Editorial: GM China: "We Can't Be Listed in the Filing." Yes, You Can

Government Motors is launching a barrage of press releases in an attempt to shock and awe all naysayers. All is fine with its Asian operations, they are insulated from the bankruptcy of the mother ship, it’s great business as usual. As far as China (GM’s second largest market behind the United States) is concerned, business never has been better! It seems everybody is counting on the Chinese consumer to bail out the US government’s bailout.

GM China’s Prez, Kevin Wale, opened the salvo in China Daily: “General Motors Corp.’s fast-growing China operation will be unaffected by the parent company’s bankruptcy. Plans to open a new factory within five years will not change, even as GM closes US facilities.” Gettelfinger will be thrilled.

And, yes, “GM China is sticking with a five-year plan to double annual sales to 2 million units and roll out 30 new or updated models.”

More good news: Yesterday, GM China released their May sales—way before anybody else in China. Sales rose 50 percent over May 2008, Gasgoo reports. The Buick New Excelle, based on the Opel Astra Delta II platform, is selling especially well. So is the Buick New Regal, based on the Opel Insignia. And the Chevy Cruze, also a Delta II descendant.

Wale isn’t worried by the fact that many of his moving models are based on Opel technology: “The technology for the vehicles we sell is held by General Motors, and I don’t see any implications from the new structure in Europe.” Magna and its Russian partners may have a different opinion.

The Dept. of The Treasury even denied that there might be a secret deal to keep Opel and Magna out of the U.S.A. and China. “Newspaper accounts that Treasury is insisting that Opel stay out of the U.S. or Chinese markets are incorrect. The U.S. government strongly supports free markets,” Treasury spokeswoman Jenni Engebretsen said. Treasury keeps a backdoor open: If Magna and GM cut their own deals, then that’s their own business, an unnamed Obama administration official said to Reuters. I zee nozzink, especially not the Sherman act.

GM China sent a statement to Gasgoo, claiming that “the court supervised reinvention of GM in the United States will have no substantial impact on Shanghai GM, and Shanghai GM will continue its normal business operations as usual.” The statement insists that the intellectual property rights of products produced by Shanghai GM will be included in the New GM, and that GM’s joint ventures in China are not included in the court filings. Kudos for the euphemism of the day: Court supervised reinvention. Sure beats extraordinary rendition (a.k.a. “impromptu concert”.)

Readers of Bloomberg are told that GM “did not include its international operations in a filing for bankruptcy protection.”

Readers of the Wall Street Journal receive the same good news: “It is absolutely business as usual in China,” the WSJ cites Kevin Wale. “None of General Motor’s operations outside of the U.S. are included in the Chapter 11 filing, including GM China, our joint ventures and our other China operations.”

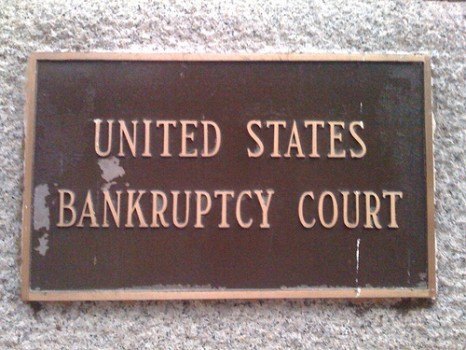

TTAC’s B&B know better. A court document filed Monday with the United States Bankruptcy Court Southern District of New York, made available through TTAC’s resident court reporter, Justin Berkowitz, names the following Chinese companies as part of the General Motors bankruptcy: Pan Asia Technical Automotive Center Company, SAIC GM Wuling Automobile Ltd., Shanghai General Motors Corporation, Shanghai GM, Shanghai GM (Shenyeng) Norsom Motors Co. Ltd., Shanghai GM Dongyue Motors Co. Ltd., and Shanghai GM Dongyue Powertrain. That’s only a partial list of GM’s international operations named in the filing.

