#TimothyCain

Cain's Segments: Q1 2014 Full-Size Truck Sales

Year-over-year comparisons are a completely valid comparison tool, indeed a vital one, when analyzing the sales volume reported by automobile manufacturers. The auto industry is seasonal; cyclical at the best of times. The number of vehicles sold in say, January, bears little resemblance to the number of vehicles sold in May.

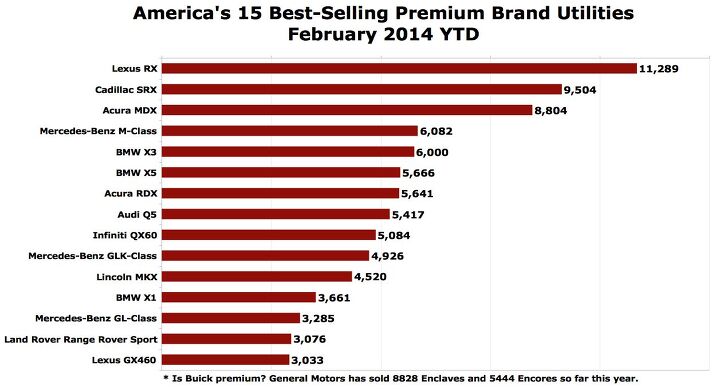

Cain's Segments: Luxury Crossovers

A strong start to 2014 has the BMW X3 leading its segment even as it’s challenged more closely in BMW showrooms by the slightly smaller and less expensive X1.

Cain's Segments: Midsize Sedans

By stealing the Toyota Camry’s best-selling midsize car crown, albeit likely on a temporary basis, the Nissan Altima ended February 2014 as America’s best-selling car overall. The Altima’s lead was also substantial enough last month to make the midsize Nissan America’s leading car year-to-date.

GM's Truck Market Share Slides In January

U.S. sales of full-size trucks slid 4.5% in January 2014 as the two leading manufacturers of pickups reported falling sales of all their big trucks.

Typically the slowest month of the year for new vehicle sales, this past January should be no different, as the U.S. auto industry generated 32,000 fewer sales than it did one year ago. Although minivans, commercial vans, and the vast SUV/crossover segment all expanded, passenger car sales plunged, year-over-year, and truck volume declined, as well.

Cain's Segments, January 2014: Subcompacts

The Mitsubishi Mirage’s status as the best-selling Mitsubishi passenger car in America in January 2014 wasn’t enough to help the subcompact segment overcome the declines reported by its leaders last month.

Cain's Segments: Minivans Up!

The story basically writes itself. America’s minivan segment, which declined faster than the overall industry before becoming mostly stagnant as the U.S. automobile market regained strength, enjoyed a sales boost in January 2014 even as the overall market decreased in size.

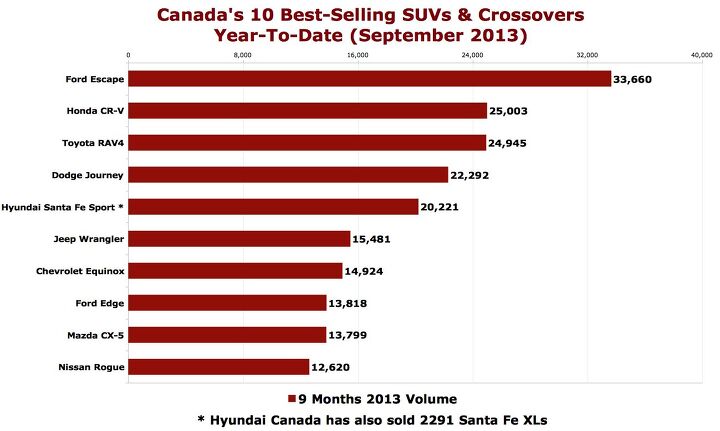

September 2013 Recap: Canada's Best Selling SUVs

September’s record Canadian auto sales were powered by huge gains among many of the country’s most popular nameplates. The record-setting industry performance occurred despite the declining volume reported by the manufacturer which sells the greatest number of vehicles south of the border. Numerous small-scale luxury automakers continue to post vastly improved sales compared with results from 2012.

