Midsize Sedan Deathwatch #5: October 2016 Sales Plunge 20 Percent, Most Cars Down By Double Digits

This is the fifth overall edition of TTAC’s Midsize Sedan Deathwatch. The midsize sedan as we know it — “midsizedus sedanicus” in the original latin — isn’t going anywhere any time soon, but the ongoing sales contraction will result in a reduction of mainstream intermediate sedans in the U.S. market.

How do we know? It already has.

U.S. sales of midsize cars plunged by 20 percent in October 2016, a year-over-year loss of nearly 39,000 sales for a segment that was already down by nearly 195,000 through the first three-quarters of 2016.

American consumers, businesses, government agencies, and daily rental fleets are still on pace to purchase and lease more than two million midsize cars in calendar year 2016. Of course, Americans had already purchased and leased more than two million midsize cars at this point in 2015, when the midsize sedan decline was already underway.

Regardless of what came before, October’s results were a punch in the midsize sector’s gut, as total sales fell by a fifth because of declines reported by every player in the category.

Save for the Subaru Legacy.

Compared with October 2015, U.S. sales of the Subaru Legacy jumped 8 percent despite the brevity of the sales month. (There were only 26 “selling days” in October 2016, down from 28 in October 2015.) It was the Legacy’s ninth year-over-year improvement in the last year. The 6,136-unit total fell just 4 percent below the Legacy’s highest-volume month ever: 6,362 sales in October 2014.

Legacy aside, however, not a single midsize car generated more sales in October 2016 than in October 2015. Most of the declines measured in the double digits. (Nissan Altima sales were down just 3 percent; Hyundai Sonata sales were down 7 percent.)

The Ford Fusion, Volkswagen Passat, Kia Optima, and Chevrolet Malibu collectively fell 28 percent, a loss of 19,845 sales for a quartet which accounts for one-third of the segment’s volume.

Not surprisingly, Chrysler continues to struggle to clear out remaining examples of the dying 200 sedan. FCA dealers had a 156-day supply of nearly 20,000 Chrysler 200s heading in to October, according to Automotive News. But 200 sales plunged 69 percent to only 2,843 units in October.

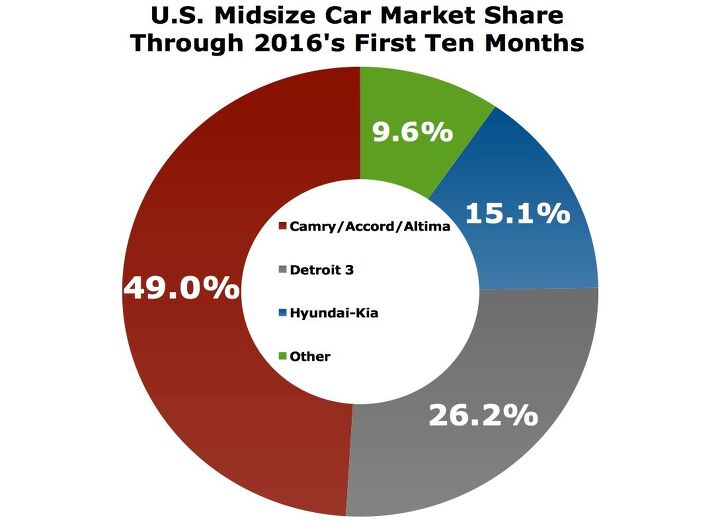

7.3 percent of the midsize cars sold in America in the first ten months of 2015 were Chrysler 200s. This year, with production shutdowns early in the year and then FCA’s announcement that the 200 and its Dodge Dart cousin would meet a premature death, the 200’s share of the market fell to 2.9 percent.

The Mazda 6, chronically unsuccessful and now particularly rare, fell 18 percent to 2,924 sales in October, only 81 sales ahead of the dying Chrysler. Ranked 11th in the category in year-to-date volume, Mazda has lost nearly 12,000 Mazda 6 sales already this year.

At the top of the heap, with a new Toyota Camry due shortly and a new Honda Accord not far off, either, sales of America’s two best-selling midsize cars are down 7 percent so far this year.

All of their rivals, combined, are down 14 percent.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- THX1136 What happened to the other companies that were going to build charging stations? Maybe I'm not remembering clearly OR maybe the money the government gave them hasn't been applied to building some at this point. Sincere question/no snark.

- VoGhost ChatGPT, Review the following article from Automotive News: and create an 800 word essay summarizing the content. Then re-write the essay from the perspective of an ExxonMobil public relations executive looking to encourage the use of petroleum. Ensure the essay has biases that reinforce the views of my audience of elderly white Trump-loving Americans with minimal education. Then write a headline for the essay that will anger this audience and encourage them to read the article and add their own thoughts in the comments. Then use the publish routine to publish the essay under “news blog” using Matt Posky listing the author to completely subvert the purpose of The Truth About Cars.

- VoGhost Your source is a Posky editorial? Yikes.

- Fed65767768 Nice find. Had one in the early-80s; loved it but rust got to it big time.Still can't wrap my head around $22.5K for this with 106,000 km and sundry issues.Reluctant (but easy) CP.

- El scotto err not be an EV but to own an EV; too much training this week along the likes of what kind of tree would be if you were a tree? Sorry. Bring back the edit function.

Comments

Join the conversation

Tim - Could there be a slight error in the 200's numbers? I see ~13658 *new* 200's available today, which doesn't fit with the 20k pre-October number you mentioned, plus October sales. It's this inventory number I'm asking about. If I apply the average sales rate for 2016, I come up with a 2.6 month supply as of today, or roughly 79 days. Using the most recent sales rate, it works out to ~144 days. I'm not sure how you choose to calculate that, but given the 200's demise, it's probably at least 100 days. Thanks for the ongoing analysis, and keep up the great work. This is one of my favorite columns at TTAC.

Yes, you drive down new-car-dealer row, and you have to wonder what percentage of auto production is sitting on dealer lots, whether new or used....