An Exhaustive List of Everything Automakers Want You to Know About Trump's Import Investigation (Hint: Higher Prices, Fewer Jobs)

It’s no secret that the automotive industry has come out universally against the Trump administration’s proposal to increase import tariffs. Numerous manufacturers weighed in independently on the issue as trade groups rise in opposition to the U.S. Commerce Department’s national security investigation.

The industry’s claim that imported vehicles don’t pose a risk to the wellbeing of the United States seems to have fallen on deaf ears. Threats that the prospective import duties on parts could result in fewer, more-expensive automobiles being produced domestically have been heard — and rebuked — by President Trump.

“What’s really going to happen is there’s going to be no tax,” he told Fox News in a weekend broadcast. “You know why? They’re going to build their cars in America. They’re going to make them here.”

However, automakers, parts suppliers, and even local governments have submitted comments to the Commerce Department ahead of the hearings scheduled for July 19th — and they’re all incredibly negative.

Despite the current administration billing itself as a friend to the industry (by helping to rollback fueling regulations and opening the door for autonomous testing), the tariff proposals seem to be straining the relationship. Bloomberg compiled some of the comments issued by manufacturers and the story remains the same. If the United States imposes a 25-percent import duty on parts and cars, automakers claim to have no choice but to raise prices and cut jobs.

The American Automotive Policy Council says tariffs would place a $83 billion tax burden on Ford, General Motors, and Fiat Chrysler that would ultimately be extended to their customers. It also said the decision to impose import duties would undermine the companies’ economic contributions within the United States.

GM went further, saying the prospect of retaliatory tariffs from other countries would hurt it and other automakers in markets around the world. It also said the White House’s decision would ultimately lead to “a smaller GM” and risked the automaker cutting domestic jobs. Presently, the company has 47 manufacturing facilities and employs about 110,000 people within the United States.

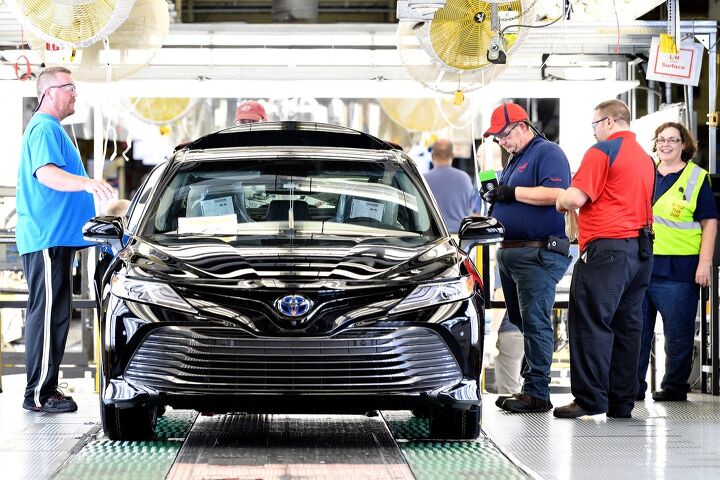

Toyota, which also has sizable investments in the country, said a 25 percent tariff on imported vehicles and parts would raise sticker prices on most of its fleet. For example, it estimated the Kentucky-built Camry sedan’s MSRP would increase by about $1,800.

While not as heavily invested in America, Nissan has still paid out $11.8 billion for U.S. manufacturing and employs thousands in the country. “Given the breadth and health of our operations here in the United States, we could easily meet the U.S. military’s requirements without the need to restrict importation of either automobiles or auto parts,” it said.

Mitsubishi also said the consequences of tariffs will be especially felt in local and regional economies, citing “rural Kentucky and suburban areas of southwestern Ohio” specifically.

States have also come out against the tariff proposals. Kansas Gov. Jeff Colyer (R), issued a letter to the Commerce Department saying the automotive industry brings in more than $1 billion in state tax revenue and employs about 60,000 Kansans. “While I understand the Administration’s desire to achieve a level playing field when it comes to international trade, I remain concerned about the continued growth of the automotive industry, a major economic contributor to Kansas and the nation,” Colyer wrote.

Public officials from Birmingham, Alabama, also weighed in by saying they’re “especially troubled” by the possibility of taxed auto parts. The city’s statement noted that more than 200 suppliers feed assembly plants for Mercedes-Benz in Tuscaloosa and Hyundai in Montgomery. “We grasp the Administration’s apprehensions about the balance of trade, but we are distressed by the significant negative effect on the automotive industry in Alabama and the tax revenue stream of the City of Birmingham were punitive tariffs to be placed on imported automotive parts,” the city said.

Daimler echoed this in its own statement. “New tariffs on imported parts will result in a reduction of vehicles being produced in Alabama,” it said in a comment to the Commerce Department. “Lower production volumes will result in fewer shifts with fewer U.S. employees.”

