Always Be Closing: U.S. Vehicle Sales Top 17 Million in 2019

Many talking heads and auto journos, your author included, theorized the American car market in 2019 would fail to sell in excess of 17 million new vehicles for the first time in several years. However, thanks to a late-year push, a total of 17.11 million copies of fresh metal moved off showroom floors and onto America’s highways.

If you’re keeping count, and many are, this makes for the fifth consecutive year the industry topped the 17 million mark. The only other two calendar years it did so was 2000 and 2001. We can draw these conclusions now that Ford has gotten off its Blue Oval butt and posted its numbers, a full 48 hours after just about everyone else.

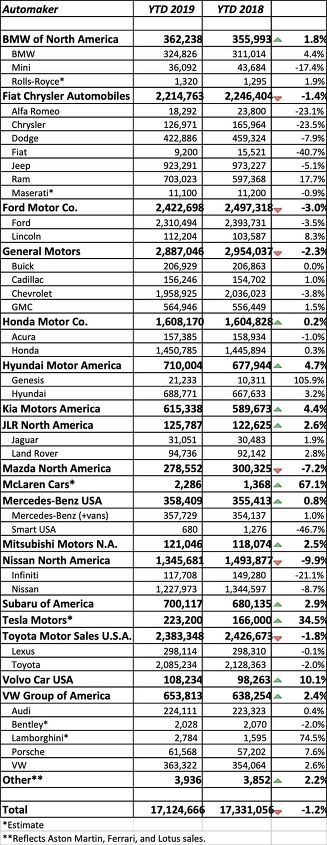

Starting with the Detroit Three, sales were down across the board in terms of full-year numbers. Barra’s Bunch was off by 2.3 percent, Hackett’s House slid 3 percent, and Manley’s Machines skidded 1.4 percent. The latter is being carried by Ram trucks, by the way, which was up a gobsmacking 17.7 percent on the year — making it the only FCA brand to post a positive finish to 2019.

This speaks to Ram’s strategy of selling two different Ram 1500 pickups side-by-each. After a slow start, the tactic is paying off in spades, with the “new” truck appealing to customers who want all the latest toys, while the older Classic version is picked up by those seeking a deal. All this comes as the average transaction price of a Ram 1500 has jumped almost 50 percent from 2010 to about $50,000. Meanwhile, the average transaction price for the Ram Heavy Duty has increased more than 20 percent to about $55,000. This speaks to two things: the consumer desire for snazzier trucks and the manufacturer’s thirst for luxurious profits.

Across town, The General shed 66,991 units compared to 2018, which is about the entire yearly Porsche volume, if you’re wondering. GM’s fleet mix was 19.7 percent in the fourth quarter and 21.8 percent for the year, with Commercial and government deliveries making up more than half the company’s fleet sales. Average transaction prices at RenCen were $37,558 in Q4 and a record $36,844 for 2019.

Dearborn-based Ford, a company which finally deemed us slovenly journalists worthy of sales numbers a full weekend after most other brands played by the unwritten rules and released their stats on time, surprised no one by claiming 2019 as the 43rd straight year for F-Series being America’s best-selling pickup. With the addition of Ranger, Ford trucks produced their best sales results since 2005, with a total of 986,097 pickups sold. Lincoln is enjoying a well-earned resurgence — hooray for good product and real names — up by nearly 10,000 vehicles (8.3 percent) last year.

There were some losers last year, most notably Nissan North America, whose volume plunged a shocking 29.5 percent in December before sputtering to a 9.9 percent decline on the year. Product that’s in need of update doesn’t help this scenario, nor does ex-CEO Carlos Ghosn fleeing Japan in a musical instrument box to avoid trial. His press conference scheduled for later this week could do more damage to the company, especially if he starts to name names.

Winners? Well, the VW brand rose 2.6 percent last year thanks in no small part to revised and rejigged products. Subaru continues its sunny ways, setting a new all-time sales record of 700,117 vehicles, up 3 percent over 2018. That number marks eleven consecutive years of the company posting an annual sales record. In other words, it’s a very good time to be slinging the beauty of all-wheel drive.

Those average transaction prices and, according to some talking heads, negative equity levels remain high. But, in December at least, the average interest rate on a new-vehicle loan fell — for the third straight month — to 5.4 percent. That’s the lowest rate in about two years, according to Edmunds.

Did anyone in your circle of family or friends take delivery of a new car in 2019? Sounds off in the comments below.

[Image: Fiat Chrysler Automobiles, Lincoln Motor Company]

Matthew buys, sells, fixes, & races cars. As a human index of auto & auction knowledge, he is fond of making money and offering loud opinions.

More by Matthew Guy

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- InCogKneeToe Wow, memories. My Parents have a Cabin on a Lake, I have a Plow Truck and Friends, access to Lumps (old tired autos). What happens? Ice Racing!. The only rules were 4 cylinder, RWD only. Many Chevettes were destroyed, My Minty 1975 Acadian Hatch Auto with 62,000kms, did also. Rad, Rad Housing etc. My answer, a 1974 Corolla Hatch 4 speed, the rest of the Vettes took offence and Trashed the Yota. It was so much quicker. So rebuttal, a 1975 Celica GT Notch, 2.2L 20R, 5 Speed. Needed a New Pressure ate but once that was in, I could Lap the Vettes, and they couldn't catch me to Tag me.

- 28-Cars-Later I'm not sure when it was shot, but I noticed most shots featuring a Ford are pushing the BEV models which haven't sold well and financially kicked the wind out of them. is it possible they still don't get it in Dearborn, despite statements made about hybrids etc.?

- ToolGuy I watched the video. Not sure those are real people.

- ToolGuy "This car does mean a lot to me, so I care more about it going to a good home than I do about the final sale price."• This is exactly what my new vehicle dealership says.

- Redapple2 4 Keys to a Safe, Modern, Prosperous Society1 Cheap Energy2 Meritocracy. The best person gets the job. Regardless.3 Free Speech. Fair and strong press.4 Law and Order. Do a crime. Get punished.One large group is damaging the above 4. The other party holds them as key. You are Iran or Zimbabwe without them.

Comments

Join the conversation

It still was a good year overall, especially considering how expensive new vehicles are becoming. Massive long term loans are the only way the majority of automakers are able to sell cars these days. GM throws a lot of cash on the hood in order to move its metal. I’m so surprised how many vehicles GM sells a year considering I don’t see a whole of GM products on the Westcoast besides for its Trucks. I see tons of Nissans though. New cars/trucks/suvs are slowly becoming out of reach for the average middle class family. And because newer cars are so reliable, there’s not much of a need for people to trade in their newish one for a newer one.

It's hard to believe people keep buying (or leasing) new cars. Just shocked that people keep shelling out big bucks for average cars. The appeal of a new car isn't lost on me, but spending $600-$900/month for it sure is. All to avoid budgeting $150/month for repairs on a nice used car? And you're still paying for tires, brakes and oil changes on new cars too, so the delta is even bigger.