How An 86-Year-Old African-American Woman Was Charged Over Sticker For Last Year's Buick

Imagine the following scenario: You’re a Buick salesman. An elderly woman comes into your showroom to inquire about a replacement for her Regal. You decide that she’s a great candidate for an Encore, and since you have some previous-year Encore stock you decide that she’s a great candidate for a 2015 Encore instead of the new model. There’s a $149/month lease deal available from GM Financial. What kind of deal do you make for this woman?

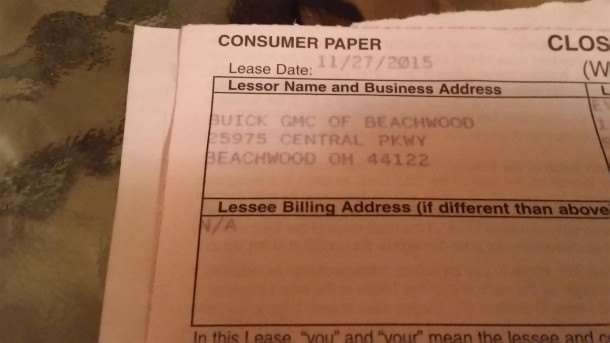

If your answer is, “I’d charge her over sticker for the vehicle, switch the lease company to make some back-end money, and add nearly a thousand dollars of profit in fees above that,” then you might just be the salesman that Buick GMC of Beachwood, OH needs.

When my old pal Rodney’s grandmother went to Buick GMC of Beachwood, the sales team decided to take advantage of her age and relative lack of knowledge concerning car-buying in order to take a considerable amount of money. How much money? Well, that’s the most amazing part. It’s laid out in the video at the top of this article, but here’s the deal in a nutshell:

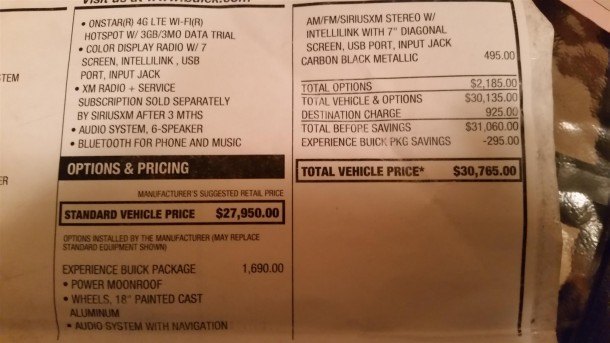

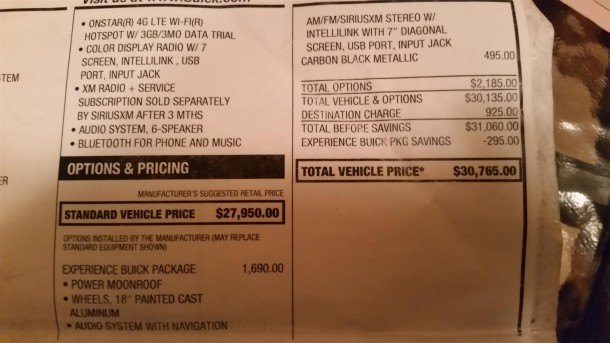

The Encore in question is a 2015 “Leather FWD” model with a sticker of $30,765. According to TrueCar, there’s approximately $600 of markup in this vehicle. There’s also about $923 of holdback, bringing the total to $1,523. Given that this car is last year’s vehicle, there could be as much as five percent of additional factory-to-dealer incentive, which would bring the total profit to $3,060.

