#congress

Frustrations Flare At GM Bailout Hearings: Did Ron Bloom Perjure Himself?

Well, I just wrote about 1,500 words on this topic which our post editor just obligingly disappeared into the digital void, wiping out over an hour of work. This was, perhaps, an appropriate turn of events, however, as the majority of those 1,500 words were used to describe the frustrating political stalemate that played out over the last two days of hearings on “The Lasting Implications of the GM Bailout.” The dynamics of the government’s exit from GM seem to have changed little since I wrote “Government Motors: The Exit Strategy,” and the hearings focused on the political implications of the bailout. Having determined that the bailout will help the President’s reelection in midwestern states, the White House (as represented by auto task force member Ron Bloom) sought to retrench its “things would have been worse” position, and Republicans attacked on all fronts for the very same reason. The government’s favorable treatment of UAW-represented workers, especially in comparison to Delphi’s non-UAW retirees was a major point of attack, and the committee caused Bloom deny (under oath) having ever said that “I did this all for the unions,” despite the fact that both the Detroit News’s David Shepardson and Bloom’s task force colleague Steve Rattner have quoted him directly. Emails obtained by The Daily Caller were also presented as ( more) evidence that the government intervened in a number of day-to-day decisions at GM, including the Delphi retiree issue.

Ultimately, the Republicans landed some serious body blows on the policy, although nothing radically new was presented. Bloom, meanwhile, defended the bailout by arguing that the alternative would have been much worse. In short, the political stalemate over the auto bailout continues… much to GM’s dismay. And since insiders are indicating that any collusion to boost GM’s stock price in order to improve the taxpayers’ return would be worse than a larger loss, a $10b+ loss is as good as guaranteed. Which means the Republican attacks will continue and the political trench warfare over the issue will only continue.

Senate Votes To Repeal Ethanol Tax Credits

Cracks continued to in the ethanol industry’s once-impregnable political vanguard, as the San Francisco Chronicle reports that the Senate has voted to roll back the Volumetric Ethanol Excise Tax Credit (VEETC) as well as import tariffs on foreign-produced ethanol. This rollback of multi-billion-dollar ethanol credits failed earlier in the week, when the Detroit News reports automakers came out in opposition of a bill that would have required that 95% of all cars built in the US be capable of running 85% ethanol by 2017. The Senate did fail to pass a repeal of a government ethanol blending mandate that underpins the VEETC, however, and funding is moving forward for ethanol blending pumps. Still, the Senate’s repeal of VEETC alone means taxpayers could save over $5b per year on subsidies, and as one expert puts it

“Looks like we’re going to be relying on the biofuels mandates to make sure blenders use biofuels, rather than bribing them to use it with $6 billion,” [Bruce Babcock, professor of economics and the director of the Center for Agricultural and Rural Development at Iowa State University] said.

In fact, Babcock thinks killing the subsidy could help ethanol because it would come out from the stigma of being a subsidized industry. And removing the subsidy may strengthen support for the mandate, and the tariff on imports.

Over to you, House of Representatives…

Quote Of The Day: Busted! Edition

If it were up to the candidates for president on the Republican side, we would be driving foreign cars; they would have let the auto industry in America go down the tubes,

These were the words of Democratic National Committee Chair Rep. Debbie Wasserman Schultz (D-Fla.) at a breakfast put on by the Christian Acienec Monitor. But, as TheHill‘s Michael O’Brien reports, Ms Wasserman Shultz owns a 2010 Infiniti FX35 that is built by Nissan in Tochigi, Japan. And, adds O’Brien, “The car appears to be hers, since its license plate includes her initials” (it is, see picture above). The congresswoman’s response (through a spokesperson):

They can try to distract from the issue if they want. But if Republican opposition researchers are snooping around garages, they should know that if Republicans — who said that we should let the U.S. auto industry go bankrupt — had their way, they wouldn’t find a single American made car anywhere.

