You Missed Your Chance to Score Really Cheap Gas and Dream of a Less Regulated Life

California is typically painted a scorching red on Gasbuddy’s heat map, but some drivers got a break from high pump prices in Beverly Hills this morning.

You needed a classic car to make the cut, and you needed to be at the historic (Union) 76 Gas Station at Little Santa Monica Boulevard and Crescent Drive, but if you were, you took a trip back in time without having to worry about dodging the draft.

Because it’s National Collector Car Appreciation Day, vintage car insurance provider Hagerty figured it would be nice to offer owners gasoline at vintage prices. Whatever year your vehicle rolled off the lot determined the price. When was the last time an insurance company brightened your day?

Got a ’55 Chevrolet? 29 cents a gallon, please. 1970 Ford? Pry open that Costanza wallet and pay 35 cents a gallon. The gasoline wasn’t leaded, because you can’t completely escape federal regulations.

Pump prices in the Beverly Hills-Hollywood are (mostly) well above three bucks a gallon today, so it would be nice to imagine — just for a fleeting moment — that Eisenhower is still alive, drum brakes are just fine for stopping, and a limitless future of Jetsons-like convenience awaits us all.

Hell, because prices weren’t adjusted for inflation, you’d have scored a great deal even if you showed up in a 1981 LTD with that awful 255 Windsor.

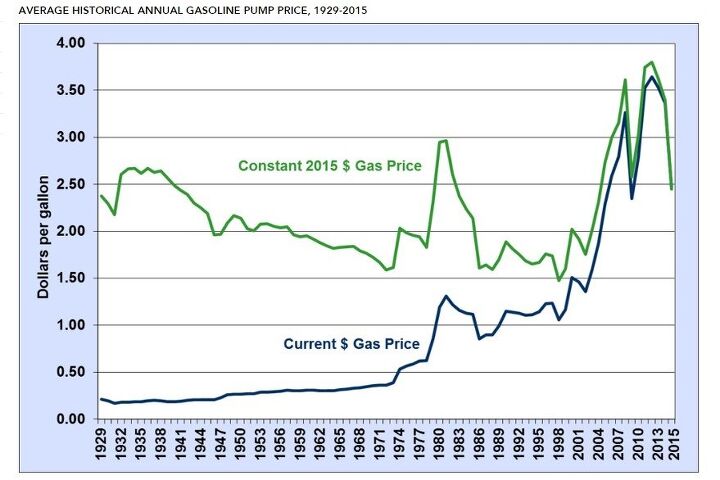

Depending on who you are (cynic, misanthrope, idealist, realist), it’s easy to think of those bygone days as the pinnacle of the American Dream or an unprogressive era rife with discrimination. But at least gas was cheaper, right? Well, it was…except for that era when WKRP was on the air.

Want to know what you really paid back then, adjusted for inflation? The federal government has graced us with this chart:

[Image: U.S. Department of Energy]

More by Steph Willems

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh A prelude is a bad idea. There is already Acura with all the weird sport trims. This will not make back it's R&D money.

- Analoggrotto I don't see a red car here, how blazing stupid are you people?

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

Comments

Join the conversation

My humble proposal, meant to please the business sector, environmentalists, and federal budget hawks. Let's set a target price of, for example, $2.50/gal, before state & local taxes. When the market price of crude drops below that level, continue charging $2.50 and put that revenue, while it lasts, towards the national debt. When gas rises over $2.50/gal, subsidize it to bring it down to that level. With me so far? Great, but let's also raise the target price by a regular amount, like $.05 per year. A longterm pricing plan like this would help businesses -- even the oil business -- by making oil prices steady and predictable. It helps the environment and the renewable sector by gradually lifting the pump price at a bearable rate. And it helps the economy by providing a new revenue source dedicated for debt reduction. Please don't waste time speculating whether I'm a liberal or a conservative. I'm just trying to propose a a practical idea. Whats the matter with it?

I don't know about CA, I didn't live in SoCal until starting in '81, but in the Midwest in 1977 I remember paying in the 50 - 60 cent per gallon range for premium (Sunoco 260). Price was very important to me in those days as I was trying to keep enough premium in a thirsty (5-ish mpg) '69 L-78 SS Camaro to be able to cruise the strip on Saturday nights on a part time, after-school grocery clerk salary. For comparison, just about an hour ago here in the Midwest I filled up for $1.83 per gallon, which according to the gov't inflation calculator works out to 46 cents a gallon in 1977 money. That's pretty much right on the money for 1977 regular, pun intended.