#FinancialResults

NIO Cutting 20 Percent of Its Staff After Dismal Q2

Despite assuming the role of one of China’s most promising electric vehicle startups, NIO is struggling. The first quarter of this year was a mess. Worried about bad publicity stemming from battery fires, NIO recalled 4,800 vehicles — more than it sold in Q1. It also endured a noteworthy sales decline, a drop in share price, sold off its Formula E racing team, and announced it would cut around 10 percent of its workforce.

The situation has not improved for Q2. According to reports from the manufacturer, losses expanded 83.1 percent from the previous year to about 3.3 billion yuan ($463 million). Despite NIO’s recent addition of the ES6 crossover, Q2 sales were down 7.9 percent from Q1 — resulting in a grand total of 3,553 deliveries. NIO now believes it will have to sheer 20 percent of its workforce to save costs.

Subaru Quarterly Profits Rise Because Of America, But It Could've Been Even Better

Global Subaru operating income rose 19 percent to $1.06 billion in the quarter ending June 30. Net income was up 4 percent to $733 million on an 11-percent revenue increase to $8.9 billion.

Why?

Subaru’s long since gone to look for America. And while U.S. auto sales keep on slowing — falling for a seventh consecutive month in July 2017, for example — Subaru’s U.S. sales keep on rising. July, in which Subaru begins the current fiscal year’s second quarter, was Subaru’s 68th consecutive year-over-year monthly increase.

The U.S. market generated six out of every ten global Subaru sales between April and June.

Chrysler Profit For Q2 Up 16% to $507 Million, Full Year Forecast Reduced

Chrysler Group reported net income of $507 million in the second quarter, with strong sales of SUVs and pickup trucks helping the car company make a profit for the eighth consecutive quarter. Earnings were up 16% from the same period a year earlier when $436 million was made. However, the company reduced its projected full year profit. Second-quarter revenues grew 7 percent to $18 billion, up from $16.8 billion in 2012.

Ford Posts Record Q2 Profits, Up Almost 19%, Surpasses Expectations, All Regions Profitable Except Europe

‘Good job, Al’, ‘Thanks Bill’

For the 16th consecutive quarter, Ford Motor Co. profits have risen, with the Dearborn automaker reporting a 2nd quarter 2013 profit of $1.23 billion, up 18.6% from 2012, working out to 45¢ per share, exceeding analysts’ projections of 37 cents a share. Pretax profit for the quarter was up 40% to $2.56 billion. The company said that it set records for pre-tax profits in both the 2nd quarter and 1st half of 2013, making $4.8 billion in the first six months of the year.

GM Bumps Up Q3 Results Prior To Election Day

General Motors hasn’t announced their Q3 financial results prior to November in six years, but they intend to announce them on October 31st, 2012 – just prior to the U.S. general election on November 6th.

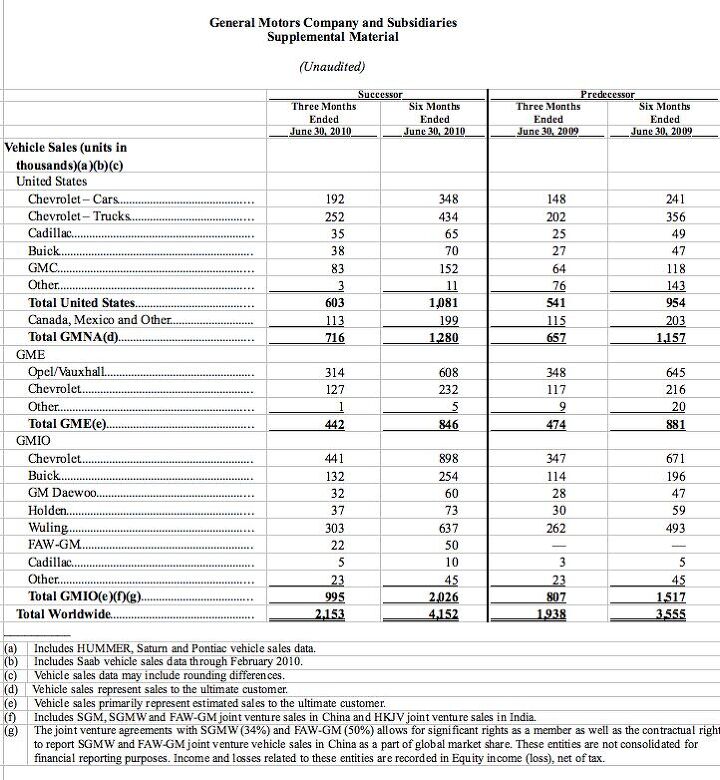

With Opel Back In Black, GM Records $2.5b Profit in Q2

GM has announced its Q2 earnings [ Analyst slides in PDF here], and the firm has recorded a healthy $2.5b profit for the quarter on strong North American performance and an end to losses from the European Opel division. In fact, on an EBIT (earnings before interest and taxes) basis, all of GM’s global divisions were in the black last quarter, although GM Europe and GM South America both recorded modest $100m gains and GMIO (which includes the lucrative Chinese market) recorded a $600m EBIT. The powerhouse continues to be GM North America, which recorded $2.2b in EBIT, continuing North America’s post-bailout importance as the driver of GM’s financial results. Globally, a $600m reduction in EBIT due to costs and “other” was offset by the same amount of gains in volume/mix, while pricing added a billion dollars to overall EBIT. And though fleet sales were up in North America, incentives for the quarter appear to have hit record lows. [Hit the jump for global deliveries and market share/fleet data, via GM’s financial highlights release].