*Sigh*

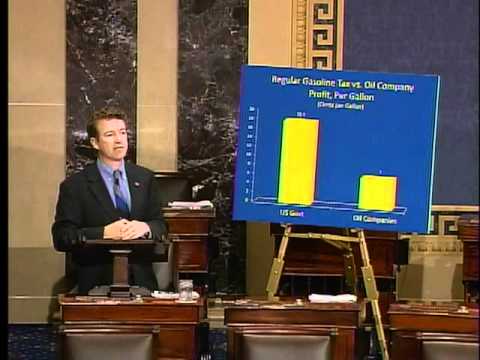

Senate Proposal Would Suspend Federal Gas Tax

The average price of regular unleaded gasoline was $3.96 this week, an increase of 38 percent over the same time last year. US Senator Rand Paul (R-Kentucky) on Tuesday proposed to temporarily reduce that cost by 18.4 cent cents by suspending the federal gas tax. Under the freshman lawmaker’s plan, the highway trust fund would be replenished by reducing payments made to foreign governments.

“Let’s have a gas tax holiday,” Paul said in a floor speech. “Let’s take the money from foreign aid and let’s give it back to the American people who worked hard to earn it…. That would help people, that would lower the price of gasoline and that would be a stimulus to the economy.”

Feds Moving EV Tax Credits To "Cash For Clunkers" Model

Speaking at Nissan’s Smyrna, TN electric car factory, Transportation Secretary Ray LaHood noted that his staff is working with Congress to make federal tax credits for plug-in car purchases available as a rebate on the dealer level, saying

We’d like for people to get a $7,500 rebate on the day they buy the Leaf. We’re doing a lot of talking about it. When you give people that incentive to buy a battery-powered car, they’ll do it. We know these incentives help.

Speaking to Automotive News [sub], LaHood even went as far as to argue that the new direction for the tax credits, which were previously only claimable when filing taxes, would be successful for the reason that it would make the credits more like the Cash For Clunkers program. Apparently LaHood has completely forgotten how riddled with waste, inefficiency, fraud, confusion, delays, unintended consequences and all-purpose madness that program was. And that’s just scraping the surface. Foolish as it is to subsidize vehicles during the “fleecing the early adopters” phase of a new technology rollout (perhaps we should be saving stimulus for the inevitable “trough of disappointment”?), making those credits available at the dealer level is even worse, increasing the hype and incurring C4C-like downsides along the way.

62 MPG: The War Of The Letters

The war of words over a possible 62 MPG 2025 CAFE standard is accelerating this week, as letters in support of the standard [sub] are vying with industry responses against the proposal for media attention. And though environmentalists are quick to point out the often-misunderstood difference between EPA and CAFE mileage ratings (a fact that even the industry-friendly Automotive News [sub] concedes, if only in a blog post], the industry’s response is miles away from any kind of compromise, saying

The alliance believes it is inappropriate to be promoting any specific fuel economy/greenhouse gas at this point

How’s that for some old-school, don’t-tread-on-me corporate attitude? No room for compromise, no sense of nuance… and yet, that doesn’t actually represent the industry’s position at all.

Bipartisan Bill Seeks To End Cornerstone Ethanol Subsidy

Yesterday evening I directed some ire at President Obama’s continued reliance on ethanol as a major plank of his do-nothing transportation/energy agenda, noting

That extra money for 10,000 E15-capable pumps? That’s because no gas station owner will pay to install a pump for a kind of fuel that only cars built since 2001 can use… and which the auto industry has tried to ban. And why E15 in the first place? Because blenders can’t sell enough E10 to blend the government-mandated amount of ethanol and collect their $6b this year in “blender’s credits” to do so. A subsidy to support a subsidy which in turn props up yet another subsidy (I may have missed a subsidy in there somewhere). You can’t make this stuff up.

The “cornerstone” subsidy that all other ethanol subsidies support is the Volumetric Ethanol Excise Tax Credit, or VEETC, or “blender’s credit,” a $6b per year subsidy that directs 45 cents to refiners for every gallon of ethanol they blend with gasoline. The VEETC nearly died in December’s lame duck session, only to be revived as a way to buy votes for the President’s tax policy. Now, however, The State Column reports that a bipartisan Senate bill has been introduced that would eliminate both the VEETC and import tariffs on foreign-made ethanol. And with a rash of bad news coming out about ethanol, this could just be the opportunity to kill this wasteful government subsidy with fire.

