The Pretty Side Of Honda

There has been a lot of, well, criticism, of Honda on these pages lately, including allegations that Honda had lost it. So far, more that fifty of the Best & Brightest offered advice on how to save the company from certain annihilation.

Today’s Nikkei says “domo arigato gozaimashita” for all the support, and runs a different story: “Honda Motor Co. has emerged from the economic turmoil at the head of the pack, thanks in good part to a nimble production network that can meet the latest consumer preferences at relatively low cost.” Here is why.

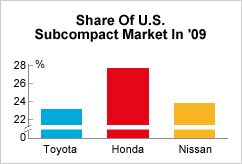

According to the Nikkei, Honda retooled its U.S. production operations in a mere six months last year, responding to the sudden demand for smaller vehicles. As the chart shows, the realignment translated into a substantial share of the U.S. subcompact market.

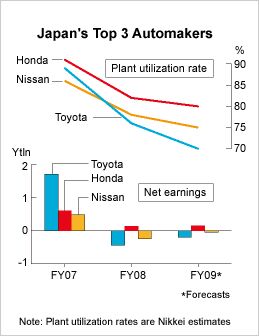

It is also the reason for Honda being “the only major Japanese maker likely to score a net profit” in the current fiscal year, says the Nikkei.

Capacity utilization rates at some facilities have been boosted by as much as 20 percent. In the current fiscal year, which ends March, Honda will most likely report an overall utilization rate of 79 percent, highest among Japan’s three largest automakers. In the industry, anything above 80 percent utilization is considered healthy. Given the worldwide capacity utilization, estimated to be between 50 and 60 percent, 79 percent are short of a miracle.

Honda can make sm

all and large vehicles on the same production lines. All it needs is a quick change of welding pieces, paint nozzles and other components.

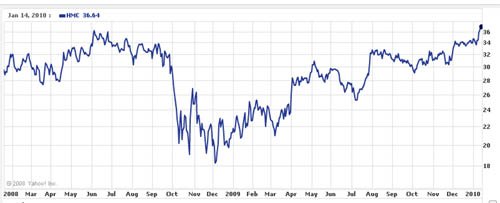

Not only the Nikkei is impressed with Honda, the stock market likes Honda as well. At the time of this typing, Honda’s stock (HMC) changed hands for $36.90 at the New York Stock Exchange, eclipsing its pre-carmageddon highs.

Honda may have “ugly styling highlighted by uglier front grilles; a hybrid system that simply isn’t as advanced and effective as Toyota’s; a bloated Accord; no new direct injection engines; lots of muddling about future EVs; and a misplaced optimism about fuel cells,” as Edward Niedermeyer wrote it.

However, Honda’s stock chart, a market capitalization of $67.7b, and a near-pornographic P/E of 47.92 on the other hand are a sight to be seen. Maybe you shouldn’t have bought the Insight. But you would be very pleased if you would have had the foresight to buy the Honda stock in December of 2008. You could have doubled your money.

Or, looking at the chart and all that’s wrong with the company, maybe it’s time to short HMC?

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Dale Had one. The only car I ever bought because of a review in a guitar magazine.Sure was roomy inside for such a small car. Super practical. Not much fun to drive even with a manual.Sent it to college with my stepson where it got sideswiped. Later he traded it in on an F-150.

- Bd2 Hyundai's designs are indeed among the most innovative and their battery technologies should allow class leading fuel consumption. Smartstream hybrids are extremely reliable.

- 28-Cars-Later So now H/K motors will last longer in between scheduled replacements. Wow, actual progress.

- AZFelix I have always wondered if the poor ability of Tesla cars in detecting children was due to their using camera only systems. Optical geometry explains that a child half the height of an adult seems to have the same height as that same adult standing twice as far away from the viewer.

- 28-Cars-Later Actually pretty appealing (apparently I'm doing this now). On a similar note, a friend of mine had a difficult situation with a tenant which led to eviction and apparently the tenant has abandoned a 2007 Jag S-Type with unknown miles in the garage so he called me for an opinion. Before checking I said $2-3 max, low and behold I'm just that good with the 3.0L clocking in at $2,3 on average (oddly the 4.2 V8 version only pulls $2,9ish) and S-Types after MY05 are supposedly decent.

Comments

Join the conversation

Good analysis on the stock price. However, despite the loses, Toyota's stock has raised to 90 from 60 last year. And it has been steadily going up. Same for the Ford stock. But in this case, you'd have earned 10 times your investement, from 1$ in about June-July to the 11 posted today. Sadly, I didn't purchase them. What is the minimum in $$$/stocks than can be purchased in of one company? Because, even starting with peanuts you could build a nice amount in some months with clever buying/selling. And still have stocks.

Hmmmm I find it quite amazing to look at: Honda of Japan Honda of Europe Honda of US / Canada and Honda. The US stuff... or the stuff we get.. has got to be some of the worst inspiring crap... that Honda produces. Yes, we get a CUV that shares parts with the Ridgeline and the Ody. We get a BASE version of a very nice, but PORKY car for the US.. http://www.zcars.com.au/images/honda-inspire-modulo-concept1.jpg Against a http://www.caradvice.com.au/wp-content/uploads/2009/10/HondaAccordLimitedEdition.jpg We get a 2dr and a 4dr Civic, paired with a Si, thats weak as hell. Ya got competitors that do much better with less, ntm a high displacement motor, better interior design.. AND more variation on a sport model I mean C'MON, Honda CAN produce a 3and 5dr hatch, along side a 2 and 4dr with the Si. But it might intrude on the Fit / Jazz production. Heck.. Honda is the most nimble in production OUT OF any of the Japanese (besides Toyota) but the amounts that even THEY sell is BADLY tilted towards the heavy and useless shit. In the US market, ya got the 2.5 Mazda 3 hatch, a GTI with a TURBO, Impreza with awd and the WRX (the domestic stuff from FORD is a couple of years out).. but there is plenty of competition. I could even live with the bad interior of the Civic is the body was in more variations... Jeez.. Who gets the shaft?! Now from someone who would buy their stock.. They are a stable company, with manufacturing prowess, full flexibility and if ya buy into how Honda builds an interior, or justifies 2 vehicles for a 3 or 4 range or how lack of hatches in the U.S.. then its all understandable. Buying Honda stock.. is a shoe in. And I for one.. base my opinion not just from what I see in the U.S, but from everywhere on the globe. If the company isnt doing well financially.. then buying their stock is pointless. Ex FORD and their stock v GM and theirs.