#EmergingMarkets

Toyota Launches All-Out Assault On Emerging Markets, Meets "Fierce Competition" - Not From Detroit

Emerging market-san: Toyota's Yukitoshi Funo

If you are the executive of a car company, then you better be with both feet in the emerging markets, or seek other employment. Markets in the U.S., Europe and Japan are saturated and off their peaks. At the same time, people in the world’s most populous countries are trading in their mopeds for cars, and this is where you want to be. Sadly, Detroit appears to be underrepresented in these markets.

Indonesia May Be The Next Big Emerging Market

With the largest economy and biggest population in Southeast Asia, Indonesia also has one of the lowest rates of car ownership. Although the market is set to expand by more than 50 percent in five years, Toyota dominates 90 percent of that market – and General Motors wants a piece of it.

Never Mind The Showcars, Here's How Daihatsu Gets It Done

Since the Tokyo Auto Show and some Scion scuttlebutt have us on something of a Daihatsu theme here, I thought I’d show a bit of what the small car specialists are up to these days. The truth: despite the brand’s futuristic showcar image projections, Daihatsu mostly plays in the rough-and-tumble entry-level segments of emerging markets, where the cars are small and the margins can be even smaller.

And it’s had better luck there than in the so-called “mature markets.” Though the third generation Charade flopped on the American market amid much popular ridicule of its name (and, according to gearhead lore, oversight of other favorable qualities), the previous generation became the FAW-Tianjin “Xiali,” one of China’s most ubiquitous cars. Now Daihatsu is ditching Europe and hustling strangely cool little mini-MPVs built in Indonesia with the taglines “it’s very cheap” and “we build them compact.” Who needs developed markets?

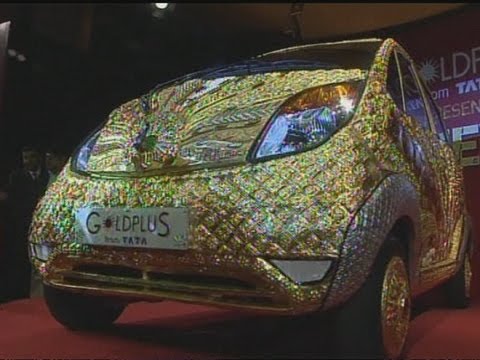

The Nano No-No: Export Launch Delayed Over… High Price?

Designed to be the world’s cheapest car, the Tata Nano is supposed to compete with scooters and three-wheelers rather than full-priced, global-brand vehicles. But the Nano has already seen several price increases since the target MSRP of $2,500 was announced, and the price in India for a base-level Nano is now about $2,870. And when you talk about such low prices, even small increases can wreak havoc on expected volumes, and as a result the Nano is turning into something of a flop (helped along by its pyromania problem).

Get Sterilized, Receive A Tata Nano

With a massively growing population, and no Chinese-style national one-child policy in place, sterilization campaigns in India’s provinces and municipalities are far from uncommon. But now, in the Rajasthani district of Jhunjhunu, officials in charge of sterilization campigns have found a new incentive to encourage Indians to undergo the procedure: the subcontinents growing obsession with automobiles. Britain’s The Independent was the first Western news outlet to report on the scheme, which offers those undergoing sterilization

a coupon for a forthcoming raffle, with prizes including a Tata Nano car, motorbikes and electric food blenders.

GM Reactivates Indonesia

GM knows where the growth is: In the emerging markets, BRICs and beyond. GM announced today it will “invest $150 million in the reactivation of its Bekasi manufacturing facility in West Java, Indonesia.”

Launch Report: Toyota HiLux and Fortuner

An extravagant ceremony at Bangkok’s Impact Arena has seen the launch of Toyota’s new Hilux and Fortuner – key models in its developing market portfolio. The pair are products with big, tough reputations, and importantly, the profit-generating ability to match.

Trade War Watch 18: DetNews Fumbles With The Saber

Just over one week ago, a Detroit News piece pointed me towards a letter written by Senators Carl Levin and Debbie Stabenow, which took China to task for considering draft legislation that might possibly require more technology transfers to Chinese companies as a precondition to market access. Having chased down both the letter and the US National Trade Estimate it was based on, as well as several reports on the draft legislation itself, I wrote a lengthy piece about how Senators Levin and Stabenow were rattling the saber about what appeared to be a complete non-issue. In that piece, I not only debunked the senators’ concerns, but I also pointed out that China’s local consumer EV subsidies were the far more worrying potential trade barrier, as we have been hearing that they require that all qualifying EVs be built in China and sold with Chinese brands (a condition at odds with at least the 2004 version of China’s Auto Industry Development Plan, which stated “local governments should encourage fair competition among motor vehicles made by different places on the local market. They are not allowed to carry out any discriminative policy or measure which may lead to discrimination against non-locally manufactured automobile products.”). And it turns out that my 2,000+ words didn’t put everyone to sleep, as a new DetNews piece re-reports the Stabenow/Levin letter with the inclusion of a new motivation never mentioned in their actual letter, to wit:

For electric or plug-in vehicles to qualify for incentives under the proposed rules, they must be produced in China — by a Chinese carmaker or in a joint venture with a Chinese company

Ignoring for a moment that this wasn’t explicitly mentioned in the letter, there’s another issue here: subsidies aside, building any car in China requires a joint-venture. More importantly, China need not establish any barriers to the sale of imported plug-in or hybrid cars for the simple fact that the Toyota Prius’s epically weak sales there prove that imported NEVs can’t compete in the market. Of course subsidies may change that, but even more important is the issue of registration limits: if China requires EVs to be locally-made in order to waive Beijing’s registration restrictions, that could create more of a barrier than any cash subsidy. Meanwhile, neither Daimler nor Toyota nor VW nor BMW seems to have a problem with building EVs locally under a JV (cost and supply chain make Chinese production the logical choice anyway, necessitating a JV). The DetNews (and presumably Senators Levin and Stabenow) are getting closer to understanding the problems with China’s New Energy Vehicle Plan, but it seems they may yet have some more TTAC reading to do.

Toyota To Emerge With Emerging Market Strategy

On Wednesday, March 9th, Toyota will announce its new long term strategy plan to the public. A core piece will be a push into emerging markets. TTAC has been following signs of this for a while. The signs range from a car, the Etios, designed exclusively for the emerging markets, to a factory up in the woods near Sendai, Japan, that looks very much like a prototype for Toyota’s latest export product: Low cost car factories.

The Nikkei [sub] agrees and says that “Toyota Motor Corp. is overhauling its strategy because it is now clear that emerging nations will replace industrialized ones as its most important markets.” Will replace? Wake up!

Winterkorn: No 13th Brand For VW

VW CEO Martin Winterkorn is a superstitious man. He doesn’t want to add a 13th brand to his (or rather Piech’s) large collection. (Coincidentally, 12 is the number of Piech’s children. More or less. Nobody is quite sure,) “There are some who knock on our door. Some really want to come under our roof as they see we’re on a good path strategically. But we are satisfied with the current line-up,” Winterkorn said to Wirtschaftswoche. Specifically questioned about Volvo or (gasp) Daimler, Winterkorn answered: „There are many who would like to snuggle in VW’s cozy bed. Thank you, not interested.” Instead, he’s re-thinking the line-up of his new acquisitions: “I could imagine a smaller Cayenne derivative. Or a Porsche below the Boxster. This is under discussion.”

Recent Comments