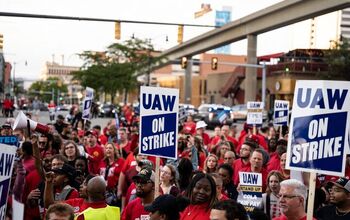

What's the Deal? UAW Strike Deadline Nears With No Contracts Signed

Last week, Stellantis slid the United Auto Workers (UAW) a contract proposal that would raise hourly workers' pay by 14.5 percent over the next four years. The deal is roughly on par with the 15 percent initially offered by Ford and 16 percent from General Motors. It likewise said it would provide workers $10,500 in inflation-related bonuses while GM offered $11,000 at GM and Ford said it could swing $12,000. Though Stellantis doesn’t appear to be offering any contract ratification bonuses, whereas others manufacturers said they’d be happy to throw in another $5,500.

GM and Stellantis also said they’d be adding Juneteenth as an official paid holiday. Meanwhile, all three automakers have said they would raise starting wages to $20 per hour and shorten the amount of time it takes for new employees to become eligible for wage increases by two years.

UAW leadership has publicly stated that the above fails to make up for today’s inflation rate or the decades of stagnating wages that failed to keep pace with past inflation rates. UAW President Shawn Fain expressed on social media that the latest offers from Stellantis were insufficient and don’t “reflect the massive profits we’ve generated for this company.”

Detroit’s other automakers seem to be closer to appeasing the union, with Ford appearing to have the sweetest deal by offering the most money and the quickest time for employees to reach the highest tier of pay. But Fain has said the Blue Oval’s proposed cost-of-living adjustments were unacceptable, adding that the possibility of a strike remains very real for all automakers.

While negotiations continue, the industry only has until September 14th to settle things with the UAW. If things are not resolved by then, with new contracts signed, union members will be leaving their posts the following day to engage in formal strikes.

With numerous industries seeing hard pushback from unions right now, it seems plausible that the UAW could be joining their ranks. The real question is how long a prospective strike could actually last and what the economic impact would be. The Anderson Economic Group, an economic consultancy based in Lansing, Michigan, told Bloomberg that even a 10-day strike could reduce U.S. gross domestic product by $5.6 billion and send the state into a serious recession.

It’s also likely to limit vehicle inventories to a point where prices would be driven back up after the average vehicle transactions continued breaking records. However, considering how many Americans have already been forced out of the new car market due to inflation and a widening income gap, the long-term ramifications for the industry are more difficult to predict. Automakers have managed to maintain healthy profits by dumping low-margin vehicles to prioritize more expensive models. However, the situation hardly seems sustainable in the long term as fewer households can afford to purchase a new vehicle.

“If we were to have a long strike in 2023, the state of Michigan and parts of the Midwest would go into a recession,” said Patrick Anderson, CEO of the Anderson Economic Group. “When GM workers went on strike in 2019, you saw gross state product drop in Michigan in the fourth quarter, while in the rest of the country it was largely unaffected. That won’t be the case this time if the UAW goes through on its threat to strike all three companies.”

Anderson also cautioned against yielding to the UAW demands that would cost the most money in the long run. These included the industry returning to offering guaranteed pensions and retiree health care — something General Motors and Chrysler (now Stellantis) attributed to their 2009 bankruptcy filings.

However, it should be noted that Anderson Economic lists both General Motors and Ford as clients and clearly has an interest in protecting their bottom line.

Politicians also seem incredibly worried about what the union might do. While the UAW still decided to reach out to Democrats first, it said it would not support anyone that failed to have its back through contract negotiations — potentially breaking the union’s long-held ties with the Democratic Party.

From Bloomberg:

The Biden administration is on edge about the strike. The auto industry accounts for about 3 [percent] of US GDP but plays a much bigger role in the Great Lakes economies, and Democrats will rely on winning Michigan and Wisconsin to retain the White House. The President has tapped Gene Sperling, former economic adviser to Presidents Barack Obama and Bill Clinton and a Michigan native, to act as a liaison between the automakers and the union.

Michigan Gov. Gretchen Whitmer told Bloomberg News in an interview last week that she is concerned about where the negotiations are headed. She is talking to leaders of each company and the union to try and head off a strike, but added that it is “unclear” what more she and her state can do.

Of the $5.6 billion in economic impact, lost worker pay would come to $859 million and lost automaker earnings would be $989 million, Anderson said. The rest would come from layoffs and lost business at parts makers and other industries that rely on the three automakers.

There have likewise been claims that wage increases coming on the heels of numerous unions striking over the summer (with the UAW poised to join them) could ultimately raise labor costs nationwide.

“At least in sectors where workers are scarce, average pay rises of [over 5 percent] annually are to be spread over a number of years — meaning labor costs will continue to rise at rates above those consistent with 2 [percent] inflation for some years to come,” Bloomberg cited economists at Citigroup as saying earlier this month.