Automobile manufacturers collectively reported a 4.1% year-over-year improvement in September sales, an increase of nearly 6000 units, an increase of more than 14,000 units compared with September 2011. 42.9% of the new vehicles registered in Canada in September were sold by the Ford Motor Company, Chrysler Group, and General Motors, down slightly from 43.2% in September 2012 as volume at the Detroit Three grew 3.5%. In September, those three manufacturers owned 45.3% of the U.S. market, where General Motors wasn’t outsold by Hyundai-Kia.

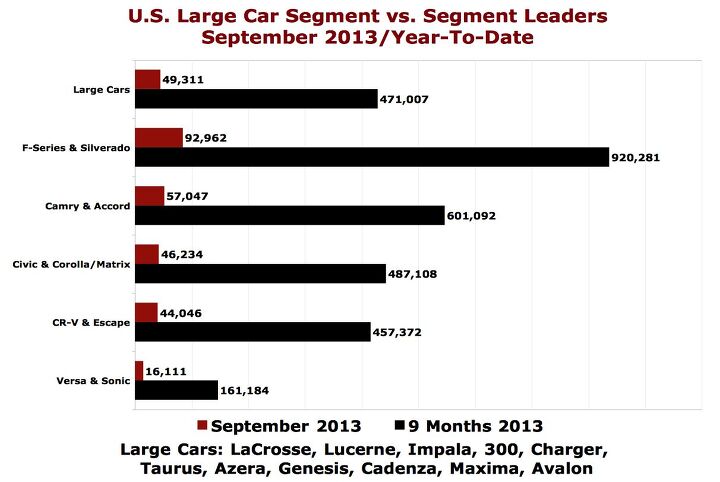

Cain's Segments: September 2013 Large Car Sales

As America’s new vehicle market posted a 4% sales decline in an abbreviated September 2013 and total passenger car sales slid 7%, sales of large cars at mainstream brands rose 5%.

Growth was powered in large part by the Dodge Charger, which hasn’t sold this well since 2008.

Toyota reported its tenth consecutive significant Avalon sales increase. The Hyundai Azera’s 67% jump equalled 596 extra units. In its sixth month, Kia sold 926 Cadenzas, down 35% from the average it had achieved over the prior three months.

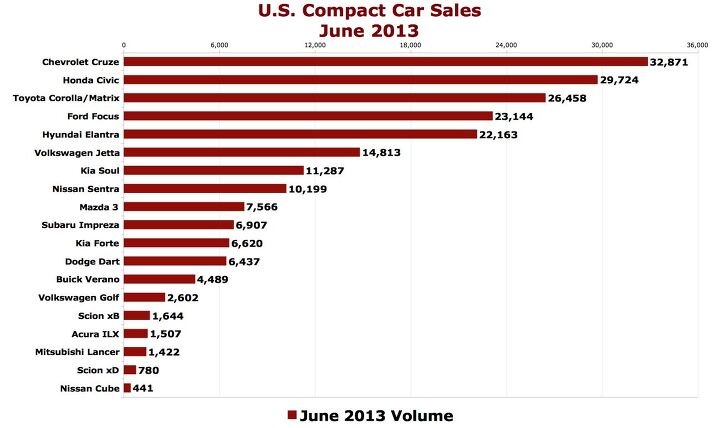

Cain's Segments: Compacts Lifted By Cruze And Dart

Compact cars, many of which are now as roomy as older midsize cars, collectively sold at a significantly better rate in the first half of 2013 than in the first half of 2012.

It may have proven to be a bit of a disappointment thus far, but 35,764 of the extra 87,149 compact sales have come from the Dodge Dart. Exclude small Dodges from the equation and compact sales in America are up 4.8% this year. America’s auto industry has produced a 7.5% improvement.

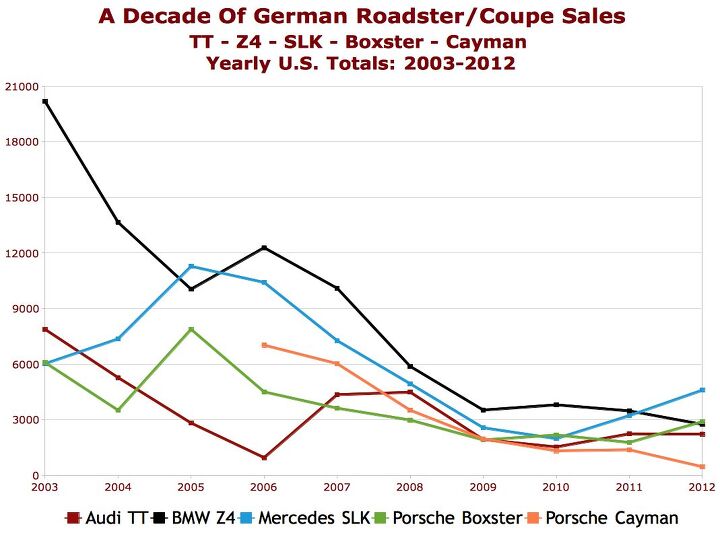

Cain's Segments: Where Did All The German Roadsters Go?

