Analysts See North American Auto Production Above 16 Million, U.S. Sales Not Far Behind

The recent rise in U.S. car sales emboldened forecasters to predict that 16 million units will be made in North America this year. Some already raise a specter that was thought to be dead for nearly a decade: Capacity constraints.

According to Automotive News [sub]

“Automakers are expected to build more than 16 million light vehicles in North America this year, the region’s highest output since 2002. Two major forecasters, LMC Automotive and IHS Automotive, predict that production will rise from last year’s 15.5 million units as the U.S. economy continues to improve. “

LMC’s Jeff Schuster said:

“We’re getting close to the point where all factories are hitting full speed. We could hit a wall if this keeps up.”

According to Schuster, automakers are running their plants at close to 90 percent capacity utilization.

Note: These forecasts are for North American Production, not for U.S. sales. The U.S. sales outlooks however are not far behind.

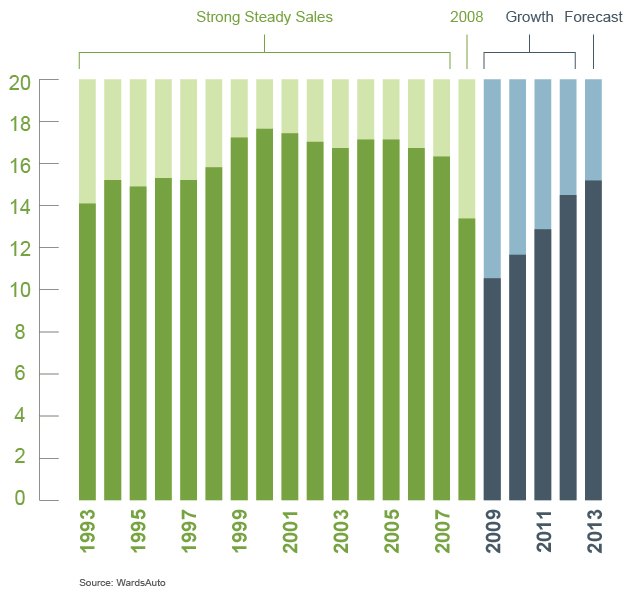

LMC Automotive currently maintains the total U.S. light-vehicle sales outlook for 2013 at 15.4 million units.

U.S. light vehicle sales were the highest in the year 2000, when they exceeded 17 million. Sales hovered above the 16 million mark through 2007, only to crash to below 10 million in 2009. Since then, sales recovered steadily.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

Let's see what happens when the free money window at the Fed closes.

What surprises me is not the number per se, but transaction prices. According to almost all reports transaction prices have gone up pretty steeply, so not only do you have the old levels back, but these old levels are much richer. In a contracted market one could've thought prices would go down, not the case this time. BTW, I heard a very good analysis on the radio today. The US is now receiving more dollars as investors are putting money back into the US. AS a result, the Brazilian real, the Australian dollar among others have seen a steep devaluation as the dollars that used to be lying around in these places gets diverted back home. With China slowing down commodity imports, those dependent on their export could be hurt pretty bad soon. I guess you can say the US is back.

This happens a lot Marcelo. When one country (usually the U.S.) leads out of a recession the money flows there and the currency rises. We had a very strong dollar in the mid-to late eigthties coming out of that recession and then again right around the turn of the century when the Euro was trading in the 0.70s to the dollar. When I traveled to your country in 1987, I remember the exchange rate was highly favorable to the currency of the time which was the Cruzado and there were currency controls in place by your government. During the commodity boom of the first ten years of this century, the Real I believe more than doubled against the dollar.

I am baffled that the so-called rating agencies that utterly failed their due diligence in the mortgage crisis have any credibility whatsoever. Is it that there is no alternative, so everyone just holds their nose and plows onward? Especially regarding something as important as a national rating that is reflected by billions in additional interest payments. What alchemy are they relying on these days? What are they doing that a simple computer program could not? On the subject at hand, I'm encouraged by these sales projections. I'm still amazed by our productivity. We're producing this many cars annually with a fraction of the workforce it took previously.