Is Detroit Headed For Oversupply?

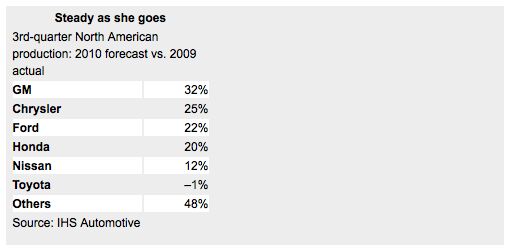

Third quarter North American auto production is headed for the 11.8m mark, even as analysts at IHS Automotive revise their sales projections downwards to 11.5m, once again raising the specter of oversupply which haunted Detroit for much of the last decade. GM, which is forgoing a Summer plant shutdown this year, is expected to increase its Q3 production by 32 percent over last year, as its market estimate ranges from 11.5 to 12m units according to Automotive News [sub]. Though that’s on the high end compared to the IHS number, and though GM’s market share has been anything but stable, the firm is keeping a steady hand on the tiller to maintain a sense of normalcy headed into its forthcoming IPO. And with inventories in far better shape than they’ve been in years, automakers reckon they can always get rid of extra cars when the market rebounds next year. In the meantime, however, the risks of overproduction are very real.

Chrysler, for example, has the highest inventory level in the industry at 60 days of supply. That’s considered the industry “ideal” for supply, but the fact that Chrysler’s competition is keeping supply even lower is a sign that a rapid sales recovery isn’t in the cards. Meanwhile, IHS’s Mike Jackson points out that Chrysler is only maintaining that volume through fleet sales.

Chrysler is relying pretty heavily on fleet sales. You have to play the cards you are dealt. They have to make sure they maintain volume

At the price of even greater resale weakness, brand degradation, and the perpetuation of Chrysler’s rental-car image. In short, Chrysler is already stuffing sales into fleets to (barely) meet its 95k monthly “survival” volume, keeping the lights on at the expense of future brand equity. With a wave of facelifts and refreshed product hitting the market soon, Chrysler can ill afford to keep up its fleet sales binge, let alone actually increase production volumes.

GM’s production increase is likely due at least in part to a ramp-up to Cruze production, while Ford’s 22 percent production bump is tied closely to the release of the new Fiesta. If both of those products make big initial plashes, the production increases associated with them could be worth the risk. Chrysler, on the other hand, is still months away from releasing new product, and there’s not much to indicate that a sales increase of its existing product is in the offing.

Meanwhile, with IHS revising its sales estimate from 11.8m to 11.5m, and talk of a double-dip recession bubbling away, it’s not impossible to imagine US-market sales falling lower still. If that happens, look for fourth quarter production to more than make up for the summer glut, and expect end-of-year sales to cut into razor-thin profit margins. After all, even Hyundai, which has several brand-new and red-hot products on the market is keeping its inventory down to a 35 day supply, or nearly half of Chrysler’s level. After all, the way for a brand to make a comeback is to build great cars and sell every one they build at full price. Chrysler already tried the volume-über-alles approach under Cerberus, and we all know how that turned out.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Probert They already have hybrids, but these won't ever be them as they are built on the modular E-GMP skateboard.

- Justin You guys still looking for that sportbak? I just saw one on the Facebook marketplace in Arizona

- 28-Cars-Later I cannot remember what happens now, but there are whiteblocks in this period which develop a "tick" like sound which indicates they are toast (maybe head gasket?). Ten or so years ago I looked at an '03 or '04 S60 (I forget why) and I brought my Volvo indy along to tell me if it was worth my time - it ticked and that's when I learned this. This XC90 is probably worth about $300 as it sits, not kidding, and it will cost you conservatively $2500 for an engine swap (all the ones I see on car-part.com have north of 130K miles starting at $1,100 and that's not including freight to a shop, shop labor, other internals to do such as timing belt while engine out etc).

- 28-Cars-Later Ford reported it lost $132,000 for each of its 10,000 electric vehicles sold in the first quarter of 2024, according to CNN. The sales were down 20 percent from the first quarter of 2023 and would “drag down earnings for the company overall.”The losses include “hundreds of millions being spent on research and development of the next generation of EVs for Ford. Those investments are years away from paying off.” [if they ever are recouped] Ford is the only major carmaker breaking out EV numbers by themselves. But other marques likely suffer similar losses. https://www.zerohedge.com/political/fords-120000-loss-vehicle-shows-california-ev-goals-are-impossible Given these facts, how did Tesla ever produce anything in volume let alone profit?

- AZFelix Let's forego all of this dilly-dallying with autonomous cars and cut right to the chase and the only real solution.

Comments

Join the conversation

Chrysler does have brand new product that did just come out... sure its an mid size SUV, not a compact car, but it is new product. There is also a slew of Refresh and new products coming out this fall... unlike GM who really doesn't have much of a pipeline right now, and Ford which has the Fiesta and new Focus to carry on for a couple of years of hype. While Chrysler's new stuff that we think is coming out may be vaporware, they delivered what they said they were going to with the Grand Cherokee... so I think their may be a wait. Out of that list that surprises me (well other than GM, that many Cruze are going to be sold?) Honda's forecast is quite optimistic.... where are these sales going to come from? From what new products? Have they not looked at recent sales?

It doesn't really matter. GM no longer needs to worry about profits. As long as BarryO holds the purse strings, he can just pump more tax payer into his UAW pet project.