Using Your Tesla to Mine Bitcoin is a No-Go

As I type this, it’s been less than 24 hours since Tesla announced v.9 of their Full Self Driving Beta. Full Self Driving, as the name implies, claims to use advanced artificial intelligence software along with a whole host of sensor arrays and digital inputs to get you and your passengers from point A to point B with minimal input – if any.

Tesla’s bombastic ring leader, Elon Musk, has called this latest version of his autonomous tech “mind-blowing”, and has touted the computing power of Tesla’s “Full Self Driving Chip” as the key to making all this possible. Since that chip’s reveal in 2019, however, Musk has become almost as famous as a pitch-man for cryptocurrencies on Saturday Night Live as he already was as a carmaker, which begs the question: could your Tesla really pay for itself mining for crypto?

The short answer is: No. Not even a little bit. The real-world limitations on the project are nearly totally insurmountable. As a thought experiment, though, it might be fun to explore – and, in the right light, the answer becomes a resounding: Kinda.

Ed. note — the initial headline read “Using Bitcoin to Pay for Your Tesla is a No-Go. This was an editing error and the headline has been changed to better reflect the piece.

So, if you’re still with me, keep on reading.

We’re halfway through 2021, so I’m going to assume that most of you reading this article have some idea of what cryptocurrencies like Bitcoin are about, but I want to talk a little bit about how they work so we can begin to wrap our heads around the “Can your Tesla pay for itself?” problem.

Cryptocurrencies work using a technology called “blockchain”, which is pretty much what it says on the tin. You have a “block” of code that has to be processed, and that “block” of code sort of “locks” into place with the block before it in a sort of “chain” of blocks. That’s overly simple, but it gets us to the “crypto” part of cryptocurrency, which is in the hashing.

See, at the end of each block of code is a given value, and that value is then “hashed”, or turned into another value, by a fancy bit of math called a hashing algorithm. If it’s done right, hashing creates a way to compare and verify that examples of the previous code are the same, but not a way to go any further back. It’s a one-way street, in other words, that makes going back and making changes nearly impossible, which is what makes blockchain an attractive technology for companies like Volvo, who use the immutable blockchain records to establish the provenance of the rare-Earth compounds used in their EV batteries and ensure that they’re “ethically” and “sustainably” sourced.

As more and more blocks are added and the blockchain gets longer, there’s more information to calculate and “hash”, basically, and it takes lots of computing power to do that quickly. Lots of computing power typically needs lots of electricity to run, too, and electricity can get pretty expensive pretty quickly … if only we had access to a powerful computer and plentiful, virtually free electricity at the same time.

Tesla hasn’t published the hash rate for its Hardware 3.0 Full Self Driving Chip, but they have told us that the processor is about 21x faster than the NVIDIA Xavier-based chips it’s replacing, so we have some (admittedly, dubious) benchmarks we can try to pull numbers from.

A few of the guys on the NVIDIA developer forums have made the point that the Xavier AGX “is more or less comparable to an NVIDIA GTX1050/1050”, which has a hash rate of about 20, according to Miner Monitoring, a site that helps crypto miners plan out their computer builds. So, if the in-house Tesla chip is about 20 times faster, that would give it a hash rate of 400.

Four-hundred sounds like a lot, so let’s keep going.

The next thing we’ll need is access to electricity. Lots of electricity, and – ideally – lots of electricity that we wouldn’t have to pay for. That’s where the Tesla Supercharger Network comes into the picture.

Tesla claims its Superchargers deliver a consistent 72 Kw of energy in most urban areas. Next, consider that, in the early days of the Tesla Model S rollout, back when six-figure quarterly delivery numbers seemed like they were a long, long way off, Tesla offered Model S owners unlimited access to free charging at their high-speed Supercharger network. The plan was called “Unlimited Free Supercharging”, and was listed as option code SC01 for total, no-restriction access (if you bought a used Tesla, you can see if you have it by going to your My Tesla User Account and selecting “Manage”, then “View Details”, then searching for SC01).

This isn’t exactly “free” energy, then – but it’s free to you, and that’s what matters for the purposes of this poorly conceived thought exercise, right? Right!

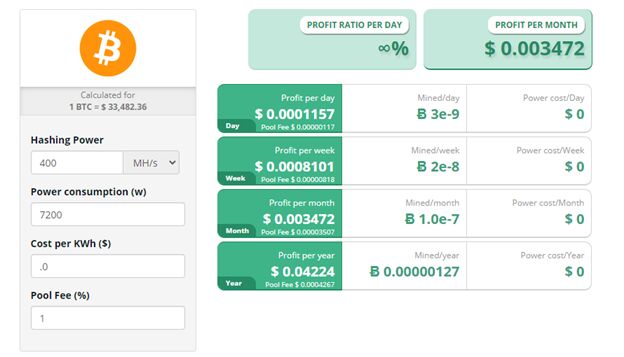

So, we have a hash rate of about 400 and, assuming we were clever enough to buy a used Tesla with Unlimited Free Supercharging, we should be able to do some quick math and see that, at about $33,500 per Bitcoin (give or take) we’ll make … hmm.

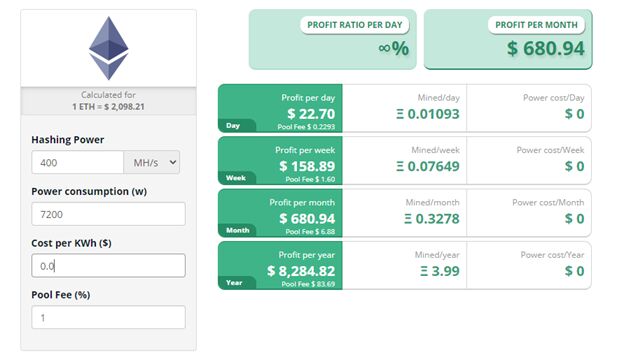

At a profit of less than a penny per month, it doesn’t look like we’re going to get far with Bitcoin – but switching the crypto asset to Etherium (another popular crypto that’s much more energy-efficient than the OG Bitcoin) changes things dramatically.