White House Disowns Pay-Per-Mile Tax Plan

Hackles were raised here at TTAC and around the internet this week, when a draft version of the Transportation Opportunity Act circulated, tipping us to the administration’s preference for pay-per-mile road taxation. According to that version of the bill,

section [2218] would establish a Surface Transportation Revenue Alternatives Office within the Federal Highway Administration. The office would analyze the feasibility of implementing a national mileage-based user fee system that would convey prices to users to reflect system use and other travel externalities and serve as a funding source for surface transportation programs.

TTAC has been tracking and criticizing attempts at pay-per-mile taxation (both state and federal) since at least 2007, and because Transportation Secretary Ray LaHood had previously come out in support of pay-per-mile road taxes, we weren’t surprised by the TOA’s inclusion of a move towards pay-per-mile. And because the White House smacked LaHood down the last time he praised pay-per-mile, we aren’t all that surprised to find The Hill reporting that the White House is disavowing any interest in pay-per-mile. Spokesfolks explain:

This is not a bill supported by the administration. This was an early working draft proposal that was never formally circulated within the administration, does not take into account the advice of the president’s senior advisers, economic team or Cabinet officials, and does not represent the views of the president

So fear not, Americans opposed to a GPS tracker in every car: the White House has no interest in tracking your every movement. But until such time as a politician finds the cojones to address the highway fund’s shortfall by raising the gas tax, expect pay-per-mile to pop up again and again.

House Transportation Committee Blasts Transportation Stimulus

One of President Obama’s signature achievements, passage of $812 billion in stimulus funds at the height of the recession, was labeled a failure by the chairman of the US House Transportation Committee, which had jurisdiction over about eight percent of the projects funded. In a hearing yesterday, Representative John Mica (R-Florida) explained that the money did not end up going to needed infrastructure projects.

“This will go down in history as one of the greatest failures of a government program to stimulate the economy that mankind has ever created,” Mica said. “This is a trillion-dollar lesson.”

"Transportation Opportunity Act" Moves Towards Freeeway Tolls, Pay-Per-Mile

Editor’s Note: The text of the “Transportation Opportunity Act” with section-by-section analysis can be downloaded in PDF format here [courtesy: bna.com]

The White House last week began circulating its legislative proposal for transportation reauthorization that included provisions to add toll booths to existing freeways and impose a tax for every mile driven. The “Transportation Opportunities Act” for the first time gave the Obama administration’s full approval to the concept of an added charge on drivers for the use of roads throughout the country, including on existing, untolled freeways in major metropolitan areas.

Obama EV Credit-To-Rebate Plan Draws Opposition… From Democrats

President Obama’s goal of putting one million plug-in vehicles on the road by 2015 has faced serious challenges from day one, with several studies pointing out that the goal probably isn’t achievable without more government action. But up till now, President Obama has forwarded only one actual policy change aimed at achieving his goal, namely turning an existing $7,500 federal plug-in tax credit into a rebate, redeemable at the point of purchase (an idea first forwarded by Michigan Democrat Debbie Stabenow). This plan should help drive a Cash-for-Clunker-style EV buying frenzy, as the rebate would not be dependent on the buyer’s tax burden. But Automotive News [sub] reports that Senate Finance Committee Chairman Max Baucus (D-MT)

is very concerned [about the credit-to-rebate scheme] from an effectiveness standpoint.

Baucus doesn’t make a regular habit of opposing the President, but apparently his concerns about the Obama/Stabenow credit-to-rebate plan are serious enough for him to put politics aside.

"Right To Repair" Debate Returns To Congress

After several abortive attempts over the last several congresses, the “Right To Repair” Coalition for Auto Repair Equality has had a new bill introduced in the 112th Congress with the goal of

requiring that car companies provide full access at a reasonable cost to all service information, tools, computer codes and safety-related bulletins needed to repair motor vehicles.