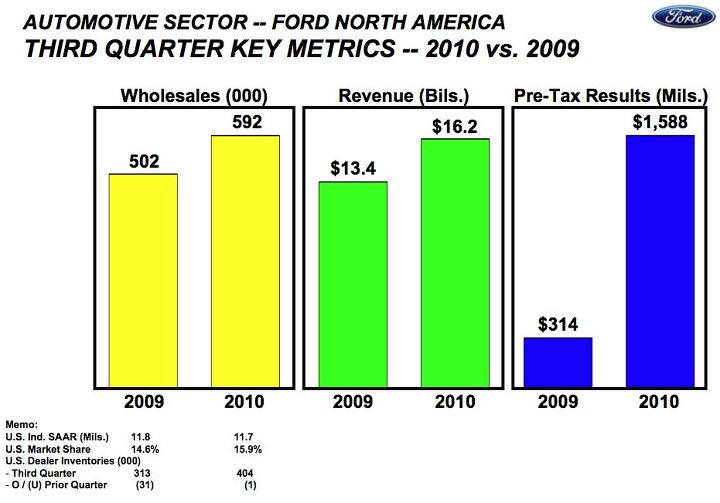

Ford Reports $1.7b Profit For Q3

Ford’s profitability outstripped even yesterday‘s $1.37b estimate, coming in at a whopping $1.68b, as Ford made mad money in the North American market in the 3rd Quarter of this year, for a fifth consecutive profitable quarter. Global revenue was down by about $1b, but excluding Volvo from Q33 2009 results, revenue was actually up $1.7b. $1.6b of Ford’s profitability came from North America, as its most crucial market carried the company over weak overseas results. And with $900m in positive cash flow, Ford says its “automotive cash” will equal its debt by the year’s end, sooner than it had previously forecast. Ford paid of $2b of its revolving credit line last quarter, and plans to pay off the final $3.6b it owes the UAW VEBA trust in Q4. By the end of the year, Ford estimates it will have reduced its overall debt by $10.8b over the course of 2010. Hit the jump for a few key slides from Ford’s Q3 financial presentation.

GM Announces $1.3b Q2 Profit

GM has released its Q2 earnings, and it’s pulled off a $1.3b net profit on improved North American revenue, and narrower losses on GM Europe. Revenues for GM International, however, were down to about half of their Q1 level. Despite over $1b in capital expenditures last quarter, GM managed to improve free cash flow from $970m in Q1 to $2.834b in Q2. Full chart packet available in .doc format here, presentation slides available in PDF format here.

GM Q1 Global Sales: Improving, But Not Dominating

Whereas Chrysler’s surprise operating profit in the first quarter of this year was achieved mainly through cost-cutting, GM’s just-announced Q1 profit comes on the strength of sales increases in most of its global markets. Though The General’s sales numbers are still lower than they need to be, momentum is headed in the right direction… albeit somewhat more slowly than had been hoped.

Ford Pulls In $2.08 Billion Q1 Profit

The Ford Motor Company released its first quarter earnings today [Full report here, Slide presentation here (both PDF)], revealing that it gained over $2b in net profit on rising revenue and improved operating margins. Sales receipts rose to over $28b, and with each of Ford’s regional units posted operating profits, Ford’s gross automotive cash rose by $400m to $25.3b (although operating cash flow was $100m in the red). North American operations earned $1.2b in pre-tax operating profit, South America earned $203m, Europe recorded $107m and Asia-Pacific-Africa brought in $23m. Ford Credit racked up $828 in pre-tax profits, as lower depreciation levels improved results. Despite these fine results, Ford finished the quarter with $34.3b in automotive debt, a $700m increase from the beginning of the year. Ford paid $492m in interest on that debt in the first quarter.

GM Lost $4.3b In The Second Half Of 2009

GM has announced its “fresh-start” post-bankruptcy accounting results, and between July and December of last year, the bailed-out automaker lost $4.3b [press release here, full numbers here, in PDF format]. The loss comes despite $57.5b in global revenue, and $1b in “net cash provided by operating activities.” According to GM’s release:

The $4.3 billion net loss includes the pre-tax impact of a $2.6 billion settlement loss related to the UAW retiree medical plan and a $1.3 billion foreign currency re-measurement loss.

Of course, you have to dig into the numbers to find the bad news, like the $56.4b in “cost of sales,” or the $700m interest cost, or the 48 percent North American capacity utilization in 2009, or the 16.3 percent US car market share. Which is why we’ve included the consolidated statement of operations, consolidated balance sheets and more, for your no-download-necessary perusal, after the jump.

GM Will Miss Financial Results Filing Deadline

Quote Of The Day: Old Lines From New Faces Edition

Ford, Ford Credit Record 2009 Profit

The Ford Motor Company [full results in PDF format here] earned net income of $2.7b last year, on pre-tax operating profits of $454m. The company enjoyed a strong fourth quarter with $868m in net income and an after-tax operating profit of $1.6b (excluding special items). Ford Motor Credit [full release in PDF format here] earned $1.3b in net income and $2b in pre-tax operating profit last year. Ford Credit’s receivables were down at the end of 2009 compared to 2008, with $93b receivable compared to $116b at the end of 2008, and leverage of 7.3 to 1.

Recent Comments