No Fixed Abode: Dealers Gone Wild!

“Character is what you do when no one is watching.” This quote, ascribed to John Wooden, C.S. Lewis, and others, is doubly true when it comes to the oft-reviled profession of automotive sales. Any dealer can be “ethical” when they are facing an informed consumer with money, credit, the ability to hire counsel, and the self-confidence to fight for own interests. I’ve had plenty of trouble-free transactions with dealerships that had well-earned abysmal reputations for ethics. Hell, I’ve even managed to buy some new motorcycles over the years without getting raked over the coals too hard.

You can’t judge a dealer based on how he treats a middle-aged white guy with a spotless credit rating, a laptop full of information, and a thorough knowledge of the laws in his state regarding new-car sales. That would be like the Misfit having a good opinion of the grandmother in the Flannery O’Connor tale. Rather, you judge a dealer by how he behaves when there is nobody of consequence looking. Given a dark-skinned female customer with a decent co-signer and some down payment money but no genuine idea of how the process works, how much advantage will a dealer take?

The answer might shock you, as they say — but it probably won’t.

A friend of mine stopped by the house a couple of weeks ago with a thick envelope full of papers from a Kia dealership in central Ohio. Three years ago, the woman who is now his live-in girlfriend had gone to see that Kia dealer about the purchase of a new Soul. We will call her “Destiny”; that’s not her name, but it’s from the same neighborhood, linguistically speaking. She’s a nice girl, but she will never be mistaken for a New York socialite or even a member of the urban-Midwest Eloi. Born of mixed-race parents and “country” as the day is long, she is short, squat, inordinately cheerful in disposition, and absolutely unable to comprehend any math above what you’d use to run a cash register.

Her credit wasn’t good, but as is often the case in this world, she had a mother who had kept her nose clean and could easily co-sign to a bank’s satisfaction. There was just one minor hitch: Mama had a 2006 Maxima she wanted to get rid of at the same time. The good news was that the Max was a creampuff and she didn’t owe much money on it compared to its likely retail price.

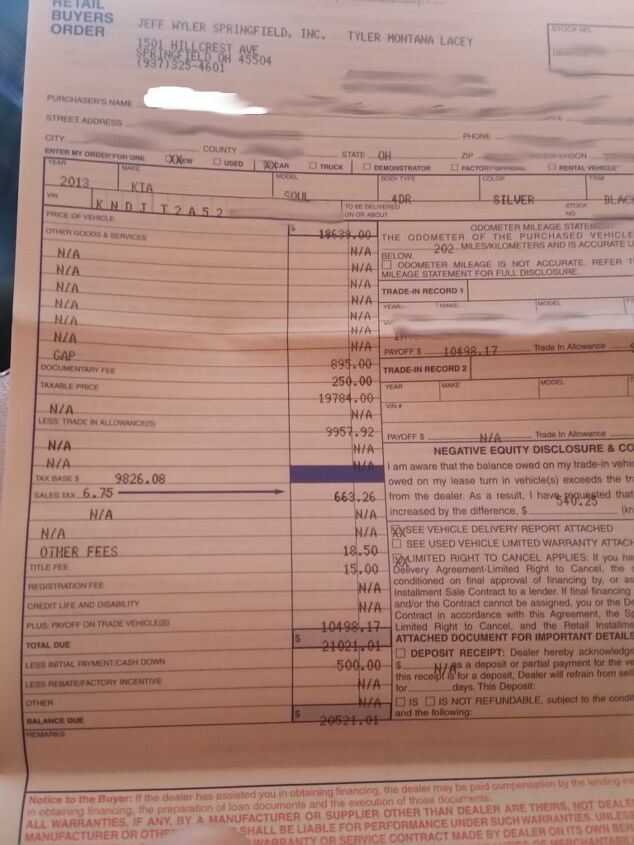

Mama and daughter went to the Kia dealership to get a Soul. Here’s a picture of the deal, but if you aren’t the kind of person who likes to pore over paperwork, don’t worry because I’m going to give you the highlights.

The full MSRP of a 2013 Kia Soul+ automatic is $17,700 plus $810 destination, for a total of $18,510. This was revised up to $18,639 through methods that were opaque to Destiny; probably a stripe package. The dealer can be excused here, I suppose; if you don’t ask for a discount, you don’t get one, and I’m sure that Destiny and her mother were told that there wasn’t much (meaning any, meaning negative) room to deal on these low-margin automobiles.

To that, the dealer added a $250 doc fee, which is on the absolute high-end of the ethical or even legal range. They charged her $18.50 for a $3 temp tag and $15 for the 39-cent stamp they used to mail the MSO to the Ohio title office. That’s about all the money you can screw out of someone in that department, I’d say.

