Seriously, How Much More Abuse Can Faraday Future Take?

It’s been a while since we’ve discussed the ongoing plight of Faraday Future. While most of this year — and all of the last — was riddled with missteps from the automotive startup, we’ve taken a break from reporting on it. That wasn’t because its situation had improved, however. Oh boy, is that ever not the case.

Earlier this month, details emerged that the business was preparing to file for bankruptcy, followed immediately by the firm denying the validity of those claims. Then, news broke that Faraday’s chief financial officer, Stefan Krause, had quietly resigned in October — despite having been hired specifically to solve the company’s financial troubles back in March.

This got us wondering as to exactly how much more can go wrong before Faraday Future finally throws in the towel.

After lapsing on payments to the contractor responsible for building a billion-dollar factory in Nevada, Faraday eventually scrapped the plant. The new plan was to start smaller with a single model — the FF 91, which was showcased earlier this year as an impressive but incomplete prototype vehicle. In fact, the model suffered an embarrassing tech hiccup during a live broadcast when Jia Yueting, the company’s chief financial backer, attempted to use its automated parking system.

Jia has also suffered catastrophic financial problems. The situation is so dire that he was forced to resign as chairman of Leshi Internet after being unable to fulfill commitments (after branching the firm into several new business lines). The Chinese government has frozen over $182 million in remaining assets and he has been left to helm LeEco’s electric car business — and the struggling Faraday Future.

However, without solid financial backing, the company has been forced to seek investment opportunities elsewhere. While Stefan Krause was expected to be the tip of that spear, Jalopnik reported that the CFO decided to abandon his post on October 14th. Despite Jalopnik having its finger on the pulse of what is happening at Faraday better than most outlets, that news didn’t break until Friday morning. This is likely because FF is more secretive than a cat when company comes over.

It’s almost unbelievable to suggest this, especially considering how this year’s news has progressed, but Farday’s problems have — if anything — been underreported. In addition to nonpayment lawsuits with Electrical Services Solutions (for $580,000) and The Mill Group (for $1.8 million) from earlier this year, our own Bozi Tatarevic discovered that other civil suits have been quietly mounting in California.

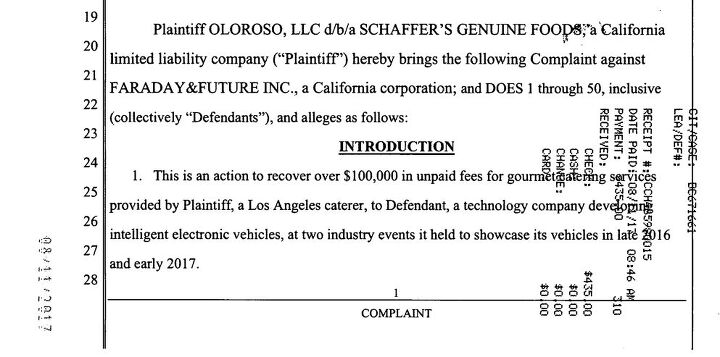

The most interesting of these is with Schaffer’s Genuine Foods, which filed a $100,000 complaint against Faraday over unpaid catering fees.

Which brings us to the issue of bankruptcy. How can the company even maintain that filing for Chapter 11 isn’t its only course of action? In the last days of October, TMTPost issued a financing plan for Faraday that appeared legitimate. According to the document provided, Faraday was supposed to raise $150 million in conjunction with the bankruptcy filing. Afterward, new investors would inject $130 million to settle claims with “outstanding creditors” and eventually assume control of the company.

However, Faraday has categorically denied the authenticity of those documents.

Fine, let’s say they are fake. That doesn’t change everything else that has happened nor does it address the astronomical financial problems the company is currently facing. Jia may even face possible fraud charges in China for intentionally inflating Leshi’s earnings and operating details to investors. So, what’s the plan here? Is Faraday going to continue waiting for an investor willing to hand over $1 billion with Jia still in control of the company?

Faraday is hemorrhaging money, getting into all kinds of legal trouble, and losing employees faster than it can take them on. Maybe it should take a look at those fake bankruptcy documents and put them into action.

[Image: Faraday Future]

A staunch consumer advocate tracking industry trends and regulation. Before joining TTAC, Matt spent a decade working for marketing and research firms based in NYC. Clients included several of the world’s largest automakers, global tire brands, and aftermarket part suppliers. Dissatisfied with the corporate world and resentful of having to wear suits everyday, he pivoted to writing about cars. Since then, that man has become an ardent supporter of the right-to-repair movement, been interviewed on the auto industry by national radio broadcasts, driven more rental cars than anyone ever should, participated in amateur rallying events, and received the requisite minimum training as sanctioned by the SCCA. Handy with a wrench, Matt grew up surrounded by Detroit auto workers and managed to get a pizza delivery job before he was legally eligible. He later found himself driving box trucks through Manhattan, guaranteeing future sympathy for actual truckers. He continues to conduct research pertaining to the automotive sector as an independent contractor and has since moved back to his native Michigan, closer to where the cars are born. A contrarian, Matt claims to prefer understeer — stating that front and all-wheel drive vehicles cater best to his driving style.

More by Matt Posky

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Turbo Is Black Magic My wife had one of these back in 06, did a ton of work to it… supercharger, full exhaust, full suspension.. it was a blast to drive even though it was still hilariously slow. Great for drive in nights, open the hatch fold the seats flat and just relax.Also this thing is a great example of how far we have come in crash safety even since just 2005… go look at these old crash tests now and I cringe at what a modern electric tank would do to this thing.

- MaintenanceCosts Whenever the topic of the xB comes up…Me: "The style is fun. The combination of the box shape and the aggressive detailing is very JDM."Wife: "Those are ghetto."Me: "They're smaller than a Corolla outside and have the space of a RAV4 inside."Wife: "Those are ghetto."Me: "They're kind of fun to drive with a stick."Wife: "Those are ghetto."It's one of a few cars (including its fellow box, the Ford Flex) on which we will just never see eye to eye.

- Oberkanone The alternative is a more expensive SUV. Yes, it will be missed.

- Ajla I did like this one.

- Zerofoo No, I won't miss this Chevrolet Malibu. It's a completely forgettable car. Who in their right mind would choose this over a V8 powered charger at the rental counter? Even the V6 charger is a far better drive.

Comments

Join the conversation

"We are doing these things not because they are easy, but because they are hard, because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone." Easy is to sit in armchair and play smarta$$. The road to success is paved by failures.

According to Autocar TATA motors are about to spend 900 million USD investing in Faraday Future. I'm guessing that might buy them most of the company....