European Car Sales, February 2010: Ouch

European new car sales have fallen back to crisis levels. With many of the incentive programs withdrawn or phasing out, it’s back to reality. Reality is quite rough. Basically, Europe is back where it was in the carmageddon days of early 2009. The few bright spots are caused by on-going life support measures. Without government generosity, the European market place would be a wasteland.

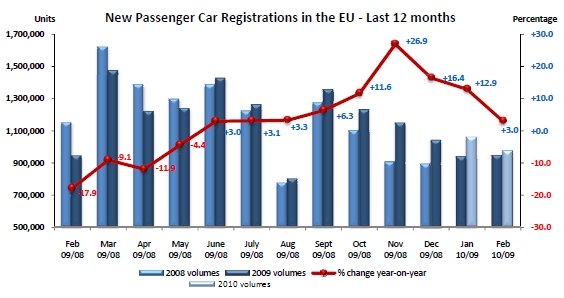

New passenger car registrations in the EU increased by a mere 3 percent in February. Compared to the pre-crisis levels of February 2008, new car registrations decreased by 16 percent, reports the European Automobile Manufacturers Association ACEA.

The biggest hit came from Germany. Germany dropped by 29.8 percent, and, insult adding to injury, had to hand the title “Europe’s largest car market” to Italy. Italy saw sales of 200,560 units in February, in Germany only 194,846 changed hands. France is #3 with 180,535 units sold.

Countries under the continued influence of government fleet renewal incentives still see their sales grow: France recorded 18.2 percent more registrations in February, Italy +20.6 percent, the UK +26.4 percent and Spain +47.0 percent. Imagine what happens when those programs run out. France will leave their program in place in 2010 and 2011. Italy isn’t so sure how long they will keep theirs in place. Britain’s “bangers for cash” program is due to end this March if its £400m budget does not run out sooner.

Countries without artificial respiration, such as Romania, Hungary and Poland saw registrations decrease by 63.0 percent, 57.9 percent and 19.2 percent.

In the all important market share dept., Volkswagen runs the roost with 20.8 percent of the European market, slightly down from 21.8 percent in February ’09. PSA added nearly 2 percent of market share, up to 14.9 percent, and is most likely under the close watch of the boys in Wolfsburg. Renault added 2.3 percent of market share, Toyota lost 1.3 percent of share in February and is down to 4.4 percent. Other Japanese brands appear to be collateral damage: Suzuki 1.4 percent share, down from 2 percent. Mazda 1.2 percent share, down from 1.7 percent. Honda 1.2 percent share, down from 1.8 percent. Only Nissan is up to 2.8 percent share from 2.2 percent in February 2009.

Hard data can be downloaded as PDF here, and as Excel spreadsheet here.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Peter I want a self driving red ragtop 1958 Plymouth Fury. Just like the car in the movie Christine.

- Mgh57 Doesn't seem like this tech is ready for prime time.

- Nathan The Ram is the most boring looking of the full size trucks, kind of like a Tundra.If they cancel the Ram Classic, I hope a full resign makes the Ram at least look interesting.

- DJB1 I'll be all for it when it has a proven safety record. I have an awesome life and a lot to live for, so right now I'm not putting that in the hands of overconfident tech-bros.

- Mgh57 I had to read the article because I had had no idea what the headline meant. I've never seen this in the Northeast. Don't understand the point. Doesn't seen efficient aerodynamically

Comments

Join the conversation

This is so confusing. I see a Market Watch report this morning saying European markets are up today. One of the headline reasons is an increase in new car registrations across Europe. Who's selling the cars? BD