5 Views

Chrysler Bankruptcy Analysis III: Will The "Absolute Priority Rule" Kill The Sale?

by

Steve Jakubowski

(IC: employee)

Published: May 5th, 2009

Share

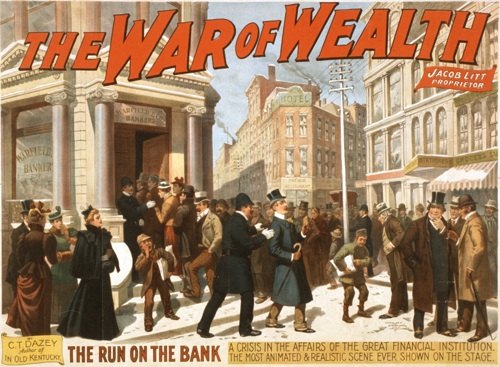

Well, the initial pleadings have been filed. Chrysler’s argument is essentially that it’s a “dead man walking.” In its opening memorandum of law in support of its motion to approve the sale, Chrysler argues that if the “sale” doesn’t close on the accelerated timetable proposed, it will wither on the vine, resulting in “a rapid and severe loss of value.” (Mem. at 10). Surprisingly, though, Chrysler’s opening memorandum doesn’t squarely address the issue laid bare in my previous post and in the preliminary objection of the dissident lenders; that is, why isn’t the proposed transaction a sub rosa plan of the kind prohibited under the law of the Second Circuit?In dancing around this question, Chrysler’s lawyers submit a two-pronged response, arguing that the transaction should be approved because, first, Old Chyrsler is receiving “fair consideration” in the transaction and, second, Chrysler’s going concern value will be preserved, jobs will be retained, and an extensive network of independent dealers and suppliers will live to see another day.Chrysler’s opening memorandum of law, however, does not address the important question of why, absent the consent of the dissident lenders, 65% of the equity in New Chrysler should go to junior creditors in satisfaction of their respective claims against Old Chrysler while the claims of senior dissenting lenders go unpaid?One thing’s for sure, Chrysler’s (and soon GM’s) court battles will afford us a rare opportunity to witness one of bankruptcy law’s most fundamental questions being litigated in the highest stakes battles of all time: when does the “absolute priority rule” which establishes a hierarchy of recovery rights among creditor classes, take a back seat to the “fresh start,” rehabilitative policy of chapter 11?Chrysler’s opening memorandum touched upon this question by focusing on the US Supreme Court’s pronouncement in NLRB v. Bildisco & Bildisco, 465 U.S. 513, 528 (1984). The Court stated that the “fundamental purpose of reorganization is to prevent the debtor from going into liquidation, with an attendant loss of jobs and possible misuse of economic resources.” This principle, Chrysler argues, is paramount and (quoting NY’s judicial patriarch, Bankruptcy Judge Lifland, in the old Eastern Airlines case) “all other bankruptcy policies are subordinated” to it.Many, however, will surely disagree with Judge Lifland’s statement from twenty years ago that all bankruptcy policies should be subordinated to the reorganization objectives of the Bankruptcy Code. Indeed, even on a practical level, as “ Chapter 11’s Failure in the Case of Eastern Airlines” note, such a policy is a failure:Eastern Airlines’ bankruptcy illustrates the devastating effect of court-sponsored asset stripping—using creditors’ collateral to invest in negative net present value “lottery ticket” investments—on firm value. During bankruptcy, Eastern’s value dropped over 50%. We show that a substantial portion of this value decline occurred because an over-protective court insulated Eastern from market forces and allowed value-destroying operations to continue long after it was clear Eastern should be shut down.And what of Northern Pacific Railway Co. v. Boyd?Following the Panic of 1893, shareholders and bondholders combined in a proposed reorganization plan to transfer the debtor’s assets to a new company that they would own, while freezing out the railroad’s general unsecured creditors, whose priority fell between the bondholder and shareholder classes ( sound familiar?).The unsecured creditors argued that the foreclosure sale contemplated by the plan “was the result of a conspiracy between the bondholders and shareholders to exclude general creditors” from the new company.The trial court overruled the unsecured creditors’ objection. They held that as the debtor was insolvent and there was no value for unsecured creditors (or in this case, the dissident lenders). So the unsecured are entitled to nothing.Nowadays, collusive efforts to squeeze out the dissenting middle are often called “reverse cramdowns.” As noted previously, the Third Circuit held that plans proposing “reverse cramdowns” may violate the so-called “ absolute priority rule.”More significantly, the Second Circuit in Motorola, Inc. v. Official Comm. of Unsecured Creditors, addressed attempts to squeeze out the middle in the context of a settlement that the debtor sought to have approved under Bankruptcy Rule 9019.That case provided critical guidance in gauging the authority of Judge Gonzalez to approve the proposed “sale” transaction, in contravention of the requirements of the absolute priority rule. The court stated:Motorola claims that a settlement can never be fair and equitable if junior creditors’ claims are satisfied before those of more senior creditors. The phrase “fair and equitable” derives from Section 1129(b)(2)(B)(ii) of the Bankruptcy Code, which describes the conditions under which a plan of reorganization may be approved notwithstanding the objections of an impaired class of creditors, a situation known as a “cramdown.”Bottom line: the court must be certain that parties to a settlement have not employed a settlement as a means to avoid the priority strictures of the Bankruptcy Code.Glaringly absent in Chrysler’s motion in support of the sale: reference to Bankruptcy Rule 9019. This could be fatal.While Section 363(f) permits sales free and clear of liens, nothing in Section 363 contemplates the kind of restructuring of rights preposed. Given the seemingly narrow instances in which the Second Circult would authorize a compromise that violates the absolute priority rule, the omission may be intentional.It’s surprising that the dissident lenders didn’t raise this point in their preliminary objection to the sale, but I suspect it won’t be long before they do.[Steve Jakubowski works for the Coleman Law Firm]