The list presented to the court was obviously done with care, and wasn’t just a cut & pastie from the latest Sarbanes-Oxley filing. GM Europe, handed over into the care of a trustee appointed by the German government, isn’t there. Also missing is GM’s Australian unit, GM Holden Ltd. Holden “expects to be part of the new GM and will not cut jobs,” Holden’s managing director Mark Reuss said to Bloomberg. Whether the listed companies will finally end up in a “Good GM” or “Bad GM” doesn’t change the fact that they are all included in the filing.

The list of GM’s 50 largest unsecured creditors, also filed on Monday, reads like a Who’s Who of the parts business. Delphi is owed $111 million. Bosch is owed $66 million. Lear Corp. is owed $44 million. Renco Group is owed $37 million. Johnson Controls is owed $32 million. Denso is owed $29 million. TRW is owed $27 million. Magna is owed $26 million. American Axle is owed $26 million. Continental AG is owed $15 million. Tenneco is owed $15 million. Yazaki is owed $14 million. International Components Corp. is owed $12 million. Visteon is owed $10 million. And the list goes on. No wonder that companies on that list have already declared bankruptcy themselves, or are listed as bankruptcy risks. Thousands of smaller suppliers are affected. According to CNN Money, “a vast network of companies outside Detroit are bracing for impact. Suppliers to the auto goliaths are going to feel the aftershocks of the industry’s titanic shift.”

Business as usual? Viewed through the eyes of GM, it probably is business as usual.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- CKNSLS Sierra SLT Since they are the darling of the rental fleets I have probably spent about 5,000 miles in two different Malibus. I was ready to be discouraged. But for what they are-they are a competent riding vehicle and they get close to 40mpg cursing at a reasonable speed. A little too much plastic in the interior-making it look "cheap". But if I was looking for a competent sedan I would consider an off rental one at a decent price. A new one would suffer massive depreciation-probably.

- Arthur Dailey Kinda wish that I had bought one back in 2011. Yes I know that some here prefer the first generation to the second. But the first was not available new in Canada.I didn't appreciate the centre mounted instrument panel.However one of my children had one as a week long rental and much preferred it to the Prius that she had previously.

- MaintenanceCosts 308/311 is just the rating of the gas engine by itself. The full powertrain power rating, taking into account both power sources is 483/479. The car will do 0-60 in under five seconds. Frankly, I find the idea of that being "underpowered" bizarre.Also, "understated" has never been less fashionable within my lifetime. We are in a moment where everyone wants to make a Bold Statement with everything they do.

- 28-Cars-Later @PoskySo here's some interesting data, Manheim's Used Car index is still 28% higher than shortly before the Plandemic (155 on chart) after declining from a height of 39% (roughly 215) in January 2022, yet interest rates are now more than double on average. Maybe the White House should focus on some deflationomics instead of mucking up everything?

- Dale Had one. The only car I ever bought because of a review in a guitar magazine.Sure was roomy inside for such a small car. Super practical. Not much fun to drive even with a manual.Sent it to college with my stepson where it got sideswiped. Later he traded it in on an F-150.

Comments

Join the conversation

To clarify this, Berkowitz needs to get the laws "Pursuant to Rule 1007(a)(1) of the Federal Rules of Bankruptcy Procedure and Rule 1007-3 of the Local Rules for the United States Bankruptcy Court for the Southern District of New York" and explain wtf they mean. I quickly got http://www.law.cornell.edu/rules/frbp/rules.htm but too lazy to pursue further.

MichaelJ: You should be working for GM's PR dept. I wasn't and am not talking about GM (China) Investment Corp. Here in China, "GM China" refers to GM's web of Chinese business interests. As in "GM operates seven joint ventures and two wholly owned foreign enterprises and has more than 20,000 employees in China." The two WFOEs are said investment corp and a warehouse. All others are JVs. And the JVs are listed in the court document. The Investment Corp and the warehouse ain't. It's not possible to run a car manufacturer as a Wholly Foreign Owned Enterprise in China. A car manufacturer is viewed as a venture with strategic importance, and foreign ownership is limited to a JV. This is currently being discussed and may be relaxed. Currently bu yao, no good.