I guess Citigroup hasn’t gotten the memo that today’s inflation rate is nowhere near 2 percent and hasn’t been for some time. While the official rate from The Bureau of Labor Statistics is supposed to be somewhere around 3.3 percent, it was sitting closer to 7 percent in 2021 and 2022. However, claims that the true rate is much higher are relatively common and you only need to check the math on your grocery bills over the past 48 months to get a sense of things.

Additional ramifications would exist for parts suppliers, the steel industry, and practically any other company with even a tangential relationship with automakers. However, the full impact would hinge almost entirely on how long the strike lasts. While they’re still not as robust as they were five years ago, vehicle inventories are much higher now than they were during the pandemic.

“I don’t know that a couple weeks would have a noticeable impact in the marketplace,” Charlie Chesbrough, senior economist at Cox Automotive, told Bloomberg. “If it goes on for a couple months, we’ll be back to where we were in 2021 with semiconductor-related shortages.”

Cox estimates that most automakers have roughly 58 days' worth of inventory. However, top-selling models yielding the best margins (e.g. pickup trucks) tend to run much higher. While the industry starts losing money the second the first picketer walks off the assembly line, that’s still a reasonable strike buffer. The United States has sent $75 billion in assistance to Ukraine thus far, almost $800 billion on its own yearly defense budget, and spends nearly $2 trillion annually on Social Security and Medicare, so losing a few more billion in GDP isn’t going to bankrupt the nation any worse than it already would have been. But the threshold for catastrophe is in there somewhere and a month-long strike from the UAW certainly wouldn't be desirable for the automotive sector, nor the broader economy.

Union advocates would say the same about stifled wages, companies walking back employee benefits, and the industry’s inability to keep up with inflation.

Currently, it looks like the industry is trying to meet the UAW's wage demands. But there’s not much happening in terms of the benefits the union has been demanding to be restored. It’s likewise unclear what’s going on with the proposed 4-day work week, despite automakers signaling that could be doable if it helped reduce overtime pay. That seems to have encouraged UAW leadership to shy away from the premise and we’ve not heard much about it since.

But it has continued pushing for its other demands, including more paid time off, with the industry offering more frequent contract proposals as the contract deadline draws nearer.

"We need to get back fighting for a vision of society in which everyone earns family-sustaining wages, and everyone has enough free time to enjoy their lives and see their kids grow up and their parents grow old," Fain said last Friday, adding that the union would take action if a deal is not made by September 14th when the old UAW contract expires.

[Image: UAW]

Become a TTAC insider. Get the latest news, features, TTAC takes, and everything else that gets to the truth about cars first by subscribing to our newsletter.

A staunch consumer advocate tracking industry trends and regulation. Before joining TTAC, Matt spent a decade working for marketing and research firms based in NYC. Clients included several of the world’s largest automakers, global tire brands, and aftermarket part suppliers. Dissatisfied with the corporate world and resentful of having to wear suits everyday, he pivoted to writing about cars. Since then, that man has become an ardent supporter of the right-to-repair movement, been interviewed on the auto industry by national radio broadcasts, driven more rental cars than anyone ever should, participated in amateur rallying events, and received the requisite minimum training as sanctioned by the SCCA. Handy with a wrench, Matt grew up surrounded by Detroit auto workers and managed to get a pizza delivery job before he was legally eligible. He later found himself driving box trucks through Manhattan, guaranteeing future sympathy for actual truckers. He continues to conduct research pertaining to the automotive sector as an independent contractor and has since moved back to his native Michigan, closer to where the cars are born. A contrarian, Matt claims to prefer understeer — stating that front and all-wheel drive vehicles cater best to his driving style.

More by Matt Posky

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Carson D Just don't be the whistleblower who reports on the falsification of safety data. That's a deadly profession.

- Carson D I'd have responded sooner, but my computer locked up and I had to reboot it.

- Todd In Canada Mazda has a 3 year bumper to bumper & 5 year unlimited mileage drivetrain warranty. Mazdas are a DIY dream of high school auto mechanics 101 easy to work on reliable simplicity. IMO the Mazda is way better looking.

- Tane94 Blue Mini, love Minis because it's total custom ordering and the S has the BMW turbo engine.

- AZFelix What could possibly go wrong with putting your life in the robotic hands of precision crafted and expertly programmed machinery?

Comments

Join the conversation

For years, even decades the Big 3 gave the unions pretty much what ever they wanted. These contracts may be a sea change for both sides.

We haven't heard from our commenters who have worked in vehicle plants. Of course our two useful idiots have told how they would do things.

I really think that our commenters who have worked in automotive manufacturing haven't commented due to the sheer volume of disrespectful comments they know they'd receive. I mean why tell someone on here your life and real world experience when someone would want to argue with you or tell you that you are stupid.

Ever notice how pretty much ALL problems facing this dying nation stem from lesser societal elements on both sides of the political divide (albeit not necessarily in equal proportion) feeling entitled to respect, consideration and/or compensation they do not deserve?

We really, really need to do something about that...