Steve Jakubowski

More by Steve Jakubowski

Published May 5th, 2009 11:23 AM

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Redapple2 The VW saga is well remembered. Ug. RE your Lexus, with such a long refuel interval I d burn only E 0. Some of your E 10 in the tank may be from 6 mo ago.

- 28-Cars-Later The CD player is glorious. Edit: Also really nice job on the initial shot. I'm not sure if you had any training in photography but it looks professional.

- Carson D I was thinking that this is such a nice car, and it is a bit of a shame that you use it so little. Then I remembered that I still have a car that I purchased new in 2007 which now has 78,000 miles and is sitting in a parking space I moved it to so my parents could park in its space when they visited about a month ago. That your 2019 Golf Sportwagen had headliner and water intrusion issues is a stark reminder that people who still buy VWs are like those people who still vote for bail reform politicians after they've been assaulted by someone who'd already been arrested for violent acts half a dozen times in two months. I knew two people who bought new Jetta Sportwagens who suffered spooling mesh headliners that became jammed, unfurled and frayed combined with leaking two-plane sunroofs...in 2009! They were also involved in a class action lawsuit about 'mandatory optional' equipment that they paid for that the cars weren't actually equipped with. I think it was Bluetooth links.

- Bd2 Engine problems have been fully remedied, please have no further concerns. All customers are satisfied, check Google and Reddit for further information. Salutations and please have a nice day.

- Wjtinfwb Keep it. A good car you're not tired of is like a great dog. Irreplaceable. After 45 years of car ownership, there's just a few I wish I never sold and realized my total proceeds from selling those few cars was less than 75k dollars. Not a lot of Lexus that you'd say are irreplaceable, but a solid GS is one of them.

Comments

Join the conversation

This is why I sold my Ford bonds. I was afraid I would get crammed down to nothing in a government bailout. I and walked away with my principal and even a substantial profit with self respect intact, which is more than i can say for the Chrysler bondholder