In a Slowing U.S. Auto Market, Minivan Sales Are Falling 7 Times Faster Than the Overall Market

The minivan as we know it is not dead. Credit for the minivan segment’s still-beating heart belongs in large part to the disappearance of most contenders – so few competitors remain that a handful of remaining minivan nameplates may well still sell in six figures in the United States in 2019.

Most automakers determined years ago that sticking their forks into this pie isn’t worth it; the pie was just too small. The absence of GM, Ford, Hyundai, and Volkswagen, along with the steady rise of the family-oriented crossover, caused the pie’s shrinkage to continue. Nissan and Mazda left, too, and the pie kept shrinking.

In fact, the rate at which the minivan pie is shrinking has picked up speed. Auto sales are slowing, to be fair, but U.S. minivan sales volume in 2019 is slowing nearly seven times faster. And no, for FCA and Toyota and Honda and Kia, the whole “bigger slice of a smaller pie” argument just isn’t holding water these days.

According to Automotive News, auto sales fell 2.4 percent in 2019’s first half. Minivan volume, however, was down 15.8 percent, a loss of nearly 7,000 sales per month. Each of America’s three leading pickup truck nameplates – F-Series, Ram, Silverado – now easily outsell the entire minivan segment. America’s top-selling utility vehicle, the Toyota RAV4, is closing in on the minivan sector’s overall tally, as well.

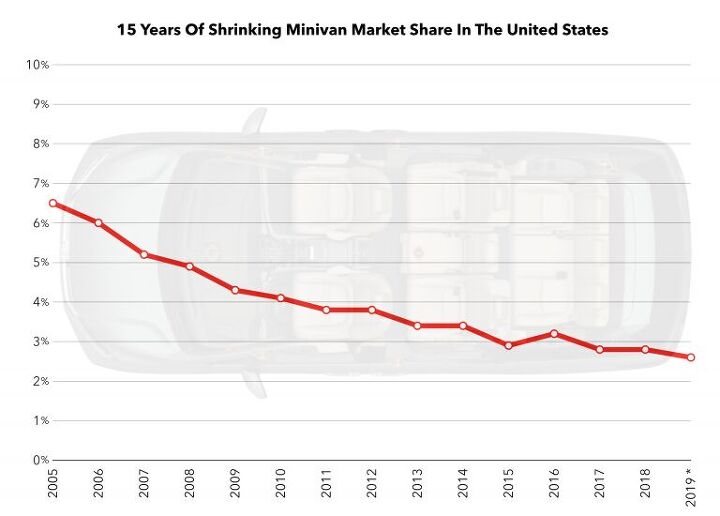

With only 218,635 sales in the first half of the year, minivans owned just 2.6 percent of the industry’s overall volume. It’s not an insignificant share of the market, but it’s down nearly half a percentage point over the span of just one year, nearly a full percentage point in half a decade, and down from 4.3 percent during the depths of the recession.

Perhaps it’s that final comparison, that Americans acquired more minivans in 2009 – when auto sales had slowed to a crawl, when there were roughly 40 percent fewer new vehicles sold than there are now, when 540,000 fewer vehicles were sold on a monthly basis than are being sold now – that most clarifies the degree to which minivans have fallen out of favor.

Put it this way: there were more Americans who wanted minivans when barely anyone could afford to buy a new car than there are now.

Granted, it’s not as though 2009 was a minivan heyday. Minivan volume had peaked nearly a decade earlier. 1.37 million minivans were sold in 2000, Automotive News says, and the segment’s market share nudged 8 percent.

2000 was not, however, the high-water mark for America’s remaining minivans. Honda Odyssey sales are roughly one-fifth lower now than they were in 2000, but they’re down around 44 percent compared with the Odyssey’s 2006 peak. Toyota Sienna sales likewise peaked in 2006 but have since been cut in half. The Kia Sedona wasn’t even around in 2000, when minivans were at their strongest, but sales this year appear to be off 2004’s best-ever Sedona pace by – you should be sitting down for this – 78 percent.

What about the Detroit stalwarts? Dodge was selling 24,000 minivans in 2000. That’s per month, and that’s actually down from what the Caravan/Grand Caravan was accomplishing in the four previous years. The Chrysler brand added another 16,000+. Again, that’s per month. The Dodge Grand Caravan and Chrysler Pacifica now produce 20,000 monthly sales between them, or about half the circa-2000 monthly average.

America’s minivan pie is now so small that, even when cut into five portions instead of 16 or more, all of 2019’s slices are slivers compared with the slabs of fluffy lemon meringue Grandma used to serve.

Minivans nevertheless continue to command high prices. Kelley Blue Book says July’s average minivan transaction price was $35,375. The Toyota Sienna and Dodge Grand Caravan have forged ahead without major redesigns in 8 and 11 years, respectively, which is the sort of product stagnation that lends itself to high profit margins. Honda, meanwhile, benefits from a minivan that shares an architecture and an assembly plant with multiple other Hondas.

Circumstances like these justify the minivan’s existence in the here and now. But what happens if sales fall as fast next year as they are this year?

Timothy Cain is a contributing analyst at The Truth About Cars and Driving.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Make_light I like Subarus, and I often think they don't get enough credit for how they drive. Lots of people say it's the faux-rugged image that accounts for their popularity, but they also drive with a solidity and plantedness that's absent from a lot of the Japanese competition. That being said, this thing is ugly. I never felt that Subarus were as ugly as commenters claim they are. Boring, sure, but not necessarily ugly. But between this and the refreshed Legacy, it's like they're trying to make their vehicles look as incohesive and awkward as possible.

- SCE to AUX I think the 2.2 was a pretty durable engine.

- Rochester We'll probably be trading in our 2018 Touring Edition Forester for the next model, and are waiting to see what the Hybrid is all about. Would be nice if they disclose whether or not it will be a plug-in Hybrid.

- CEastwood I have a friend who drives an early aughts Forrester who refuses to get rid of it no matter all it's problems . I believe it's the head gasket eater edition . He takes great pains regularly putting in some additive that is supposed prevent head gasket problems only to be told by his mechanic on the latest timing belt change that the heads are staring to seep . Mechanics must love making money off those cars and their flawed engine design . Below is another satisfied customer of what has to be one of the least reliable Japanese cars .https://www.theautopian.com/i-regret-buying-a-new-subaru/

- Wjtinfwb 157k is not insignificant, even for a Honda. A lot would depend on the maintenance records and the environment the car was operated in. Up to date maintenance and updated wear items like brakes, shocks, belts, etc. done recently? Where did those 157k miles accumulate? West Texas on open, smooth roads that are relatively easy on the chassis or Michigan, with bomb crater potholes, snow and salt that take their toll on the underpinnings. That Honda 4 will run forever with decent maintenance but the underneath bits deteriorate on a Honda just like they do on a Chevy.

Comments

Join the conversation

So with the market shrinking who bites the dust first? Sedona probably...fca is gonna kill the GC with a rebadged pacifica. Soon itll be just voyager/pacifica odyssey and sienna...and really theyre just different manufacturers take on a standard template that the market has evolved to. makes me wish for the variary of the 80s when it was chrysler vans vs astro vs aerostar vs toyota van. That was variaty.

Chrysler. Dead brand walking the green mile.