Wild-Ass Rumor Of The Day: Renault-Nissan Considering A Stake In GM?

Flirtation between Nissan and GM has a rich history, dating back to 2006, when the two firms nearly merged, in a move that would have left Nissan-Renault’s Carlos Ghosn in charge of French-Japanese-American juggernaut. GM fought off Ghosn’s advances (and a stockholder rebellion) to stay independent, but with a post-bankruptcy IPO now looming, Ghosn has once again appeared on GM’s horizon. In a bit of in-depth speculation at Dow Jones Investment Banker [via the WSJ [sub]] Jamie Miyazaki and Alessandro Pasetti break down the pros and cons of a Renault-Nissan hookup with GM. Their conclusions: although, Renault is currently playing footsie with Daimler:

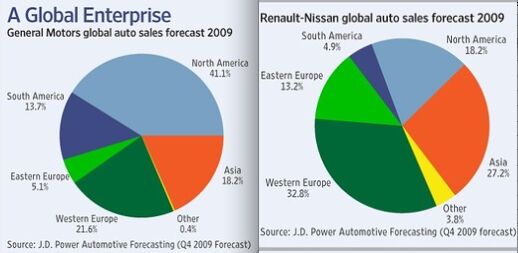

Over the long haul, looking west to General Motors in the U.S. could prove more fruitful for Renault than strengthening partnerships in Europe’s saturated market. Taking an equity stake in a reborn, and eventually relisted, GM would give the Renault-Nissan alliance exposure to the U.S. auto giant’s diverse geographic presence… GM [has] shifted about 37% of its total 2009 sales in Asia, South America and Eastern Europe, according to J.D. Power & Associates data. Throw in GM’s plans to ramp up its Indian operations and its large presence in the Brazilian market, where Renault is investing to roughly double its market share to 10%, and the Detroit giant’s allure is obvious.

Paging Captain Kirk!

Miyazaki and Pasetti figure the Renault-Nissan flirtation with Daimler is a limited deal that

wouldn’t be transformational — rather, it’s a game several European automakers have been playing since 2007 with the upshot that there are not too many eligible partners left.

That certainly adds up: the Renault-Nissan/Daimler deal is about one thing: a subcompact FWD platform to replace Renault’s flopping Twingo and give Mercedes the downmarket reach to meet Europe’s aggressive emissions standards. A long-term hookup would usher in a DCX 2.0 debacle of nightmarish proportions. The two firms are simply too strong in the same markets.

But GM and Renault-Nissan? Let’s put it this way: how often do bailed-out automakers hold IPOs? Besides, their market shares by region show that synergies are possible. On the other hand, this could just be a rumor designed to make the speculators think Ghosn will snap up a large chunk of GM’s IPO, thus inflating the value of GM’s debt and IPO. In fact, until we hear something a little more concrete, we have to assume that IPO speculation is the real motivation behind this “what if” scenario. If we’re wrong, we’ll literally have years to watch this deal unfold, as it would be one of the biggest, most complex mergers in car biz history.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lorenzo I'd actually buy another Ford, if they'd bring back the butternut-squash color. Well, they actually called it sea foam green, but some cars had more green than others, and my 1968 Mercury Montego MX was one of the more-yellow, less-green models. The police always wrote 'yellow' on the ticket.

- ToolGuy Some of my first cars were die-cast from pot-metal in 2 pieces: body-in-white plus chassis. I spray-painted some of them, the masking was a pain. The tires did burn realistically.

- Vulpine Tesla has NOT said they're scrapping the Gigacasting process, but they have also said they wouldn't cast a one-piece body. The concept is to have a total of 5 main pieces: Nose clip, tail clip, 2 sides and belly. They're already using the first two and the sides are not necessarily going to be castings. The belly casting, however, is being delayed as the battery technologies are changing far too quickly to lock into any one fixed design as the battery packs themselves are currently consisting of at least three different types based on the cells being used within them. It's a matter of convenience for the company to let the technologies stabilize somewhat before locking in on a specific design.

- MaintenanceCosts I've never prioritized color when looking for a car, but there are usually some colors (particularly bright reds and refrigerator whites) that I just won't accept.That said, one of my cars gets parked outside in a city environment, and it's silver, and that's good because silver does not complain too much when oxidized to he!l. The brown BMW is neat because there aren't many brown BMWs, and the green Legend is historically correct because the mid-'90s meant green.

- ToolGuy • Black vehicles and dark interiors burn more petrol and are bad for the planet (look it up, I'm not gonna hold your hand on this one lol).• If your current vehicle was new when you took delivery, and you didn't get EXACTLY the color you wanted (blithely accepted what was foisted on you by the dealer), shame on you. You are the problem with today's franchise system. In future, please notify the dealer that your policy is to collect a Non-First-Choice Paint Upcharge in such a circumstance. I recommend $1200.• Also, fine-thread drywall screws (in wood) waste electricity (and time). When I am President of the Universe, fine-thread drywall screws will be banned in favor of the more environmentally- and wallet-friendly coarse-thread variety. (Again, you can work out the reasons but I am absolutely correct.)

Comments

Join the conversation

Edward, you really want to claim that Mercedes and Renault are strong in the same market? Because i don't see it.

I was surprised nobody has commented here on the fact that the WSJ blog referred to "CEO Bob Lutz."