In the first six months of 2013, the volume achieved by America’s auto industry was 5% smaller than it was in the first six months of 2003. This is an important statistic, one which goes a long way in understanding how America’s appetite for the smallest German roadsters (and hardtops, and hardtop roadsters) has dwindled.

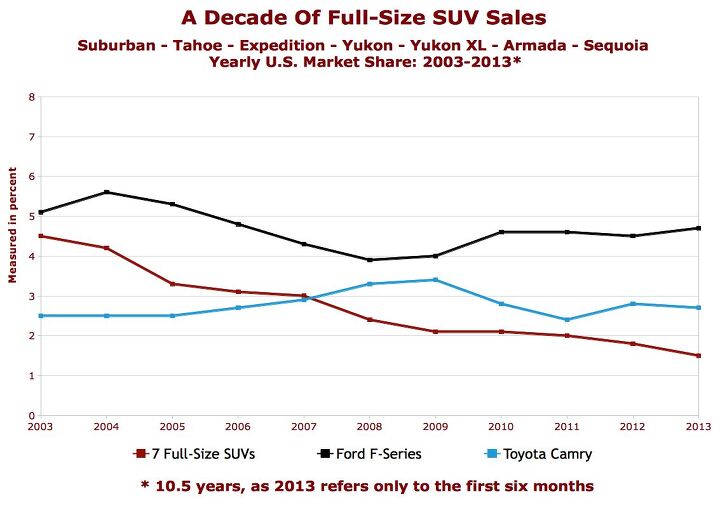

Cain's Segments: Return Of The Big, Bad, BOF SUVs

June hosted a dramatic decline in the U.S. sales of traditional full-size sport-utility vehicles but also marked the end of a successful first half in which sales of these seven SUVs rose 7.9%.

Canada In May 2013: Picking Up The Pace

(Editor’s note: Despite being a close neighbor, ally, and NAFTA member, Canada usually receives short shrift when it comes to the counting of cars. TTAC is a prime offender. We cover sales in Europe, Japan, China, and of course America – but Canada? Our resident car counter Cain will now cover the Canadian market on a monthly basis. Any volunteers for Mexico?)

For the second time in what was predicted to be yet another year of growth for the Canadian auto industry, volume grew significantly in May 2013. January volume was down 2%. By the end of February, the market was off 2012’s pace by 3%. March’s decline wasn’t as bad, but through the first quarter, sales were still down 2%. After April’s 9% increase, auto sales in May reached their highest level in six years.

Cain's Segments: Muscle Cars Weak, Challenger Dodges The Trend

That sound you’ve been hearing for nearly two decades is the weeping and gnashing of teeth roused by the Chevrolet Beretta’s demise. Oh, Ford Probe, we hardly knew ye. Whither the Dodge Daytona? Let’s look at the continuing decline of an empire, formerly ruled by the American Muscle Car.

Cain's Segments: Trucks Roll Over Subcompacts

The eleven vehicles most obviously classified as subcompacts accounted for 3.8% of the American automobile industry’s May 2013 sales volume, down from 3.9% a year ago. Overall volume increased, but not at the rate of the overall market, and certainly not at the rate achieved by their opposite, pickup trucks. Let’s have a little look at the small cars.

Cain's Segments:Truck, Truck, Hooray!

U.S. sales of pickup trucks rose 19% in May 2013 despite the disappearance of 6175 Ford Rangers, Dodge Dakotas, Suzuki Equators, Chevrolet Colorados, and GMC Canyons.

So strong were sales of the remaining trucks that these deficits weren’t simply accounted for, they were overcome to the tune of 32,144 extra sales. Overall, the auto industry reported 108,594 more sales this May than last, according to Automotive News. That works out to an 8% improvement. More than a hundred passenger car nameplates combined to generate about 36,000 more sales in May 2013 than in May 2012.

Recent Comments