It's Not Easy Being #1: Camry Incentives Rise High as Toyota Chases 15th Consecutive Year on Top

The Toyota Camry began a streak of 14 consecutive years as America’s best-selling car in 2002. Holding that number one position isn’t easy.

Toyota does not merely need the Camry to continue to live up to its reputation for reliability, and subsequently incite demand. Toyota also requires massive production capacity and a pricing scheme that matches production capacity to demand.

Demand in the United States for conventional midsize cars, however, is falling quickly. Year-to-date, overall midsize car volume is down 8 percent. In July 2016, midsize car sales fell 15 percent.

With a 2016 Camry now attempting to leave dealer lots as a five-year-old car, more than two years since its last refresh, Toyota’s desire for the Camry to maintain its high-volume nature and best-selling posture is now matched by a significant uptick in Camry incentives.

Toyota is now discounting Camrys 27-percent more than just one year ago, with an average incentive spend per Camry of $3,760 in July.

According to Autodata figures in this Automotive News article, Toyota has ramped up Camry incentives in nine of the last twelve months, from $2,969 per Camry in July 2015 to $3,459 in December 2015, to the peak of $3,760 per Camry last month.

Year-over-year, Toyota’s average incentive spend per Camry is also up 27 percent through the first seven months of 2016.

As Camry competitors similarly experience disappearing demand, incentives are the name of the game. The Camry is by no means an exception on that front.

Fiat Chrysler Automobiles’ clear out of the nearly discontinued Chrysler 200 (despite the 200 deemed uncompetitive by the collective consumer) puts a measure of pressure on cars such as the new Chevrolet Malibu. Select 2016 Malibu LTs are now advertised with a $4,143 cash back offer, for instance.

On August 10, Ford added $1,000 Smart Bonus Cash to the older half of Fusion stock, and even on some newly refreshed 2017 Ford Fusions.

Until a 26-percent July sales slide dropped it one place, the Nissan Altima was America’s second-best-selling midsize car in 2016. To spur demand, Nissan offers interest-free financing for six years with at least $500 in bonus cash.

The list goes on.

Despite the incentivization, Americans nevertheless purchased and leased 116,000 fewer midsize cars in the first seven months of 2016 than during the same period one year ago.

Toyota appears entirely unwilling to see the ageing Camry lose sales faster than the segment as a whole.

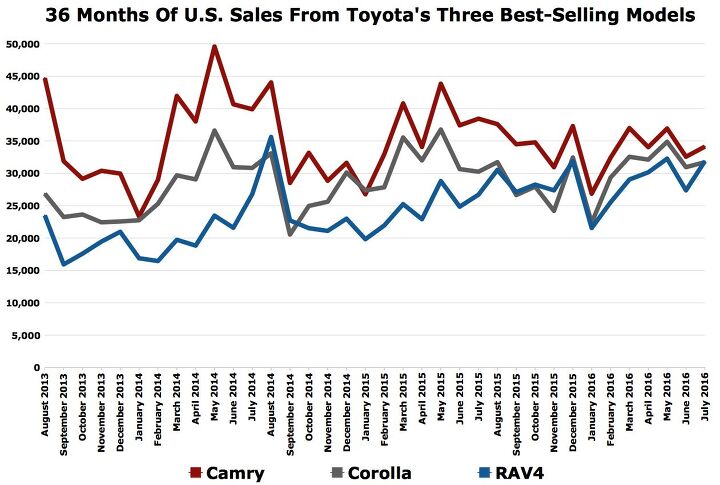

Year-to-date, Camry volume is down 8 percent, a loss of 20,369 sales in a category that is likewise down 8 percent inside a passenger car sector that’s down — you guessed it — 8 percent. The Camry’s 4,313-unit decline played a significant role in the month of July, specifically, as midsize volume plunged by 31,000 sales.

The upside is easy to locate in Toyota showrooms. With similar MSRPs, U.S. sales of the Toyota RAV4 are up 16 percent this year, a year-over-year gain of 27,487 sales, which more than counteracts the lost Camry volume.

