China's Auto Makers Have Big Plans

While Toyota is successful in hitting the target it painted on its own foot, Chinese manufacturers are setting more ambitious targets, Gasgoo reports. On the average, domestic automakers plan for 30 percent expansion. Joint venture car makers are a little more restrained.

Chery aims to sell 700,000 to 900,000 units this year, up 157 percent from a year earlier.

BYD plans to sell 800,000 vehicles by 2011.

Geely raised its sales target by 33 percent to 400,000 vehicles in 2010.

Brilliance set its sales target for this year to 450,000 models, up 36.4 percent.

SAIC, FAW, Dongfeng and Chang’an all kept their targets below 20 percent growth for 2010 (always better to exceed cautious targets than to come in under optimistic ones.)

Nonetheless, each of them plan to blow past the 2m unit mark. SAIC set its sights on more than 3 million units to be produced in 2010.

Even Porsche wants to set sales records. This year, they want to sell 10,000 in China. Shouldn’t be too hard, last year they sold 9090. In 2012, they want to outsell Germany with 16,000 Porsches sold to in China.

Interesting to note: All plans are well above the cautious 10 to 15 percent, China’s officials have in their plans.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

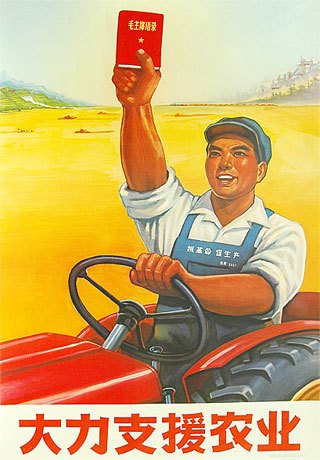

The slogan on the picture is "vigorously support the agriculture sector". What is the caption supposed to invoke?

I agree...大力支持农业!

So all this growth seems to be based on domestic demand. Are we going to see exports from China in the overseas markets anytime soon?

The Chinese auto manufacturers seem to have more than enough demand for their products in China; why should they worry too much about exporting vehicles?