The 2006 Maxima was valued at $9,957 against a payoff of $10,498. How much was the Maxima really worth? Using a sort of holistic method that involves checking sale prices at the time, evaluating current sale prices for 2009 Maximas, and holding my finger up in the wind to check which way I think it’s blowing, I’m going to say that they took a little money out of Destiny’s mother’s pocket there. This was a car they could have probably sold for $13,500 without too much trouble, which meant that they could have given her the payoff and simply left it out of the deal.

Unfortunately for certain groups of buyers, however, there’s a phenomenon at dealers that I think of as blood in the pool. If the used-car side of the house can determine from certain signs that the new-car customer is not in a strong negotiating position, they will drop the amount they’re willing to pay for a car. Why should the lazy jerks on the shiny side of the building get all the profit from a fresh pigeon?

Signs of a low-information, high-profit customer include:

- Dirt or clutter in the car. Only people with low future time orientation arrive at a dealer with a dirty, messy car. You always hear that dealers “appraise through dirt,” and they absolutely do, but they also consider that the Consumer Reports types show up at trade-in time with a clean car.

- Bumper stickers on the car. There’s a mild correlation between the number of stickers on a car and personal gullibility. The alpha example of that would be the “Salt Life” sticker; I’ve never seen one in proximity to someone with an IQ above median.

- Black or Latino compact discs. No amount of social-justice media programming will ever dislodge the hard-nosed belief in the used-car game that minority customers should pay more for a car. That’s true even among minority dealership personnel. Maybe more so.

- A car seat, particularly a beat-up one. If you have a kid, you have less negotiating room. If you’re putting your kid in a worn-out or secondhand car seat, you’re a buy-here-pay-here customer or close to it.

Don’t yell at me; I didn’t make the rules, I just report them. So Destiny’s mom took a five-hundred-dollar lowball on the trade. Fortune passes everywhere, as Gurney Halleck would say.

The last thing the dealer did to cash out on this car was to add a $895 gap insurance policy. Destiny doesn’t have much recollection of why this happened, except that it was necessary. My guess is that the F&I department told her the bank wouldn’t buy the deal without it, which is of course a lie.

So let’s compare the deal Destiny got with the deal that, say, your humble author could have gotten. I’d have expected to pay no more than a dime over $17,000 for this car, and that includes whatever stupid fees the dealer felt entitled to. I’d have scrapped for full payoff on the Maxima, and I’d have told them to pound sand on the gap insurance. If you’re reading this with a calculator in hand, you’ll see that the difference between Destiny’s deal and mine would be about $3,300. For the same car.

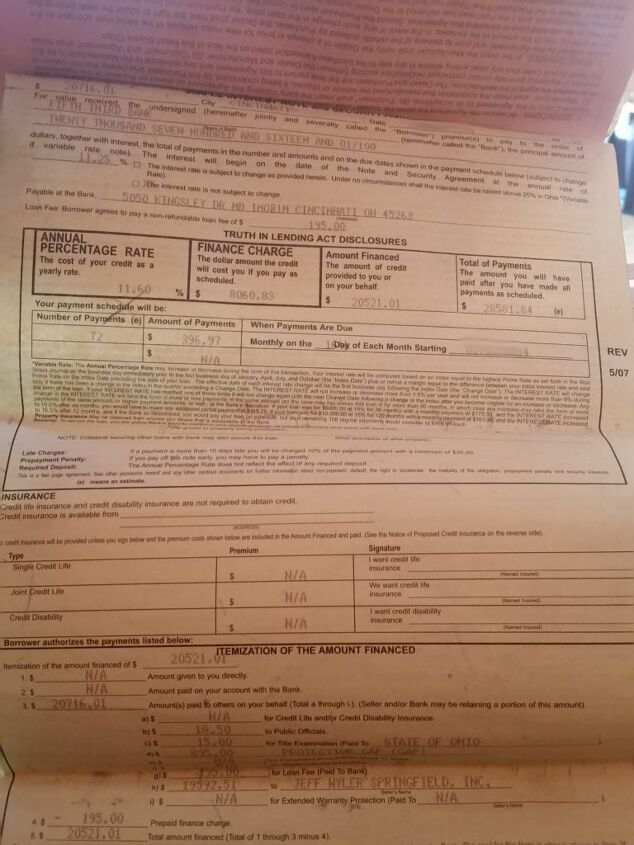

For Destiny, however, the ride was just beginning. With her rock-solid mother as co-signer, she should have expected to pay a second-tier interest rate. Maybe seven or eight percent. Instead, here’s the deal she got — and as with the bill of sale, I’ll cover the highlights afterwards:

11.6% over 72 months! For a magic-sounding payment of $396.97, even after a $500 down payment from Destiny’s mom. The bank also charged them $195 for the privilege of putting their stamp on this airtight three-hole fucking of the customer, secure in the knowledge that gap insurance would cover their tails in all but a repossession situation.