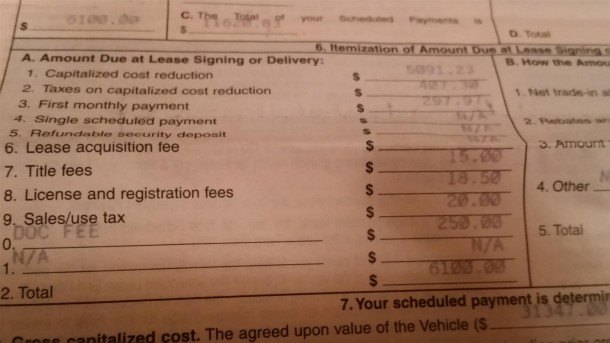

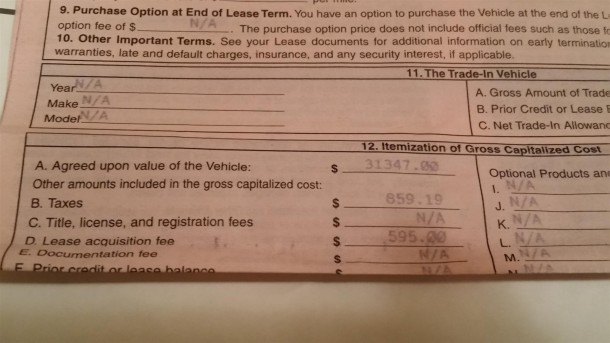

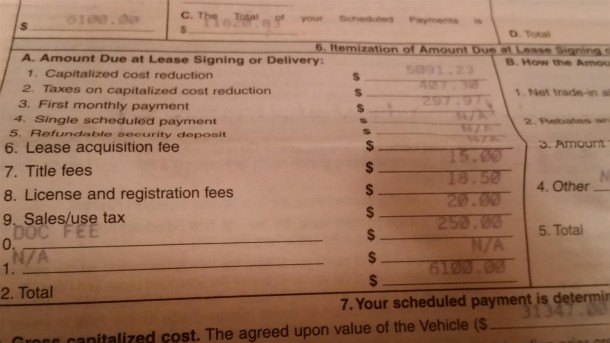

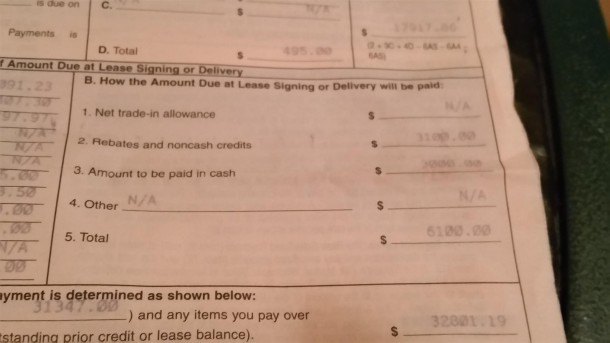

That would be nice, wouldn’t it? But this dealership actually capitalized the vehicle at $31,347. This means $582 of additional markup is added, bringing the profit to $3,642. How did they do that? Well, there’s no law that says you can’t pay over sticker for a vehicle, and the dealership relied on Rodney’s grandmother to not understand the meaning of “gross capitalized cost”.

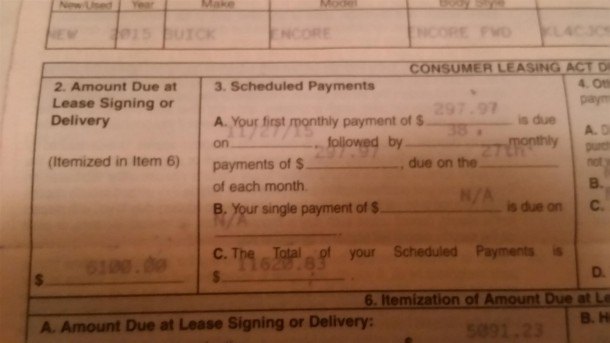

GM Financial, if they are anything like every “captive finance source” with whom I’ve ever worked, won’t finance a vehicle over sticker. But there are plenty of alternative sources that will, particularly when the customer in question has an outstanding credit rating. Wells Fargo was the bank of choice for this deal. They wrote the lease in such a manner as to maximize profit while adhering to the $297/month rate on which Rodney’s grandmother was sold. There’s a fair amount of profit for Wells Fargo built into this lease, including a termination fee at the end of the lease.

