Subaru Didn't Plan to Sell Many Ascents, but Subaru's Expectations Were Far Too Modest

Subaru didn’t believe the Ascent would add much to the brand’s monthly U.S. sales totals.

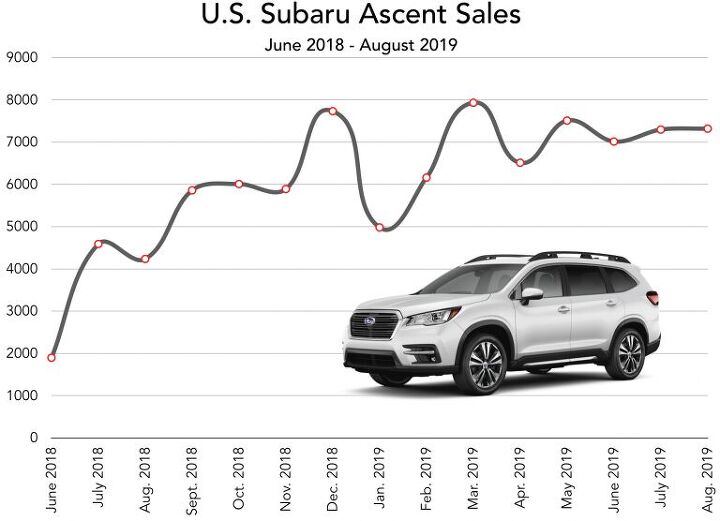

A year ago, it looked like Subaru’s forecasts were right on target. Roughly 5,000 U.S. sales per month? Check. Incremental brand-wide growth? Of course. Negligible impact on competitors? Indeed.

But the Ascent’s early capacity for helping Subaru keep its loyal customers loyal has evolved into something quite a bit more useful for the constantly-growing Japanese brand. Ascent volume is rising, rapidly so, and Subaru’s unparalleled streak of year-over-year sales growth – now at 93 consecutive months – now appears in little danger of collapsing.

That’s not to say the Ascent isn’t still pulling buyers over from the Outback and Forester. It was, after all, always Subaru’s intention that the Ascent do just that. Then CEO Yasuyuki Yoshinaga said in April 2017 that the Ascent wasn’t going to be a conquest vehicle; it would instead be a vehicle that kept growing families from leaving the Subaru brand when they began their hunt for a three-row vehicle.

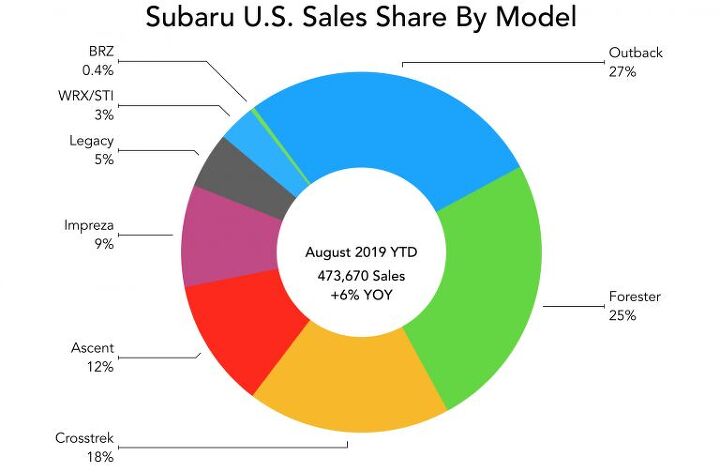

Excluding the Ascent, Subaru’s U.S. volume so far this year is actually down 4 percent, a loss of nearly 17,000 sales compared with the first two-thirds of 2018. But suggesting that Subaru’s non-Ascent downturn clarifies its cannibalizing nature ignores three factors.

First, Subaru’s supply is weak. “We’ll also be starting September with historically low inventory levels,” says Jeff Walters, Subaru’s senior vice president of sales. Second, the brand’s best-selling Outback is in a generational transition. Third, the Outback and Forester, the two Subarus most likely to lose buyers to their new big brother, both reported sales improvements in 2019’s first eight months. The Ascent seems to be causing no harm to Subaru’s two top sellers.

So, it’s a hit? By Subaru’s standard, the one that counts, yes. Subaru expected the Ascent to find the majority of its buyers in-house; generating around 60,000 annual U.S. sales.

Instead, the Ascent is not raining on the Outback’s parade. Better yet, Subaru will smash through that 60,000-annual sales mark any day now on its way to a year of potentially 80,000 Ascent sales. Subaru is certainly not letting off the Ascent throttle, either. August, with 7,319 sales, was the Ascent’s fourth consecutive month above 7,000 units; its fifth 7K+ month in the last half-year; its sixth since launching. These are welcome achievements for a vehicle that was believed to track around 5,000 sales per month.

Of course, it could go without saying that the Ascent remains relatively uncommon by the standards of top-tier competitors. The Toyota Highlander attracted nearly as many sales in August, 28,364, as the Ascent has in the last four months combined. Not even factoring in the Police Interceptor, Ford can sell more Explorers in half a year than Subaru can sell Ascents during a 12-month span. In August 2019, American Honda’s best month ever, Pilot volume actually took a 6-percent hit, yet the Pilot still virtually doubled the Ascent’s output. The Chevrolet Traverse and GMC Acadia both put up much bigger numbers, too.

Yet the very fact that we now look at Subaru results to see how they measure up in the mass-market tells you a lot about the brand’s new era. Subaru wants to sell 700,000 vehicles in the United States this year. Subaru only topped the 500,000-unit mark for the first time five years ago, crested the 400K barrier first in 2013, and as recently as 2008 held less than 2-percent market share.

Gone are the quaint days in which Subaru only sold Outbacks to your college professor’s aunt in Vermont. Oh, Subaru still sells her and everyone else in New Hampshire an Outback. But now the brand also sells Crosstreks to your neighbors and Foresters to your family members.

2019 is the year Subaru’s market share climbs beyond 4 percent. And Subaru has the Ascent to thank for pushing the brand over the edge.

[Image: Subaru]

Timothy Cain is a contributing analyst at The Truth About Cars and Driving.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Doc423 Rolling Coal is not a bad thing either.

- Ajla In high school I really wanted a yellow GTO.

- Lou_BC Sweet car.

- FreedMike With 157K miles, that's basically a beater that looks good. Plus, I heard Honda CVTs turn dicey with age. I'm a "no" at $12,500, but someone's heart will go all aflutter over the J-vin (Ohio-vin?) and pay up. With a manual in the same shape, I'd be in for a LOT less.

- EBFlex More proof the EV world is crumbling. In a market with supposedly “insatiable demand”, these kinds of things don’t happen. Nor do layoffs.

Comments

Join the conversation

Two weeks ago, I test drove a 2020 Outback XT Onyx and liked it. Then I drove the 2020 Ascent Limited and LOVED it. I unloaded my 2018 Honda Odyssey Touring on the spot. My Honda's trade-in value was impressive, and I hope the same for the Ascent, at some point.

My sister-in-law has a new Highlander, as does her niece. But if a prospective buyer is trying to avoid FWD vehicles like the poor-handling plague that it is, the Subaru lineup offers one of the extremely few (and thankfully not unpleasant) choices remaining. No wonder buyers are flooding to Subaru, 40% torque to the rear wheels under normal driving conditions is a sight better than the zip, zero, zilch, nada, offered in all other Japanese "AWD" SUVs and most small German SUVs!