Ford, GM Bail Out Australian Supplier

Ford and GM co-signed a $6.5 million loan in an effort to pull a key Australian parts supplier from the brink, Reuters says.

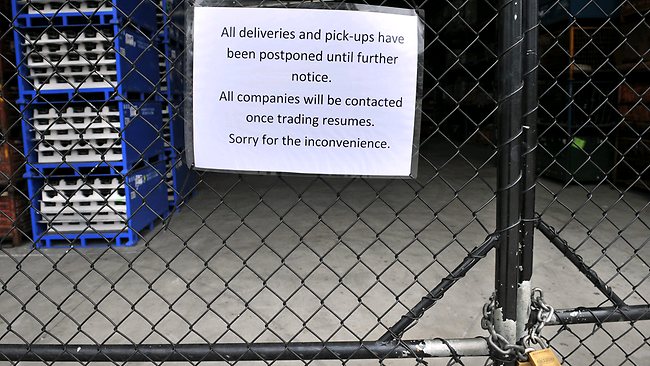

Autodom closed plants in two Australian cities last week and was about to close its complete operations. The company is strategically important to GM’s and Ford’s Australian operations:

- Ford buys hundreds of components from Autodom for its Australia-built Falcon sedan and Territory SUV. Ford only has stock until the middle of the coming week.

- GM Holden said a closure of Autodom could halt production of the Commodore sedan and Cruze compact by next week.

Ford Australia and GM Holden agreed to share the debt liability equally. After receivers were appointed, the company can resume production this week.

GM Holden said last week it was cutting 170 jobs at its Adelaide assembly plant because of falling demand for locally-built vehicles.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

I would be very curious to know the type of and which parts are apparently shared between them. EDIT: according to their site: "In late 2006 aiA acquired the business of Hendersons Components an Adelaide metal pressing and assembly business. In late 2007 it completed the purchase of Dair SA which manufactures cross car beams and hand brake assemblies. Both these businesses have been relocated into the aiA manufacturing plant at Woodville in Adelaide." "DAIR is a wholly owned subsidiary of Autodom following completion of the acquisition of its assets at the end of August 2010. DAIR manufactured items found in most locally made vehicles include rear bumper assemblies, foot brakes, clutch mechanisms, hood hinges, parking brakes and car jacks. "

I had suspected they'd eventually had to do that. Hope they learned their lesson, and making sure if your ONLY supplier seem to be in trouble, better find another one, at least as a backup! I notice in the previous article about this that the company were bought by another. Could it be a leveraged purchase, thus the company's saddled with big debt burden that in the current situation becomes hard to service?

This is interesting. I realize it is business and often the job goes to the lowest bidder in the tier 1 supplier world, but the OEMs really treat their suppliers poorly in many cases and force them out of business. I live in a town that (used to be) thick with tier 1 and 2 suppliers to the automotive industry. Often OEMs will withold payment for tooling or components for month after month forcing the supplier to give them free credit. The thinking used to be, "you don't like it, fine, we'll source elsewhere." Looks like it's finally coming to the point where enough suppliers have been culled where there is no more elsewhere. The OEMs literally bit the hands that fed (their plants).

This was easily the most predictable thing to happen in the global auto business in the last week. Nothing to see here, folks, and there never really was, despite lurid headlines. (Okay, maybe it was the second most predictable, after Tesla posting a quarterly loss.)