And Now, Indonesia

When people talk about red hot car markets, the usually mean BRIC: Brazil, Russia, India, China. Nobody ever mentions Indonesia. Indonesia? That island nation has some 235m people, three quarters the population of the U.S.A. But it’s very under-motorized. Last year, Indonesians bought only 486,000 cars, 20 percent less than in the year before. Indonesia’s car production is not much to write home about either. According to OICA, Indonesia produced 464,816 motor vehicles last year. In 2005, they made 500,710. So let’s forget about them, right? Not so fast.

The Indonesian government wants to revive production in their country. According to The Nikkei [sub], “Indonesia is expected to grow quickly in the next several years as the government is preparing a tax incentive and manufacturers are raising output capacity.”

Currently, the government charges a 10 to 30 percent tax, not when the car is sold, already when automakers sell vehicles to dealers. According to new plans, that tax will be greatly reduced for small cars, likely with engines of a liter or less, and costing below 100 million rupiah (11,200 dollars).

As a reaction, Indonesian makers are beefing up capacity.

- PT Astra International, Indonesia’s largest carmaker, plans to raise capacity at its joint-venture factory with Toyota to 150,000 units a year. Astra International also wants to boost annual capacity to 280,000 units at its joint-venture with Toyota’s Daihatsu.

- PT Indomobil Sukses will double the capacity of its joint-venture plant with Nissan to 100,000 vehicles a year. Their joint venture with Toyota’s Hino will build a factory able to turn out 25,000 small trucks annually. Indomobil will also increase the number of models it produces for Volkswagen AG.

And they are not sitting on their hands. The Association of Indonesia Automotive Industries predicts that automobile sales in Indonesia will hit a record 700,000 units in 2010, and that production will total about 620,000 units. As a start.

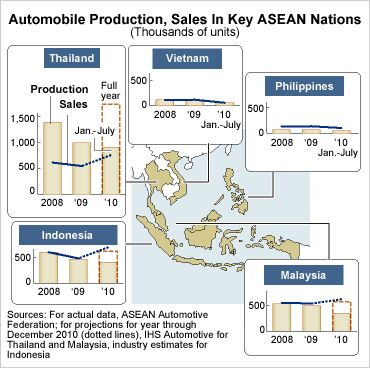

Now check the involved joint venture brands and tell me: Who’s missing out on the bonanza-in-the-making? It’s not just Indonesia. All ASEAN markets are waking up, as the picture illustrates.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Sayahh I do not know how my car will respond to the trolley problem, but I will be held liable whatever it chooses to do or not do. When technology has reached Star Trek's Data's level of intelligence, I will trust it, so long as it has a moral/ethic/empathy chip/subroutine; I would not trust his brother Lore driving/controlling my car. Until then, I will drive it myself until I no longer can, at which time I will call a friend, a cab or a ride-share service.

- Daniel J Cx-5 lol. It's why we have one. I love hybrids but the engine in the RAV4 is just loud and obnoxious when it fires up.

- Oberkanone CX-5 diesel.

- Oberkanone Autonomous cars are afraid of us.

- Theflyersfan I always thought this gen XC90 could be compared to Mercedes' first-gen M-class. Everyone in every suburban family in every moderate-upper-class neighborhood got one and they were both a dumpster fire of quality. It's looking like Volvo finally worked out the quality issues, but that was a bad launch. And now I shall sound like every car site commenter over the last 25 years and say that Volvo all but killed their excellent line of wagons and replaced them with unreliable, overweight wagons on stilts just so some "I'll be famous on TikTok someday" mom won't be seen in a wagon or minivan dropping the rug rats off at school.

Comments

Join the conversation

If you are going to use tired American cliches can you at least modernize it to..."email home about"? Im sure that putting a letter in the mail in Indonesia would take months to deliver anyway.

Apparently missing are Ford, GM and Chrysler-Fiat.