2 Views

December Sales: 2010 Ends With Steady Growth

by

Edward Niedermeyer

(IC: employee)

Published: January 4th, 2011

Share

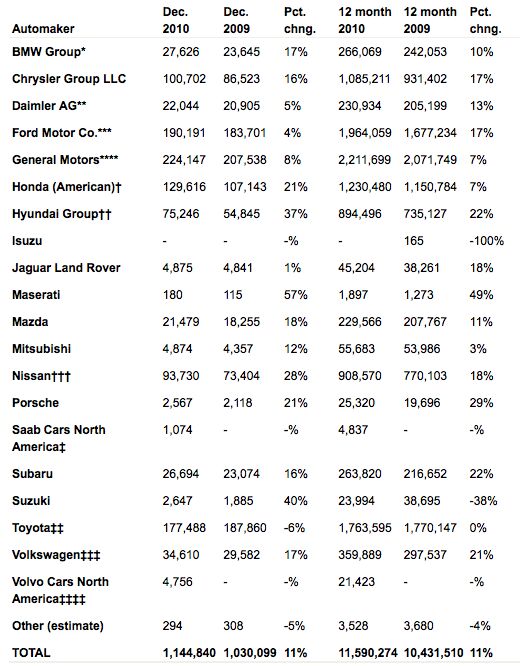

It’s looking like 2010 will end with the auto industry selling 11.5m units in the United States, as the SAAR over the last quarter of the year rose to about 12.4m units. We’ll update our table of December sales results as they become available, and in the meantime we’re preparing some year-end reporting of sales by automaker in the year that was. Stay tuned…

Edward Niedermeyer

More by Edward Niedermeyer

Published January 4th, 2011 1:50 PM

Comments

Join the conversation

FYI, according to today's GM sales press release, Saab sold 868 vehicles in the US in December 2009 and 8,680 vehicles for all of 2009. http://media.gm.com/content/dam/Media/gmcom/investor/2011/DeliveriesDecember2010.pdf

The top two sellers for 2010 are Ford and GM trucks Ford F-Series 528,349 27.7 percent Chevrolet Silverado 370,135 16.9 percent Toyota Camry 327,804 -8.1 percent Honda Accord 282,530 -1.7 percent Toyota Corolla 266,082 -10.4 percent Honda Civic 260,218 0.2 percent Nissan Altima 229,263 12.6 percent Ford Fusion 219,219 21.3 percent Honda CR-V 203,714 6.5 percent Dodge Ram 199,652 12.6 percent

What's the deal with Suzuki being up 40% for December but down 38% for the year? I am a regular visitor to this site and don't recall any mention of any possible cause for this.

I wonder if Nissan is pissed at Hyundai. I figure they'll be losing that lead by March. Man, those Koreans are on a tear!