Oil 2021 Outlook – Oversupply and Lower Demand

Oil 2021, an analysis by the International Energy Agency (IEA), explains why the pandemic caused the collapse in demand for oil in 2020, and why it may never return to ‘normal’.

Our behaviors as individuals and nations have changed due to COVID-19, and the restrictions placed on us during this time. There has also been a movement within governments around the world to accelerate the lowering of carbon emissions, causing a huge drop in oil demand over the next six years. This in turn has caused turmoil among oil-producing countries and companies, who need to make decisions regarding any new exploration and tapping existing resources that may only add to the surplus they have already.

There is an inventory surplus built up over the past year that is being worked off, and global oil stocks, minus any strategic reserves, will gradually return to pre-pandemic levels in 2021. Meanwhile, governments are looking at the recovery as a catalyst to lower our carbon footprint, especially if said governments do follow through with stricter policies that hasten our implementation of so-called clean energy.

With this in mind, oil producing-countries and companies are in a quandary. Leave resources sitting in the ground, or create new capacity that may sit idle for however long? Let’s say you and me, and motorists around the world, don’t buy into this, and all these experts fail to see the demand for oil and gasoline on the rise once again. This would leave the producers in a shortfall, and we would have another oil crisis, with geopolitical ramifications, and supply shortages to follow.

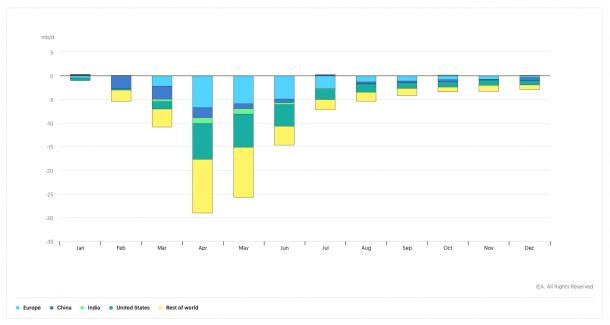

Globally, oil demand is forecast to be a record 9.3 million barrels per day (mb/d) lower in 2020 than it was in 2019, as COVID-19 brought mobility to a screeching halt in 187 countries. The second half of 2020 should show a gradual recovery, as vaccinations increase and our activity levels rise, but demand is still not expected to reach pre-pandemic levels before years end.

What we can’t account for is the speed of the recovery, and how uneven it will be geographically, between sectors, and for various products. Gasoline demand is unlikely to return to 2019 levels, as fuel efficiency and the movement towards more electric vehicles continues to offset any growth in consumption. Even as we see tens of thousands of Americans returning to the skies, aviation fuels are slowly expected to return to 2019 levels by 2024, and continuation and growth of online meetings could affect business travel indefinitely.

Investment in the oil industry and expansion plans have been curtailed, as companies spent 1/3 less at the start of 2020, and 30-percent less than they had in 2019. In 2021, only a marginal rise in investment is expected. Supply growth worldwide is being constrained, with spending cuts and project delays. World oil production capacity has been reset to 5 mb/d by 2026, and unless there’s action by developed countries, we’ll be 5.2 mb/d short by 2026 to meet the demand rebound.

Half of the increase is expected to come from the Middle East, primarily from existing capacity. Sanctions against Iran may require Saudi Arabia, Iraq, the UAE, and Kuwait, to produce oil at or near their record highs. This is a change from when the U.S. dominated world supply growth, and our investment and activity level will only increase when prices rise. The outlook for the oil industry is for spending discipline, better cash flow, deleveraging or reducing debt, and increasing returns for their investors.

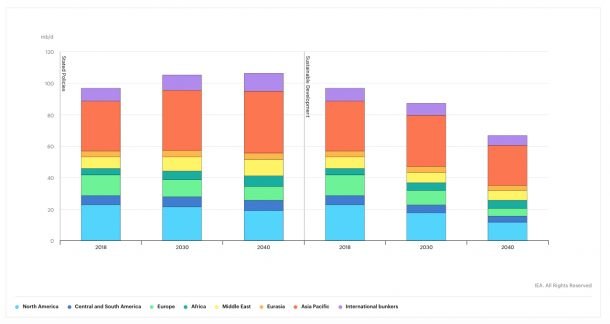

According to the IEA, passenger car oil usage will peak in the late 202os, and during the 2030s, increase an average of only 0.1 mb/d a year, with no peak overall due to continued use by the petrochemical, trucking, shipping, and aviation industries. However, a shift in policies will lead to a peak in global oil demand in the next few years, as it drops more than 50 percent in developed nations between 2018-2040, and 10 percent in developing countries.

[Images: International Energy Agency]

With a father who owned a dealership, I literally grew up in the business. After college, I worked for GM, Nissan and Mazda, writing articles for automotive enthusiast magazines as a side gig. I discovered you could make a living selling ad space at Four Wheeler magazine, before I moved on to selling TV for the National Hot Rod Association. After that, I started Roadhouse, a marketing, advertising and PR firm dedicated to the automotive, outdoor/apparel, and entertainment industries. Through the years, I continued writing, shooting, and editing. It keep things interesting.

More by Jason R. Sakurai

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Steve Biro At a $27K starting point - often with additional dealer discounts - the Equinox was an attractive option for many on a tighter budget. Especially when the FWD model came with a traditional six-speed automatic.Now, with a starting point of just under $30K (and discounts much smaller and/or less likely for a couple of years) and a CVT, the Equinox is suddenly much less competitive.Add to that the need to pay an extra $2K for AWD just to get a real transmission, and the Equinox isn't very competitive at all. An AWD base version will start at about $32K and an RS or Activ will be $36K and change - quite laughable. And one is still stuck with that 1.5-liter turbo powerplant.If this is what Chevy is demanding for the ICE Equinox, it's no wonder a $30K EV version turned out to be vaporware.

- AZFelix I know someone who spent a night in a Dodge Dynasty. The velour interior was the best part of the experience.

- MKizzy Looking at the high-nosed Equinox and its assumed huge front blind spots, I see why Mayor Pete wants to mandate improved AEB on all vehicles.In addition, GM's lack of commitment to its ICE powertrains is on full display with its continued use of its class-trailing 1.xT engines. The new Equinox may be all show/no go, but at least after a decade of shoving its 1.5T into the Equinox and Malibu, you'd think GM would've at least made it top flight reliable by now.

- Daniel China can absolutely make quality products when contracted at the right prices or their car companies trying to compete. However, I doubt any of their nearly 100 EV companies would even want to try to break into the US market with a 25% tariff (Polestar pays this) and the huge service and support network needed other than *maaaaybe* BYD eventually and only then if they end up using their upcoming plant in Mexico for not just Latin America, but decide to try the US market without the tariffs. They def would need to have excellent quality and support to be taken seriously, we'll see!

- VoGhost I know one commenter who would love to live in Kia towers.

Comments

Join the conversation

In the meantime gas will go up and the automakers will introduce more vehicles with turbo 3s and 4s with CVTs. Full size trucks will go to more turbo V6s and in the case of the Chevy Silverado a turbo 4 will be the base engine. This will be enough to make me an EV convert. I wonder how many others will feel the same way.

The infrastructure for EVs will get built and within a decade we will likely have noticeable infrastructure for EVs within major metropolitan areas. Infrastructure for EVs will take longer for less populated areas. It will cost a lot of money for new infrastructure but then the US spent a lot to develop the interstate system over decades. Nothing is free. As for charging additional tax for EVs that is already happening in states like Ohio to cover the cost of roads.