guy

- SaulTigh Saw my first Cybertruck last weekend. Looked like a kit car...not an even panel to be seen.

Comments

Join the conversation

They have morphed into Taxi's here in Australia , all are hybrids

What happened in November 2016 that would impact sales/marketshare of midsize sedans? Discussion is focused on Q1 2017, but both lines sharply reverse trends in November 2016.