How To Get Rich Buying Mazdas And Subarus

Some people like to bitch about the crafty Nips who are manipulating their currency again. Other people like to cash-in on sudden swings in currency valuations. If you are of the second kind, then Reuters recommends a look at formerly beaten-down stocks of Japanese carmakers who nearly went under during years of unfettered appreciation of the ¥en.

Reuters recommends a look at “ Mazda Motor Corp and Fuji Heavy Industries Ltd that are best placed to benefit from the weakening yen, raising their earnings forecasts as exported goods bring in more cash.” True, if you look for a quick trade, those two promise wild swings, simply because they are the most exposed to the currency. According to Reuters,

“Mazda makes 71 percent of its vehicles in Japan and exports about 80 percent of them, while Fuji Heavy makes about three-quarters of its cars at home, shipping about 67 percent of those.”

Both shares are a reverse proxy for the yen and already had quite a run-up as the yen cheapened. According to Reuters, “Mazda stock is the best-performing among Japanese automakers in the past three months, jumping 167 percent, followed by Fuji Heavy Industries’ 73 percent leap, both on expectations the weaker yen would boost their businesses.”

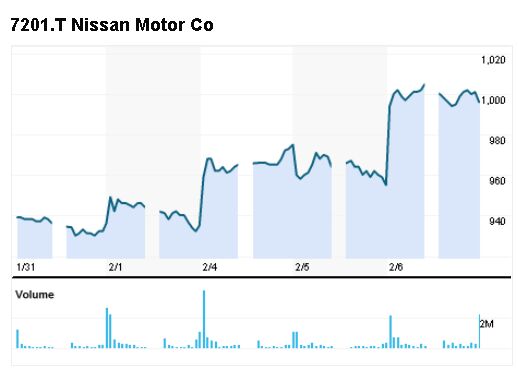

I recommend having a look at Nissan also. It’s a bit bigger than Mazda and Fuji’s Subaru, and better positioned in the world markets. It also is quite an interesting currency play. Sure, only 23 percent of its global production is still in Japan. However, and now you know why Carlos Ghosn was jumping up and down, waving his arms against the obscenely high yen for the last two years. Quite interestingly, when Ghosn went on his rampage against the deviant yen in late 2011, he called a high point of the obscene currency at 76 to the greenback. Today, a dollar buys 93 yen. The yen is still expensive, and a currency play buy buying Japanese car stocks could make you some money.

Others have similar ideas. Fuji was up 5.1 % today, Mazda 4.4%, Nissan is up 4.3%. Perversely, the company that is least dependent on exports from Japan, Toyota, was up 6 percent today in Tokyo. Can’t beat good financials on top of an improving currency situation. Also not that I said “formerly beaten down stocks.” The stock-in-question all had a good run-up in the past months. If the yen gets weaker, they will go up further. If Detroit gets its wish, you will lose money.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jalop1991 There is no inflation. Everything is cheaper than it was 5 years ago. SHRIMP AND GRITS!

- ChristianWimmer Exterior and interior look pretty flawless for such a high mileage car. To me this is an indication that it was well-maintained and driven responsibly. It’s not my cup of tea but it’s bound to find an enthusiastic owner out there.And with ANY car, always budget for maintenance.

- Fred I'm a fan and watch every race. I've missed a few of the live races, but ESPN repeats them during more reasonable hours.

- Mikesixes It has potential benefits, but it has potential risks, too. It has inevitable costs, both in the price of the car and in future maintenance. Cars with ABS and airbags have cost me at least 2000 bucks in repairs, and have never saved me from any accidents. I'd rather these features were optional, and let the insurance companies figure out whether they do any good or not, and adjust their rates accordingly.

- Daniel Bridger Bidenomics working.

Comments

Join the conversation

Could be worse, I guess. My Dad the WWII veteran told me that GIs rarely referrred to the Japanese as "nips". They customarily referred to the Japanese as "yellow bellies"

My mom would never buy a Japanese car because of "what they did in WWII". Funny though she had no problem buying a Mercedes.