There’s also profit for the dealership. There’s a kickback for sending the business to Wells Fargo instead of GM Financial. The precise amount is not something we can know, but it wouldn’t be stretching things to assign a value of $250 to that kickback, bringing us up to $3,892. That’s an impressive amount of profit on a vehicle that typically sells for well below invoice. But the dealership also charges a $250 “doc fee”, bringing us up to $4,142. There’s also a $595 “acquisition fee”, which might go to Wells Fargo but which also might be returned in whole or part to the dealership for a possible $4,737.

Another way to look at it is this: How much more will Rodney’s grandmother pay in total than she would have paid had the dealer just given her the standard GM Financial deal? The simplest answer is that she paid about $1100 more up front than the standard deal, and she’ll pay about $110 a month more during the first 24 months. That’s $2,640 for a total of $3,740. But there’s more damage than that, because she’s committed to the car for an addition fifteen months. If you assume that there would be a similar deal in the future on another Encore, then you can add $1,500 of unnecessary payments for a total of $5,240 over what a savvy shopper would pay.

Okay. So an 86-year-old woman paid $5,000 too much for a car. So what? In the immortal words of our next President, what difference does it make? I’d suggest that it’s significant for two reasons. The first is that this deal demonstrates the continued existence of ethics-challenged dealerships, even among major new-car franchises, even in 2015.

The second is this: I have always believed that we only discover our true character when we have others in our power. When we can benefit from the weakness or ignorance of others. When we have a chance to improve our situation by taking advantage of others. In those moments, you understand who you are. The people at Buick GMC of Beachwood who wrote this deal can now say that their true character is apparent both to themselves… and to all of you.

More by Jack Baruth

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Add Lightness I don't waste a lot of time watching nothing much happening by watching the YouTube 6 minute highlights.

- MrIcky from my rental fleet experience, id rather drive one of these than a camry.

- Add Lightness Protectionist fear competition under the guise of paranoia.

- Kjhkjlhkjhkljh kljhjkhjklhkjh But facebook, instagram, twitter, your cell phone, your chevy/ford/dodge, your debit card, your credit card selling your data to the SAME OVERSEAS DATABROKERS is ok.Meanwhile parler, telegram literally run on russian hardware is also ''ok''

- Redapple2 Dear lord ! That face. HARD NO.

Comments

Join the conversation

RE: "Tesla believes that current state franchise laws pose enough of a threat to its direct sale business model to have lobbyists who are attempting to change those laws." Yes they do and yes they are. RE: RE: "Dealer associations believe that changing those state franchise laws poses enough of a threat to their franchise business model to have lobbyists who oppose changing those laws." Dealer associations believe that providing different rules for Tesla or other non franchise dealer business models give them an unfair advantage. There are many dealers who would like to have a Tesla franchise. I don't know a SINGLE dealer who wants to have to deal with a Chinese direct sales dealer down the street selling new vehicles out of a mobile home on cement blocks on a gravel lot, with no service department. I don't know a single new car dealer concerned that his/her OEM will try to begin selling direct. I DO know a few who hope they try. RE: "We all know what’s up, even if you claim not to." I'm sure you think you do. You haven't yet answered the question why there are so many Teslas on the road in Texas, where they are supposed to be banned. How about the galleries there? It all seems to be working out quite well for Tesla in Texas. Go to the gallery, pick you color, trim, and options, go online and buy. If they want to do test drives and take money at the "gallery," they'd first have to establish a state approved service department and jump through some other hoops, same as Ford, GM, Chrysler, etc. The domestic OEMs all have factory owned stores in TX. Tesla is just stubborn and looking for their own deal.

Wells Fargo does not offer leases: http://www.autonews.com/article/20150109/FINANCE_AND_INSURANCE/150109877/gm-to-use-gm-financial-for-subsidized-leases-drop-ally-u.s.-bank Wells Fargo holds title but does not originate the lease. Why all the profit is a 4-letter word talk? If a middle aged white male walked into a car dealer unprepared and completely agreeable to whatever the salespeople tried to pull why would that be ok and this isn't?