Elio Motors Stock Soars in Over-The-Counter Trading

(Caveat: I know nothing at all about stocks, bonds or other financial instruments.)

After automotive startup Elio Motors raised approximately $17 million dollars in a Reg-A+ stock offering the company crowdsourced from small investors via StartEngine, it said its shares would be listed on the OTCQX exchange to provide those investors with liquidity.

It’s probably too early to call Elio another Tesla (whose own market capitalization probably exceeds its actual value), and I don’t know how many of those investors are going to sell their stock so soon. But, if they did, they would have more than doubled their money in less than two weeks as of Monday’s close.

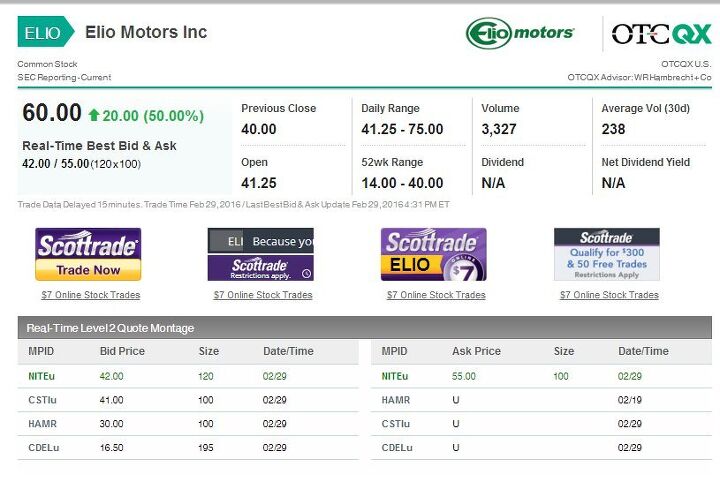

Elio stock started trading on February 19, 2016, with an initial value of $15/share set by WR Hambrecht & Co., Elio Motors’ securities advisor. As of February 29, it was trading between $41.25 and $75.00 a share.

Volume is still light — a bit more than 3,300 shares were traded yesterday, with the average transaction involving less than 240 shares. Still, the news has to buoy those Elio fans who have gone all in and invested in the company in addition to having put down money to reserve an Elio trike, should it ever come to production.

Elio is using the money raised in the stock offering to build a series of validation prototypes. It still needs to raise about $200 million to start production and has been putting most of its eggs in the basket of its application for a loan from the U.S. Department of Energy’s Advanced Technology Vehicles Manufacturing (ATVM) program.

As mentioned above, I don’t know much about securities, but it seems to me that if its publicly traded Reg-A+ stock is attractive enough to investors that it’s significantly increasing in value, the other shares held by the company and its original investors should also be increasing in value as well. If that’s the case, selling off some of that stock might be an alternative way of raising capital versus hoping for an ATVM loan.

As Elio has pushed back its proposed start of production, some early enthusiasts have become disenchanted. There’s been some hearty back and forth between the lapsed converts and those who are still true believers in Paul Elio’s dream. With Elio Motors’ stock seemingly taking off, the true believers are crowing. We’ll see if they’re singing the same tune at the end of this year when Elio hopes production will start.

[Image Source: OTCMARKETS.COM]

Ronnie Schreiber edits Cars In Depth, the original 3D car site.

More by Ronnie Schreiber

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- SCE to AUX Over the last 15 years and half a dozen vehicles, my Hyundais and Kias have been pretty cheap to maintain and insure - gas, hybrid, and electric.I hate buying tires - whose cost goes by diameter - and I'm dreading the purchase of new 19s for the Santa Fe.I also have an 08 Rabbit in my fleet, which is not cheap to fix.But I do my own wrenching, so that's the biggest factor.

- MaintenanceCosts '19 Chevy Bolt: Next to nothing. A 12v battery and a couple cabin air filters. $400 over five years.'16 Highlander Hybrid, bought in 2019: A new set of brakes at all four corners, a new PCV valve, several oil changes, and two new 12v batteries (to be fair, the second one wasn't the car's fault - I had the misfortune of leaving it for a month with both third-row interior lights stealthily turned on by my kid). Total costs around $2500 over five years. Coming due: tires.'11 BMW 335i, bought in late 2022: A new HID low beam bulb (requiring removal of the front fascia, which I paid to have done), a new set of spark plugs, replacements for several flaking soft-touch parts, and two oil changes. Total costs around $1600 over a year and a half. Coming due: front main seal (slow leak).'95 Acura Legend, bought in 2015: Almost complete steering and suspension overhauls, timing belt and water pump, new rear brakes, new wheels and tires, new radiator, new coolant hoses throughout, new valve cover gaskets, new PS hoses, new EGR valve assembly, new power antenna, professional paint correction, and quite a few oil changes. Total costs around $12k over nine years. Coming due: timing belt (again), front diff seal.

- SCE to AUX Given this choice - I'd take the Honda Civic Sport Hatchback (CVT). I 'built' mine for $28777.To my eye, the Civic beats the Corolla on looks these days.But for the same money, I can get an Elantra N-Line with 7-speed DCT, 201 HP, and good fuel economy, so I'd rather go for that.

- Kwik_Shift_Pro4X '19 Frontier Pro 4X. Next to nothing. All oil changes are on schedule. Got new tires at 60000 miles. Still on original brakes at 79000 miles. Those are due soon. Brakes complete estimate $1000 all in.

- Dr.Nick The cars seem really expensive with tight back seats and Cadillac was on the list of the highest price gouging dealers coming out of COVID. I don’t understand the combination, shouldn’t they be offering deals if they are not selling?

Comments

Join the conversation

This suffers from the 'Bitcoin Problem' - if you don't have enough volume to buffer the market rate, then the market rate is irrelevant. It's great that one guy paid $50 for something, but if no one else is willing to, the price isn't very durable.

"I don’t know how many of those investors are going to sell their stock so soon. But, if they did, they would have more than doubled their money..." By the sounds of things, if more than a dozen of them did, the stock value would collapse and everybody else would be SOL. The volumes here just aren't high enough to draw any sort of conclusions about the business.