Some of you will have already deduced how this deal was constructed. It was a typical four-square “how much can you afford per month?” Destiny told them $400, so they bundled profit into the deal until they reached the magic $400 mark. And since they were greedy — oh, so greedy, dear readers — they even pushed the term out of 72 months.

If Destiny had bought the car for $17k plus tax, gotten a fair trade, and put $500 down, she could have gotten a 6.9% loan over 60 months and paid $348/month over 60 months instead of $397 over 72. But this dealer understood that she was over a barrel and acted accordingly.

I wish I could have been a fly on the F&I office wall while this absurdly profitable deal was made. How they must have laughed, slapped each other on the back, made plans for the $500 commission the salesman would get and the $750-plus spiff that would have gone to F&I. Plus the extra profit on the used side. It’s the kind of deal that becomes short-term legend around the sales floor, the golden ticket legend that sustains the staff through endless “mini deals” made with laptop-toting H1-Bs and Consumer Reports-reading professionals.

Over the course of twenty minutes, I laid all of this out to my friend. Showed him where they made the money and how. “Well, can she get out of this and get another car?” he asked. Destiny had worked a solid job since then, kept her credit together.

“What does she owe on the Soul?” was my response.

“About fifteen thousand dollars.” For a 2013 Soul+ automatic with high-ish miles.

“It can’t be worth a penny more than eight grand to a dealer,” was my opinion. “Closer to seven is my guess.”

“So she owes $15,000 on a $7,000 car,” he clarified.

“Yes, one that cost the dealership about $15,000 three years ago. Really, she’s finally made it to the original value. She’s just been paying profit to people ever since she bought it.”

“Well … that’s horrible.”

“It is.” And that’s where we could end the story. Destiny’s life is pretty good right now; she’s shacked up with my friend, living rent-free and eating fine meals on his dime while she saves money for whatever the future holds. A three-year-old Kia Soul is a pretty reliable, livable proposition. I have no concerns about it lasting the rest of the loan. Destiny will be sadder than she’d like until she reaches equity, which should happen in about two and a half years. Let’s hope she’s wiser in the future, too.

But I would be remiss if I didn’t mention that there were four victims of this dealer’s unabashed profit-seeking:

- Destiny, who will pay $28,581 for a $17,000 car;

- Destiny’s mother, who will have this loan on her credit record for a few years longer than she would have had a reasonable term-and-rate loan;

- My friend, who is effectively financing Destiny’s life in exchange for certain other salutary qualities which she possesses;

- Kia Motors America and the Kia parent company.

Wait, what? How is Kia a victim? Simple. Destiny likes her Soul. She’d like a new one. But instead of getting a new one after three years, she’s going to keep her old one. So Kia has sold one car when they could have sold two. This doesn’t bother the dealer; Destiny’s deal on the Soul was more profitable than five mini-deals to pencil-pushing IT geeks or spreadsheet-toting middle-class accountants. But Kia didn’t make a penny more on that unit than they’d have made if I’d worked the deal instead of Destiny.

Worse yet, you’d be a fool if you think that Destiny is mad at the dealership. Her mind doesn’t work that way. She’s out there telling everybody that she got screwed over by Kia, not by a particular Kia store. And whatever joy she had in Kia ownership is long gone now, a casualty of the way she was milked for profit by the dealer. So instead of buying at least two Kias, and maybe three decades’ worth of Kias in the future, she’s now a zero-future-Kia buyer who is flapping her gums about it to every friend and family member who will listen.

In the end, therefore, the biggest sucker on this deal wasn’t Destiny, and it wasn’t Destiny’s mom. It wasn’t even my friend. It was the company that built the car and supported the dealer. And you wonder why the manufacturers would tear down the pillars of heaven to get to a direct-sales model? The first automaker to turn that particular trick will have a very bright future; everybody else will just have a Destiny.

More by Jack Baruth

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- FreedMike Your Ford AI instructor:

- Jeff Good find I cannot remember when I last saw one of these but in the 70s they were all over the place.

- CoastieLenn Could be a smart move though. Once the standard (that Tesla owns and designed) is set, Tesla bows out of the market while still owning the rights to the design. Other companies come in and purchase rights to use it, and Tesla can sit back and profit off the design without having to lay out capital to continue to build the network.

- FreedMike "...it may also be true that they worry that the platform is influencing an entire generation with quick hits of liberal political thought and economic theory."Uh...have you been on TikTok lately? Plenty of FJB/MAGA stuff going on there.

- AZFelix As a child I loved the look and feel of the 'woven' black vinyl seat inserts.

Comments

Join the conversation

When I saw the 11% APR and the yellow-ish paper, I thought that was something from the early 80's. Some things never go out of style.

"The first automaker to turn that particular trick will have a very bright future; everybody else will just have a Destiny." Please tell me the "European Delivery" option (popular in the 1970s-80s and probably earlier) didn't involve a US dealer...