We've Heard This Incorrect Forecast Before: Honda Believes in 2022 Civic Because "Passenger Cars Are Going to Stabilize"

As Toyota approached the launch of the all-new, 2018 Toyota Camry in mid-2017, the automaker telegraphed its intentions very plainly.

“I think you’re going to see the entire sedan market pick up,” then vice-president Jack Hollis said. “We want the new Camry to rehabilitate the segment,” Toyota’s Moritaka Yoshida said at the time.

Toyota wasn’t alone.

“I don’t expect to sell fewer Accords in 2018 with this great new product,” Honda’s sales vice-president, Ray Mikiciuk, said later on in 2017. Accord sales fell 10 percent in 2018 before sliding 8 percent in 2019.

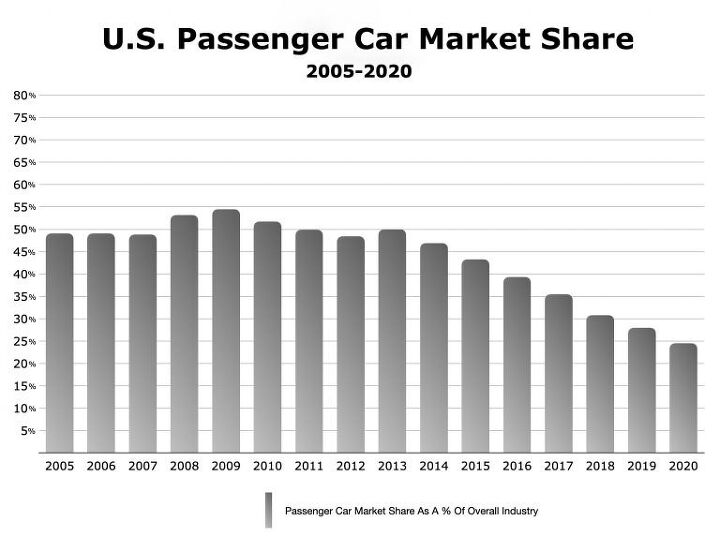

One year later, Nissan’s Dennis Le Vot worked up to the launch of the 2019 Altima by suggesting that when it comes to passenger car market share: “We think 30 percent is the bottom.” Passenger car market share fell below 30 percent in 2019, the new Altima’s first full year.

Now we’re months away from the arrival of the 11th-generation Honda Civic. You know the drill: major automaker launches major car nameplate, major automaker suggests car market will stop the free-fall, major automaker hypes possibility of car market healing.

We’re skeptical.

Gary Robinson, American Honda’s vice president for automobile product planning, says, “We do believe that passenger cars are going to stabilize and actually do quite well over the next five or six years.” Speaking to Automotive News, Robinson says that in the low-$20,000 spectrum, “It’s really hard to offer an SUV that young people are really looking for.”

Yet there are two issues being conflated here. On the one hand, there’s the strength of 10 generations of wildly successful Honda Civics, which alone can not and do not create a favorable atmosphere for cars in general. On the other hand, there’s the weakness of America’s overall passenger car demand, which can and does foment unfavorable consequences for particular models, such as the Camry, Accord, and Altima.

In the context of passenger cars, the Honda Civic is a powerhouse. It’s currently America’s second-best-selling car overall; the top-selling compact car; and according to Honda, America’s best-selling car on a retail basis in each of the last four years. Honda also says the Civic is the top-selling vehicle outright with Millenials, Gen Z, and first-time buyers.

It doesn’t take a mathematical wizard to conclude that a car with that pedigree should sell in the hundreds of thousands on an annual basis. That is likely to be all the more true as competitors – Cruze, Focus, Lancer, Dart, Verano, and Golf among the most recent – fade from memory. Indeed, as the 2022 Civic arrives with a more conventionally handsome and less divisive design, some tech upgrades, and numerous other refinements, Honda will be extremely well positioned in the compact-car segment.

But a strong Civic does not a strong car market make. Just as a strong Camry, strong Accord, and strong Altima were not sufficient to rescue America’s midsize market and did not stabilize the overall car sector’s plunging market share, a new Civic will not soon hold back this cresting wave.

What makes us so sure?

Seven years of decline. A precipitous decline that is only becoming more difficult to reverse as the car market loses offerings, as whole segments virtually disappear, as SUVs/crossovers shrink their efficiency gap, and as consumers’ replacement habits become more fixed.

