Nissan Enters Figure 8 Race For Market Share And Profits

Eight percent global market share. Eight percent operating profit. And all of that by 2016 – two times eight, get it? In Nissan’s glitzy waterfront headquarters in Yokohama, CEO Carlos Ghosn today presented a six year plan, called “Power 88.” The plan is audacious and auspicious at the same time.

Let’s do the auspicious part first.

8 is a lucky number in Japan. In China, which becomes more and more important for Nissan, one cannot have enough eights. According to the all-knowing Wikipedia, “a telephone number with all digits being eights was sold for $270,723 in Chengdu, China. The opening ceremony of the Summer Olympics in Beijing began on 8/8/08 at 8 seconds and 8 minutes past 8 pm. A man in Hangzhou offered to sell his license plate reading A88888 for RMB 1.12 million (roughly USD164,000).” In Japan, one does not pig out on eights. In this minimalist culture, one 8 is lucky enough. But to succeed with the Power 88 plan, Nissan will need all the luck it can get.

The plan is audacious, because in 2010, Nissan sold some 4 million cars worldwide, for a market share of 5.8 percent. Setting a target of 8 percent market share by 2016 takes gumption. When a reporter asked Ghosn for his production target, Carlos the Hawk waved his arms and smugly said: “We figure 90 million units worldwide by 2016. You can take the 8 percent and do your own math.” Carlos the Calculator he is not. Alright, my calculator says 7.2 million Nissans a year by 2016, more than Toyota wants to sell worldwide this year.

The plan is absolutely audacious, because 8 percent operating profit is considered a miracle for a mass market producer. Especially for one that is hobbled by the high yen. Ford’s operating profit margin was 6.1 percent last year. Profits are generated by selling more and spending less. Nissan has saved 5 percent each year since the turn-around, and is hell-bent on continuing this in the future.

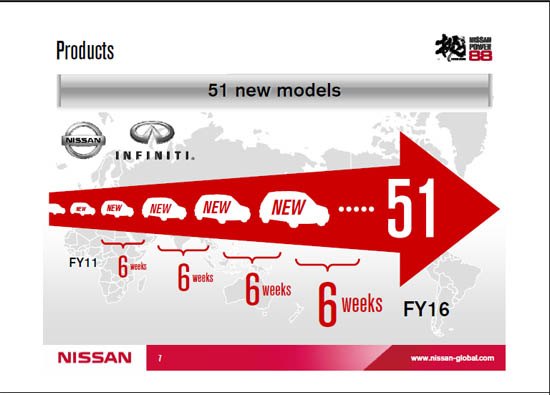

You can’t get new market share with old cars. Even more audaciously, “Nissan will deliver one new vehicle every six weeks, during the next six years.” More sixes: “By 2016, Nissan will have 66 Nissan and Infiniti vehicles in its global portfolio.” (My numerologist tells me that the number 6 carries no special meaning in the Japanese culture, and is only mildly auspicious in China.)

66 is only 2 models more than today. But there is more numerology: “We will consolidate some models and add others, eliminating 13 and adding 15 new models,” said Ghosn. Some of them might be trucks. “By fiscal 2016, Nissan will be the world’s leading light commercial vehicle manufacturer,” threatened Ghosn.

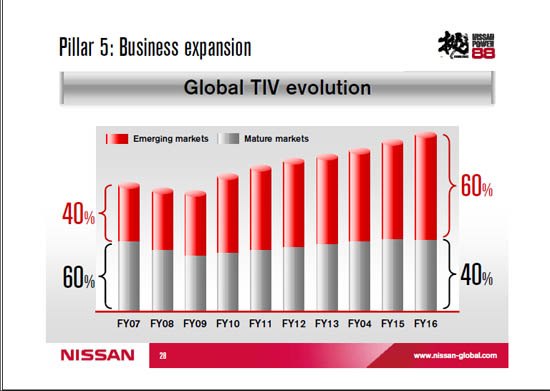

In 2007, 60 percent of all cars worldwide were sold in established markets, 40 percent in emerging markets. By 2016, Nissan expects that to flip-flop. 40 percent in established markets. 60 percent in emerging markets. And this is where Nissan wants to play a leading role.

Nissan is the largest Japanese car maker in China with a 6.2 percent market share. Nissan is aggressively expanding capacity in China and aims at 10 percent market share. In Brazil, Nissan targets “a minimum of 5 percent market share.” How do they want to perform that miracle? Says Ghosn: “We will build a new plant in Brazil, with a capacity of 200,000 units — as a first step.”

In Europe, Nissan wants to become no less than the largest volume Asian brand. In the ASEAN countries, Nissan wants to increase its market share from 6 percent today to 15 percent by 2016.

“Some people keep saying we make electric vehicles for the brand,” said Ghosn and sent some withering glances in the general direction of some reporters. ”We make electric vehicles to make money.” Ghosn says that they have sold 8,000 Leafs worldwide so far. The only thing that is keeping them from selling more are Nissan’s capacity problems. “Electric cars demonstrate that what is good for the planet is also a good business,” said Ghosn and announced that the Nissan-Renault Alliance wants to sell 1.5 million EVs by 2016, helped by four EVs under the Nissan brand and another 4 with the Renault badge. Ghosn figures that until 2015, the Alliance will have most of the EV market for themselves, dismissing “manufacturers who just make a few hundred.”

Not officially in the Power 88 plan: Nissan strives to kill the jobs of journos. Under the firm hand of Dan Sloan, former bureau chief at Reuters Singapore, Nissan is setting up a content factory that will have the news out before the members of the media have even left the conference room.

“This event will be streamed live over the Internet,” said an announcer at the beginning. ”Keep that in mind.”

Fair warning that kept the members of the Fourth Estate from picking their noses, or checking their Blackberries for the latest offerings of Yokohama soaplands.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- CanadaCraig As an aside... you are so incredibly vulnerable as you're sitting there WAITING for you EV to charge. It freaks me out.

- Wjtinfwb My local Ford dealer would be better served if the entire facility was AI. At least AI won't be openly hostile and confrontational to your basic requests when making or servicing you 50k plus investment and maybe would return a phone call or two.

- Ras815 Tesla is going to make for one of those fantastic corporate case studies someday. They had it all, and all it took was an increasingly erratic CEO empowered to make a few terrible, unchallenged ideas to wreck it.

- Dave Holzman Golden2husky remember you from well over decade ago in these comments. If I wanted to have a screen name that reflected my canine companionship, I'd be BorderCollie as of about five years go. Life is definitely better with dogs.

- Dave Holzman You're right about that!

Comments

Join the conversation

If they get rid of their awful CVT powertrains they may get more sales but Nissan has been going backwards for 20 years or more never ming things like 370z and Gtrs the ordinary product is very ordinary

Nissan needs a mainstream car that is competitive with the global cars from the other manufacturers: golf, civic, cruze, corolla and focus; the Tiida is not (except maybe the corolla). Until they do so it is hard to take this plan seriously Nissan also needs something below the Micra, and rebadged Suzuki Altos are not going to cut it.