Midsize Sedan Deathwatch #6: November 2016 Sales Flat, Market Share Keeps Falling

U.S. sales of midsize cars remained on an even keel in November 2016, decreasing by only one-tenth of one percent compared with November 2015.

But make no mistake: the midsize car category still took a hit in November. While volume remained level, the segment’s share of the overall U.S. new vehicle market fell below 12 percent last month, the fifth consecutive November in which midsize market share has declined.

This is the sixth edition of TTAC’s Midsize Sedan Deathwatch. The midsize sedan as we know it — “midsizedus sedanicus” in the original latin — isn’t going anywhere any time soon, but the ongoing sales contraction will result in a reduction of mainstream intermediate sedans in the U.S. market.

How do we know? It already has.

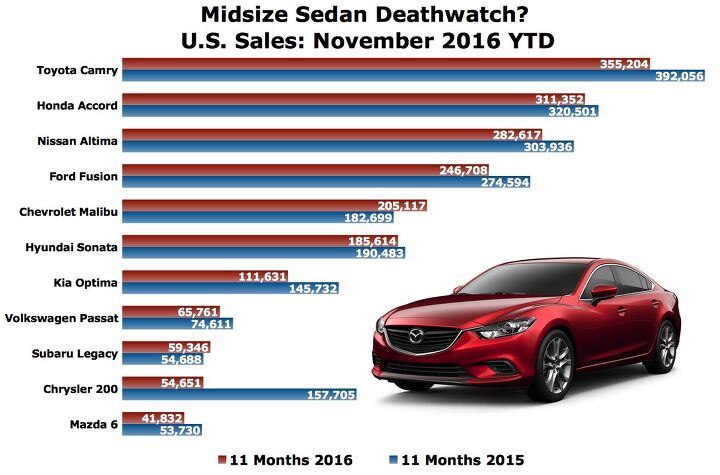

Midsize car sales plunged 12 percent through the first ten months of 2016. That decline takes into account an 18-percent slide between July and October that resulted in nearly 150,000 lost sales. November’s leveling off, therefore, was a comparatively wonderful result, particularly for those in favor of ending TTAC’s Midsize Sedan Deathwatch.

But the segment’s modest loss of around 100 units in November 2016 comes one year after the midsize segment took a big hit. In November 2015, midsize volume had fallen 8 percent, a sharp downturn after essentially level sales through the previous ten months. That November 2015 decline acted as an effective harbinger. Only once since, with a slight 1-percent uptick in February, has midsize sedan volume increased on a year-over-year basis in America.

Thus, while last month’s U.S. sales of midsize cars decreased by just 0.1 percent compared with November 2015, they were down 9 percent compared with November 2014. Last month’s 15,000-unit decline over compared with November 2014 resulted in a market share loss of 2 percentage points for the midsize car category.

During the same period, the overall market’s volume, excluding midsize cars, grew 8 percent.

Surging sales of the new Chevrolet Malibu did protect the midsize segment from greater losses in November 2016. Malibu sales jumped 72 percent, year-over-year, a gain of 7,764 units, effectively cancelling out the losses incurred by the Chrysler 200, which we have watched die very slowly.

Year-over-year, Subaru added 1,045 sales to the Legacy’s tally for 5,814 units in total, the best November ever for the nameplate.

After the diesel emissions crisis caused Volkswagen Passat sales to tumble to a 51-month low in November 2015, Passat sales more than doubled to 6,441 units in November 2016, a three-month high. Honda Accord volume rose 6 percent.

With a new Camry set to be revealed at the North American International Auto Show in Detroit next month, sales of the outgoing model tumbled 9 percent in November 2016, the tenth consecutive decline for America’s best-selling car. Ford Fusion sales decreased for a fifth consecutive month. Altima, Sonata, Optima? Down, down, down.

And then there’s Mazda. The Mazda 6’s 1 percent drop resulted in only 3,046 sales in November 2016. This was the 6’s second consecutive month below 4,000 units; the fifth month this year in which Mazda USA failed to report at least 4,000 sales. Only 1.9 percent of the midsize cars sold in America in November — only 2.2 percent year-to-date — were Mazda 6s.

That 1 percent drop in volume at Mazda actually represented a 9-percent decrease in the daily selling rate of the company’s midsize sedan. Indeed, the whole segment’s year-over-year results were skewed by the odd auto sales calendar that didn’t start “November 2015” until the third day of the month. As a result, the November 2016 auto sales month, which fell in line with your calendar, actually featured two additional selling days.

Though total volume was flat, the daily selling rate for the midsize segment was actually down 8 percent.

Kelley Blue Book says the average transaction price in the midsize segment increased 0.6 percent compared with November 2015 but fell 0.6 percent compared with October 2016. Across the industry, TrueCar says the average per-vehicle incentive spend was up 13 percent compared with November 2016.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Brendan Duddy soon we'll see lawyers advertising big payout$ after getting injured by a 'rogue' vehicle

- Zerofoo @VoGhost - The earth is in a 12,000 year long warming cycle. Before that most of North America was covered by a glacier 2 miles thick in some places. Where did that glacier go? Industrial CO2 emissions didn't cause the melt. Climate change frauds have done a masterful job correlating .04% of our atmosphere with a 12,000 year warming trend and then blaming human industrial activity for something that long predates those human activities. Human caused climate change is a lie.

- Probert They already have hybrids, but these won't ever be them as they are built on the modular E-GMP skateboard.

- Justin You guys still looking for that sportbak? I just saw one on the Facebook marketplace in Arizona

- 28-Cars-Later I cannot remember what happens now, but there are whiteblocks in this period which develop a "tick" like sound which indicates they are toast (maybe head gasket?). Ten or so years ago I looked at an '03 or '04 S60 (I forget why) and I brought my Volvo indy along to tell me if it was worth my time - it ticked and that's when I learned this. This XC90 is probably worth about $300 as it sits, not kidding, and it will cost you conservatively $2500 for an engine swap (all the ones I see on car-part.com have north of 130K miles starting at $1,100 and that's not including freight to a shop, shop labor, other internals to do such as timing belt while engine out etc).

Comments

Join the conversation

If you look at a midsize Accord sedan from 1997 and a new Civic, they're about the same size. To me, the best advantage of the mid-sizers was the V-6 engine. Now the 4-bangers are smooth and powerful and shared with the compacts. So with mid-sizers they take away the 3-liter V-6, and increase the cost with doo-dads and gimcrackery. Then they make 'em softer and blander in a market jammed with look-alikes. In those circumstances, why would anyone who doesn't need room for more than 2-3 people and not interested in a CUV go for a three-box midsizer?

Poor Mazda.