The auto industry has long opposed such bills, which have been passed on the state level but have never been passed into federal law. Back in 2009, then-head of the Alliance of Automobile Manufacturers lobby group, Charles Territo, argued against Right To Repair legislation in a TTAC editorial, calling it “a solution in search of a problem.” More recently, the AAM opposed a Massachusetts Right To Repair bill on the grounds that it would increase Chinese piracy of auto parts. Needless to say, now that CARE has finagled HR 1449 into Congress with bipartisan sponsorship (from Todd Platts (R-PA) and Edolphus Towns (D-NY)), the debate is about to get fired up all over again.

New Ethanol Bill Faces Automaker Resistance

How things change in a few years! Just a few short orbits of the sun ago, automakers like GM were some of the biggest boosters of ethanol subsidies. Now, the Detroit News reports

The Alliance of Automobile Manufacturers – the trade association representing General Motors Co., Ford Motor Co., Chrysler Group LLC, Toyota Motor Corp. and eight others – opposes a bill sponsored by Sen. Tom Harkin, D-Iowa, that would require 90 percent of all vehicles to run on E85 – a blend of 85 percent ethanol – by the 2016 model year.

Shane Karr, vice president for government affairs, said the mandate “would cost consumers more than $2 billion per year” for flex fuel vehicles if automakers passed on the full cost “even though consumers will have little or no access to alternative fuels. Therefore, such a mandate is essentially a tax with little consumer benefit.”

In the face of this new opposition, the Renewable Fuels Association has even taken to employing the rhetoric of market economics to justify market-manipulating ethanol subsidies. And it doesn’t seem to be convincing anyone. If anything, Harkin’s bill may just hasten the death of existing subsidies, which are under pressure as both Democrats and Republicans seek to trim the federal budget.

Ethanol "Blender Credit" Under Attack Again

At the end of last year, the Volumetric Ethanol Excise Tax Credit (aka “Blender’s Credit) very nearly expired before congress passed a one-year, $6b extension to the subsidy. The near-collapse of the largest “renewable energy” subsidy on the federal books came as the backlash built against the EPA’s approval of E15 (15% ethanol) blends for certain vehicles, with a huge coalition of industries, environmentalists and budget hawks coalescing around the idea of ending government support for corn-based ethanol. That coalition lost some momentum as the VEETC was extended in order to drum up support for the controversial tax bill that was passed during December’s lame duck session. But now, SolveClimate [via Reuters] reports that the brewing deficit battles have put the Blender’s Credit back on the chopping block, as a new bill seeks to cut the wasteful, inefficient and unpopular (outside of farm states) subsidy.

House Subcommittee Moves To Ban EPA GHG Regulation

House Republicans took the first steps towards banning the EPA’s regulation of greenhouse gases, as the Energy and Power Subcommittee of the House Energy and Commerce Committee approved HR 910, the Energy Tax Prevention Act of 2011. In their statements today, Republican committee leaders cited rising gas prices and negative impacts on American businesses as the main reasons for attempting to strip the EPA of its ability to regulate emissions of

Water vapor, Carbon dioxide, Methane, Nitrous oxide, Sulfur hexafluoride, Hydrofluorocarbons, Perfluorocarbon and any other substance subject to, or proposed to be subject to, regulation, action, or consideration under this Act to address climate change.

Intriguingly, subcomittee Chairman Ed Whitfield’s statement [ PDF] names a number of industry groups who support HR910, including the National Association of Manufacturers, U.S. Chamber of Commerce, American Farm Bureau Federation, National Mining Association, National Cattlemen’s Beef Association, National Petrochemical and Refiners Association, and the National Association of Realtors… but no auto industry group was named as a supporter of the bill (current regulation of GHGs only cover power stations and large-scale emitters). HR910 has been fast-tracked to the full Energy and Commerce Committee, which will begin hearings on Monday. According to Bloomberg, Senate Democrats are vowing to block the bill, arguing that Republicans attempts to link the bill to gas prices are misleading and that if passed, it would increase harmful pollution.

Recent Comments