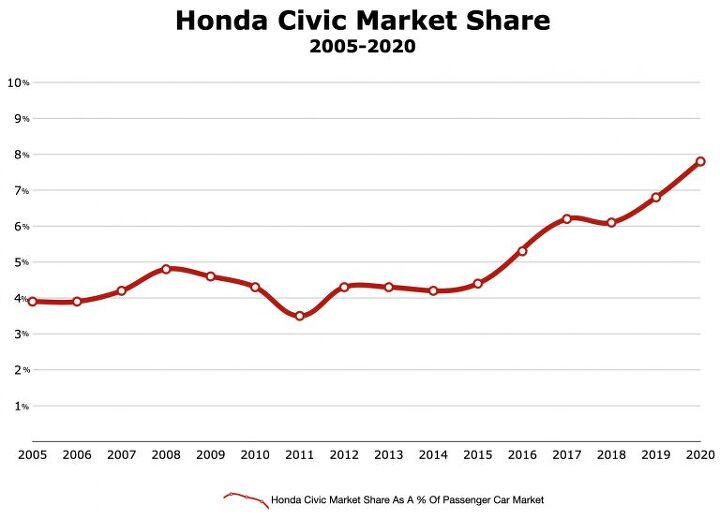

Since 2013, the car sector’s share of America’s auto industry has fallen by half. That’s certainly no knock on the Civic, which not only maintained relatively stable sales during that period (Civic sales were down just 3 percent between 2013 and 2019 and hit a record high of 377,286 in 2017) but which also nearly doubled its share of the passenger car market. Through the first three-quarters of an admittedly bizarre 2020, 8 percent of the cars sold in America were Civics.

Strong Civic sales, however, won’t resuscitate the American car market. As proof, we can just keep looking back at the results from the last seven years: strong Civic demand; weakening car demand overall. Honda’s right to expect big sales volume from the 2022 Civic. But we’ve grown all too accustomed to watching automakers make bold proclamations of increased U.S. demand for cars in cars, and watching as that proclamations coincide with decreased U.S. demand for cars.

Timothy Cain is a contributing analyst at The Truth About Cars and Driving.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Add Lightness ...and I thought the Trump Towers were excessively pretentious.

- Daniel Tons of discounts out there on the eGMP's, just pick your style: Ionic 5/6, Kia EV6 and Genesis GV60. Personally, I got $20k off on a $60k MSRP GT-Line EV6 (only $7500 of that was a "rebate" from the state, the rest was Kia and dealer discounts). They are not only the same platform, but nearly identical mechanically other than slightly adjusted wheelbases. Find this one ugly? Look at Ionic 5 or EV6 instead, it's actually pretty cool how they came up with 4 distinct styles with basically the same car to fit many different tastes.

- Dave Holzman EVs will be ready for prime time when the chargers are dependable, and easy to use, when they can fill the battery in around 10-15 minutes, when there are sufficient numbers of them that people don't have to hang out for a half an hour waiting for a fast charger to be free, when chargers are widely available even in Nebraska, Wyoming, eastern Oregon, Nevada, Utah, the northern parts of Maine, New Hampshire, and Vermont, and within 10 miles of the start of the Tail of the Dragon, and when they get fixed pronto when they have problems.

- MaintenanceCosts The Supercharger network is something with much more growth potential than their actual car building operations, which has been marvelously run to this point and has a years-long head start on all its competitors, and Elon lays the whole team off?I don't know if it's distraction or the drugs, but he is not making good decisions and should not be CEO anymore.

- Dirk Wiggler I drive down the Palisades and near the George Washington Bridge I see FIAT housing complex (apartments, same font as the auto company). Seems like they tout energy/electric efficiency. I always wonder, 'what's that...is it really the same FIAT?'

Comments

Join the conversation

I was sure (at some point) that Honda will combine the Accord and Civic into one car, same as they did with the TL and TSX into TLX, I guess I was wrong.

If you keep turning sedans into Lamborghinis (interior room, cargo capacity, entry/egress, visibility), don't be surprised when people keep buying other vehicles instead. The OEM's are kind of speaking out of both sides of their mouths here, since they generally make more money on "SUV" vs. "car."