Mazda said the company might change plans to invest in its dealer network and in a new Alabama plant it’s building with Toyota if the tariff proposal goes through. It claimed the company’s greatest concern is that consumers will lose interest in buying cars and warned that “every area of the U.S. economy and employment will be affected, including research and development, manufacturing and sales.”

Volvo, which recently finished is first U.S. auto plant in South Carolina, has managed to fill roughly half of the promised 4,000 job openings it promised to create. However, now it’s saying “those U.S. jobs may not be created at all” if it can’t export freely.

BMW is the only manufacturer that exports more vehicles out of America than it sells domestically and it’s confronting the prospect of a trade war that could severely upset its business. Having already dumped $9 billion into its South Carolina plant, BMW believes tariffs on imported parts will increase the cost of building cars in the United States — hampering its ability to export and possibly forcing it to cut jobs.

Hyundai threw a curveball by stating that tariffs would hurt U.S. efforts to stop North Korea’s nuclear ambitions. We’re not entirely sure how that would work, since Hyundai is a South Korean firm, but it’s a bizarre threat. More easily understandable were its claims that duties would hamper the companies future plans to expand manufacturing in America.

Volkswagen made what was probably the most easy to identify with statement. It “does not see how continuing imports of automobiles and automotive parts at current levels could impair U.S. national security” and believes that “this proposition — supported by no U.S. motor vehicle manufacturer — is implausible.”

That’s hard to argue with. While there are real threats from China stealing intellectual property and forcing government mandated business partnerships on foreign investors, a lot of the damage has already been done. The rest of the world doesn’t seem to have this problem. Likewise, while present-day European auto tariffs are higher than the United States’ on cars, U.S. truck tariffs are already incredibly high. The administration’s claim that this all amounts to a national security threat is a difficult to come to grips with.

However, there’s also confusion arising from the industry itself. While it’s understandable that tariffs and retaliatory duties will ultimately cost automakers money and escalate prices, the repeated claims of cutting domestic jobs and abandoning investments frequently feel like threats. While some jobs could be lost, the Trump administration’s entire strategy revolves around forcing manufacturers to set up shop within America’s borders or face high taxes.

It may not be an elegant solution, but it was one that worked incredibly well for China as automakers scrambled to get into a booming market. Would automakers really abandon their investments and eliminate staff just because the U.S. imposed new tariffs? Possibly, but it’s also hard to imagine it happening without other countries enforcing retaliatory taxes of their own. We can be reasonably certain that domestic tariffs will raise car prices, but we’re less inclined to believe in a mass exodus of automakers that still want to sell in the United States. At least, not until we know how the rest of the globe plans to respond.

[Images: Toyota; General Motors; BMW]

A staunch consumer advocate tracking industry trends and regulation. Before joining TTAC, Matt spent a decade working for marketing and research firms based in NYC. Clients included several of the world’s largest automakers, global tire brands, and aftermarket part suppliers. Dissatisfied with the corporate world and resentful of having to wear suits everyday, he pivoted to writing about cars. Since then, that man has become an ardent supporter of the right-to-repair movement, been interviewed on the auto industry by national radio broadcasts, driven more rental cars than anyone ever should, participated in amateur rallying events, and received the requisite minimum training as sanctioned by the SCCA. Handy with a wrench, Matt grew up surrounded by Detroit auto workers and managed to get a pizza delivery job before he was legally eligible. He later found himself driving box trucks through Manhattan, guaranteeing future sympathy for actual truckers. He continues to conduct research pertaining to the automotive sector as an independent contractor and has since moved back to his native Michigan, closer to where the cars are born. A contrarian, Matt claims to prefer understeer — stating that front and all-wheel drive vehicles cater best to his driving style.

More by Matt Posky

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts Whenever the topic of the xB comes up…Me: "The style is fun. The combination of the box shape and the aggressive detailing is very JDM."Wife: "Those are ghetto."Me: "They're smaller than a Corolla outside and have the space of a RAV4 inside."Wife: "Those are ghetto."Me: "They're kind of fun to drive with a stick."Wife: "Those are ghetto."It's one of a few cars (including its fellow box, the Ford Flex) on which we will just never see eye to eye.

- Oberkanone The alternative is a more expensive SUV. Yes, it will be missed.

- Ajla I did like this one.

- Zerofoo No, I won't miss this Chevrolet Malibu. It's a completely forgettable car. Who in their right mind would choose this over a V8 powered charger at the rental counter? Even the V6 charger is a far better drive.

- Offbeat Oddity Nope, I won't miss it. I loved the 2008-2012 Malibu, but the subsequent generations couldn't hold a candle to it. I think the Impala was much more compelling at the end.

Comments

Join the conversation

I just read the EU is in the process of organising all major vehicle manufacturers to drop ALL tariffs on vehicles. This is to be presented to the White House. Trump is already stated it is not acceptable (if it occurs). This great news, all we need to resolve are the technical barriers.

How does trump know that the automakers will rush to build more factories in the US - instead of waiting 2.5 years, for an administration change? Building cars here won't help at all with the export market, either.