BMW Eyes Micromini Market

Car Buying Tips: Three Ways to Reduce The Cost of Owning a Car

The American Automobile Association recently calculated the average cost of driving a car. News flash: your automobile is devouring your children’s college fund to the tune of 52.2 cents per mile. Multiply that number by 15k miles and decades of driving, and automotive ownership costs make Ivy League tuition seem like a bargain. Thankfully, you can lower your cost of ownership (of the car) with three strategies. Each one will put a nice six figure dent back into your savings account, and a big fat smile on your face whenever you turn the key.

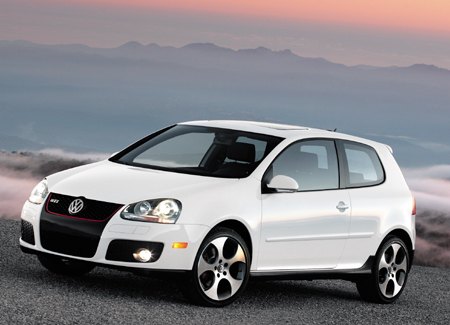

The first strategy is conservation: spending as little money as humanly possible. Automotive conservationists aren’t motivated by performance, comfort or snob appeal. All they want to do is get from Point A to Point B while keeping as much money in their pocket as humanly possible. They want to save in the showroom, at the pump, after service and at trade-in time.

Conservationists are, by their nature, small car aficionados. They’re willfully oblivious to the fact that small cars are an SUV’s accidental toe jam. They happily endure cramped quarters, sloth, low status and any of the other so-called downsides of owning a small, “boring” car. They concentrate on their econobox’s purchase price and operating costs.

Conservationists are big fans of Kia, Hyundai, Suzuki, Subaru and, of course, Honda and Toyota. They’re value junkies who scour the value of used cars before they even think about buying a new one.

To become a conservationist, find someone who drives a small, cheap, boring car who can tell you how much they spend on their car per month AND annually. Internet owners’ forums are an invaluable resource. Just register on a site dedicated to an inexpensive small car (“Cheap bastard” ought to do it) and post a thread asking “How much does it cost to run your X?”

The second strategy is endurance.

When most folks think of a car that last forever, they think of an old Volvo or Mercedes. That’s so last century. These days, most every automobile built can crest 100k miles without much trouble. In fact, 150k is the new 100k: the way point that tells an owner that he or she’s found a machine that can go the distance. Which is, let’s face it, one of your cheapest possible ownership options.

Frugal endurers are closet conservationists. They tend to pay cash up front (they consider monthly payments and interest charges an automotive fashion victim’s sin tax) for two-year-old or older cars.

They’re looking for vehicles blessed with [documented] factory-approved maintenance that have passed the “is it a lemon?” threshold. They look for unloved, low-spec models. Depending on their dedication, they’ll happily forgo such basic comforts as air conditioning and power door locks.

As endurers aren’t looking to trade in their wheels (i.e. they plan to run the vehicle into the ground), they couldn’t care less about their purchase’s short-term residuals. It’s all about keeping the car going, to get to those “cheap miles” at the end of the [hopefully] epic ownership period. And that means fastidious maintenance, extended warranties and celebrating the inevitable wear-and-tear.

To benefit from endurers’ sagacity, buy the most reliable car you can and hold it as long as possibly can. Period.

Mule trading is the third money saving strategy.

Mule traders buy from used car auctions. They buy whatever vehicle [they believe] will hold its value in the retail market. Due to a fickle public and sinister depreciation curves, many mule traders skip the way cool late model stuff and go for ‘sleds;’ vehicles that cost $5k or less. They drive em’, fix em’, sell em’, rinse and repeat.

Of course, not all mules are broken down beasts of burden. There are plenty of hot (though inexpensive) used cars available at auction that will protect the mule trader’s money (e.g. the Mini Cooper, Scion Xb, and Honda Fit). After anywhere between six months to 18 months, the traders simply sell the vehicle to a dealer, who uses them as high profit ‘finance fodder.’

The mule trader takes on the depreciation risk on the assumption that today’s hot new car will be tomorrow’s hot used car. The keen-eyed mule trader gets a higher trade-in value for the car, the dealer receives a larger profit off the financed vehicle. Everyone wins– save for the poor bastard with the hot car and large monthly payment.

Whether you reduce your overall automotive operating costs by conserving cash, fixing costs (endurer) or taking advantage of automotive fashions (mule trader), there’s always an opportunity to save a chunk of change on your motoring expenses. The challenge: determining which mindset best suits your budget, skills and time. As Patek Phillipe’s ads used to say, choose once but choose wisely.

Recent Comments