The RAV4 isn’t simply keeping pace with growth in the SUV/crossover sector, either. Presently America’s top-selling utility vehicle, the RAV4’s 16-percent volume expansion comes as U.S. SUV/crossover sales grew 8 percent in the first seven months of 2016.

While TrueCar says buyers of the 2016 Toyota Camry XLE are paying 10-percent below MSRP, the 2016 Toyota RAV4 XLE AWD buyer nets only a 3-percent discount.

Through the end of July, the Toyota Camry holds an 11,090-unit lead over America’s second-best-selling car, the Honda Civic. At this stage of 2015, the Camry was 33,871 sales ahead of the next-best-selling car, Toyota’s own Corolla.

The Toyota Camry is by no means dying, but some of its competitors might. TTAC recently forecasted the demise of a number of midsize sedans; that the continued rise of two-row family crossovers will kill off more midsize cars until the segment stabilizes with an appropriate number of competitors.

The significant discounts applied to America’s perennial best-selling car, a midsize Toyota that wears its blue chip credentials on its sleeve, is more evidence of that eventuality.

[Images: Toyota. Chart: © 2016 Timothy Cain/The Truth About Cars]

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 3-On-The-Tree In my life before the military I was a firefighter EMT and for the majority of the car accidents that we responded to ALCOHOL and drugs was the main factor. All the suggested limitations from everyone above don’t matter if there is a drunken/high fool behind the wheel. Again personal responsibility.

- Wjtinfwb NONE. Vehicle tech is not the issue. What is the issue is we give a drivers license to any moron who can fog a mirror. Then don't even enforce that requirement or the requirement to have auto insurance is you have a car. The only tech I could get behind is to override the lighting controls so that headlights and taillights automatically come on at dusk and in sync with wipers. I see way too many cars after dark without headlights, likely due to the automatic control being overridden and turned to "Off". The current trend of digital or electro-luminescent dashboards exacerbates this as the dash is illuminated, fooling a driver into thinking the headlights are on.

- Kjhkjlhkjhkljh kljhjkhjklhkjh given the increasing number of useless human scumbags who use their phones while driving (when it is not LIFE AND DEATH EMERGENCY) there has to be a trade off.It is either this, or make phone use during driving a moving violation that can suspend a license.

- Wjtinfwb Great. Another Solyndra boondoggle wasting the tax dollars we contribute and further digging us into debt. The saying, "don't listen to what they say, watch what they do" has never been more accurate. All this BS talk about "preserving Democracy" and "level playing fields" are just words. The actions say, "we don't give a damn about democracy, we want to pick the winners and use the taxpayer revenue to do it". 100 million is chump change in auto development and manufacturing and doling that out in 300k increments is just a colossal waste. Nothing happens in a large manufacturing enterprise for 300k., it's a rounding error. A symbolic gesture. Ford and GM likely spend 300k designing a new logo for the 12V battery that runs your radio. For EV development it's a fart in a Hurricane.

- Bd2 Let's Go Brandon!

Comments

Join the conversation

The incentives are up by $500? or $700? That's $20/month on a 36 month lease. Not a game changer for most people. I don't see how that is going to change a lot of minds. This is the last year before a redesign, so they deserve a discount.

So, does anybody have the nerve to come out and verbalize Toyota's popular old tagline "I love what you do for me...Toyota!" Anybody? Bueller? OK, got nothing as I've never driven a Toyota. But, apparently if given enough of a discount on a rather bland, average sedan with a decent and long-standing reputation for quality and reliability, people will bite. In comparison, my experience in driving a late-model Accord sedan is that the Earth Dreams 4-cylinder coupled to the most refined CVT on the market make for a pleasant and enjoyable driving experience. In some respects, I get what it is that has kept the Accord on Car & Driver's 10 Best list for so many years; yet, at the same time C & D have seemingly ignored some of Accord's minor flaws and/or failings as it fails to be the perfect car. Hint: the seats are less than ideal. As has been said many times, YMMV.