GM To Bow Out Of The Dow?

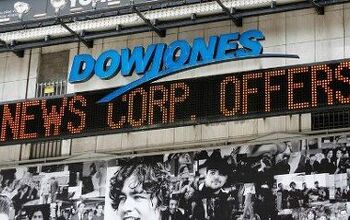

CNN Money Editor-at-Large Paul R Monica reckons GM is so Dow, I mean down, on its luck that it should be delisted from the Dow Jones Industrial Average. By Monica’s math, GM has a market cap of less than $2 billion, and its stock price has been treading water near $3. “Normally, when a blue-chip company sinks to such depths of despair,” writes Monica, “it gets tossed from the S&P 500. But not only is GM still a member of that index, it remains a component of the granddaddy of market barometers: the venerable Dow Jones Industrial average.” He reveals that Dow executive director John Prestbo is keeping a close eye on the General and any sign of a bankruptcy in the offing. “A company operating under bankruptcy protection is not on a level playing field,” says Prestbo. “What we try to do is make sure every company in the Dow is operating under the same kind of marketplace.”

And though he acknowledges that the Dow doesn’t and shouldn’t take major changes to its listing lightly, Monica argues convincingly that the time has already come to “stop the madness.” The criteria for listing on the DJIA are as follows: “There are no pre-determined criteria except that components should be established U.S. companies that are leaders in their industries. For the sake of continuity, composition changes are rare, and generally occur only after corporate acquisitions or other dramatic shifts in a component’s core business.” Clearly this has taken place, but the real issue seems to be that there are no American automakers ready to take GM’s place on the index. Though Monica recommends listing Toyota in GM’s place, the Dow won’t consider listing a foreign company. “We would justify no autos on the basis that the market currently does not offer a viable U.S. auto investment option,” says Prestbo. “The Dow’s main job is to reflect the U.S. markets and the U.S. economy.”

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC Well, I'd be impressed if this was in a ZR2. LOL

- Lou_BC This is my shocked face 😲 Hope formatting doesn't fook this up LOL

- Lou_BC Junior? Would that be a Beta Romeo?

- Lou_BC Gotta fix that formatting problem. What a pile of bullsh!t. Are longer posts costing TTAC money? FOOK

- Lou_BC 1.Honda: 6,334,825 vehicles potentially affected2.Ford: 6,152,6143.Kia America: 3,110,4474.Chrysler: 2,732,3985.General Motors: 2,021,0336.Nissan North America: 1,804,4437.Mercedes-Benz USA: 478,1738.Volkswagen Group of America: 453,7639.BMW of North America: 340,24910.Daimler Trucks North America: 261,959

Comments

Join the conversation

AFAIK index funds follow the S&P and not the DOW. Buying 10% of Toyota wouldn't lead in itself to a higher Yen. The market cap of Toyota is to small for that.

I think placing Toyota in the Dow isn't as radical as it sounds. The companies American Depository Receipts (ADRs) trade on the NYSE, and of course the company has scads of employees here, designs and sells certain models exclusively in the U.S., etc. I thought having Microsoft join the Dow was somewhat radical in that Microsoft is not a NYSE listed stock as it has elected to remain at home on the tech-laden NASDAQ. At least TM is on the NYSE.