With a hash rate of 400 and using all the free juice we can pull from Ol’ Musky’s network, it looks like we’re looking at a tick over $680 per month – assuming that, you know, you keep your Tesla parked at a supercharger 24/7.

In other words, then: It can’t be done, and not the least of which because the Teslas equipped with the chip in question never came with Unlimited Free Supercharging, but also because Tesla hasn’t (and probably never will) make its chips available to be used for the task of mining, anyway. So, it seems like this idea is doomed to fail. Obviously stupid and immediately dismissible without a second thought — and I’d totally agree with you … except it seems like someone may have made this work.

What you’ll be looking at when you click the next link is a Tesla Model S trunk that’s been stuffed with GPU connectors and wires and fans (the GPUs aren’t installed, in this photo) to become a sort of rolling cryptocurrency mine. The linked photo is from the Tesla Owners Worldwide Facebook group and surfaced way back in November of 2017, when Bitcoin prices were hovering around $8,000, and the images made the rounds of the crypto and EV websites around the same time.

Some speculated that, because there are no ASIC chips in the photo and the GPUs aren’t connected to the power risers the way one might expect, that the car was a hoax and that these pictures were posted to troll the boards – if that’s true, then mission accomplished. We’re still talking about it four years later … except that two things have changed. The first is that the cost of a used Tesla Model S has come down significantly, and the second is that cryptocurrencies have, by and large, more than tripled in value since this rig was shown off in 2017.

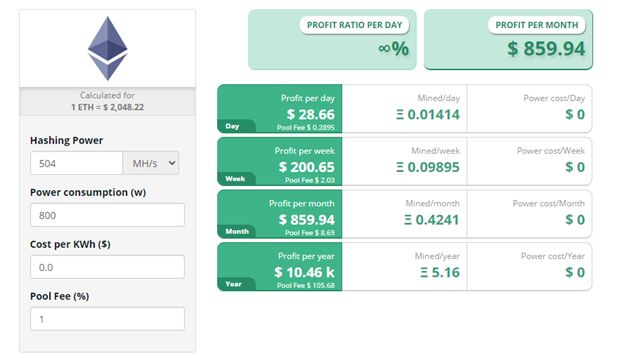

So, even if it’s not real –would it work? Let’s ignore any questions about the ethical liabilities of using the Supercharging network for unintended purposes for a while –at least until Elon gets to Mars, amiright? –and focus on some really basic numbers. If you could get 4 Antminer L3+ rigs in that same space, each running at about 504 mH/s, that would get you close to $860/mo., based on the most optimistic scenarios of full power, 100 percent connectivity rate, etc.

So, no, even in fantasy land this wouldn’t enable your Tesla to pay for itself – but if you were somehow able to park a rig like this at an unlimited fast-charger for a few hours a day? Five days a week? It certainly wouldn’t pay off your car, but it might be enough to pay your car insurance bill … which you’ll want to keep on top of, because I can’t imagine all these wires and fans running at full capacity in a poorly ventilated trunk will make a Tesla less of a fire hazard!

Don’t try this one at home, kids.

[Images: Tesla, Screenshots from Cryptocompare.com]

I've been in and around the auto industry since 1997, and have written for a number of well-known outlets like Cleantechnica, the Truth About Cars, Popular Mechanics, and more. You can also find me talking EVs with Matt Teske and Chris DeMorro on the Electrify Expo Podcast, writing about Swedish cars on my Volvo fan site, or chasing my kids around Oak Park.

More by Jo Borras

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Bd2 The coolest true SUV on the market. Change my mind.

- VoGhost Fettle, racket, wade, throne -- what's going on with Matthew?

- Mcw I have only seen one on the road in Northern California, but I have to say I liked the appearance. Too bad.

- Bd2 I hope Elon eats one for dinner.

- Wjtinfwb I really like these, but can't shake the voice in my head that says, "$9000 will just be the starting point. You'll have 20 grand in this baby inside of 18 months".

Comments

Join the conversation

Running in-house developed software on a state-of-the-art GPU we have in-house, I'm looking at a meter right now that's showing 1200W for a 400 MH/S ethereum rate vs. 7200W for the system you show. Also, the GPU isn't getting pushed to its limit either. That would keep it alive much longer. The hosts are 7nm technology and the GPU is 12nm. Milspec chips and machine, so it can take a lot of abuse. It's not used for serious mining. Just as a test machine for the software. The mining software is more efficient than what's normally available because it's more closely bound to the hardware it's running on. I have other devices that are much more powerful. They have about 32mb of 38 terabyte/second HBM2 memory on-chip and about 64GB of 77GB/s memory off-chip, which isn't too, too slow. I think the GDDR6 on GPUs is only 14-16GB/s. Unlike a GPU, these devices don't require the host to talk to ethernet. I'm more focused on quantitative trading which leverages my AI technology and really haven't had time to focus on crypto. I do have internally developed mining software for several algorithms, but no time or manpower to port it. I might do it if I have a cash crunch though. With those devices, I could probably blow the numbers in the article totally out of the water. Of course, as you can imagine, with HBM2 memory, they are expensive with each accelerator card costing 5 figures, so not practical to add to a vehicle.

This article was so boring it kept even the Russian trollbot posters away.