Europe In May 2012: Losses Widen

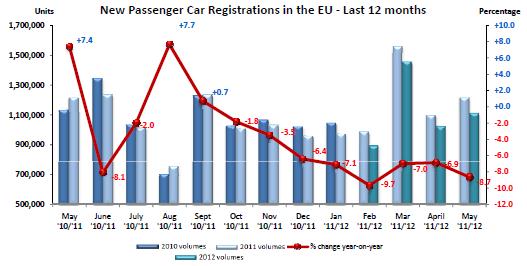

The European car market – if taken together, the world’s second largest behind China and before the U.S. – continues its slow drift to the bottom. Sales in May were down by 8.7 percent in the EU. This is the eighth month in a row that sales are in minus territory. Five months into the year, the market is down 7.7 percent.

18 out of 26 EU countries are down, now including all volume markets except the U.K. Greece leads the list of laggards with sales down 47.3 percent. However, the crisis is no longer a southern affair. Second worst country in terms of sales is Finland.

May %Share UnitsUnits% Chg ’12’11’12’1112/11ALL BRANDS** 1,106,8451,211,665-8.7VW Group24.623.8272,157288,701-5.7VOLKSWAGEN12.912.8142,628154,768-7.8AUDI5.75.163,39561,623+2.9SEAT2.12.223,07227,039-14.7SKODA3.93.742,79545,053-5.0Others (1)0.00.0267218+22.5PSA Group12.013.6132,561164,677-19.5PEUGEOT6.57.372,11488,101-18.1CITROEN5.56.360,44776,576-21.1RENAULT Group8.69.094,814109,105-13.1RENAULT6.67.373,36688,099-16.7DACIA1.91.721,44821,006+2.1GM Group8.98.998,873107,885-8.4OPEL/VAUXHALL7.47.781,48992,887-12.3CHEVROLET1.61.217,37114,954+16.2GM (US)0.00.01344-70.5FORD7.68.084,39396,756-12.8FIAT Group7.37.680,58992,166-12.6FIAT5.45.659,43967,549-12.0LANCIA/CHRYSLER0.90.89,6459,605+0.4ALFA ROMEO0.81.08,77912,490-29.7JEEP0.20.22,3571,897+24.2Others (2)0.00.1369625-41.0BMW Group6.46.270,50474,951-5.9BMW5.14.956,88359,044-3.7MINI1.21.313,62115,907-14.4DAIMLER5.25.157,97761,734-6.1MERCEDES4.64.451,10353,843-5.1SMART0.60.76,8747,891-12.9TOYOTA Group3.93.243,33338,506+12.5TOYOTA 3.73.041,30036,624+12.8LEXUS0.20.22,0331,882+8.0NISSAN2.93.231,97938,429-16.8HYUNDAI3.12.734,44832,583+5.7KIA2.81.930,55623,527+29.9VOLVO CAR CORP.1.71.818,38421,801-15.7SUZUKI1.21.113,19213,861-4.8HONDA1.00.810,7589,546+12.7JAGUAR LAND ROVER Group0.80.69,4026,991+34.5LAND ROVER0.70.47,5125,188+44.8JAGUAR0.20.11,8901,803+4.8MAZDA0.70.87,9839,956-19.8MITSUBISHI0.60.86,4099,574-33.1OTHER**0.80.98,53210,916-21.8Manufacturer-wise, all large European manufacturers are down, led by PSA (-19.5 percent), Renault ( – 13.1 percent), Ford (-12.8 percent) and Fiat (-12.6 percent).

The GM Group is down 8.4 percent. Losses at Opel (-12.3 percent) are offset by a 16.2 percent gain at Chevrolet.

In May, a total of 13 GM cars are listed as imported from the U.S. Following Detroit logic, which postulates that a market must be closed if American cars don’t sell , complaints at the WTO should be imminent.

As predicted yesterday, Volkswagen’s sales are down in Europe. They are down 5.7 percent in May, they are down 2.4 percent January through May. Volkswagen’s data department lists sales as unchanged in May, and up by 1.3 percent January through May. Must be a different Europe.

Data are available here as PDF and here as Excel file.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Analoggrotto EV9 sales are rivalling the Grand Highlander's and this is a super high eATP vehicle with awesome MSRPs. Toyota will need to do more than compete with a brand who has major equity and support from the automotive journalism community. The 3 row game belongs to HMC with the Telluride commanding major marketshare leaps this year even in it's 5th hallowed year of ultra competitive sales.

- Analoggrotto Probably drives better than Cprescott

- Doug brockman I havent tried the Honda but my 2023 RAV4 is great. I had a model 20 years ago which. Was way too little

- Master Baiter The picture is of a hydrogen fuel cell vehicle.

- SCE to AUX SAE Level 2 autonomy requires the driver to be the monitor, nothing more.That's the problem, and Tesla complies with this requirement.

Comments

Join the conversation

The Greek elections (re-elctions) are this weekend.... Depending on what or whom you believe on the different doomsday scenarios, a 7.3% drop in sales will be considered wonderful news in the near future.

Other than JLR the biggest winners seem to be Korean: Hyundai, Kia and Chevrolet.