End of Days: GM Vs. GMAC Vs. Toyota

Let’s review. GMAC was GM’s “captive lender,” a wholly-owned subsidiary of the artist once known as the world’s largest automaker. You want a loan or a lease at a GM store? GMAC did the deal. It was a cash cow– until it started writing a lot of sub-prime/bad paper in both its automotive division (to keep GM’s cash flowing) and its ResCap mortgage unit (just ’cause it could). When GM CEO Rick Wagoner was looking for a way to keep his job (i.e. dress-up GM’s books with asset sales), he sold 51 percent of GMAC to Cerberus, a private equity group. [NB: Wagoner claimed that he did so to help GMAC’s credit rating. Yeah, that turned-out well.] Cerberus had recently purchased Chrysler, and Chrysler Financial Services. TTAC (and others) reckoned Cerberus would jettison Chrysler’s car-making ops (one way or another), combine GMAC with Chrysler financial and proceed with the business they know and love: finance. When the shit hit the fan for Chrysler– about ten minutes after Cerberus bought the company– Cerberus tried to swap Chrysler for GM’s remaining share of GMAC. Uncharacteristically, GM said no to a stupid idea. When the things got REALLY bad, Cerberus tried to sell ITS share of GMAC BACK to GM. Again, GM passed. And then things got worse…

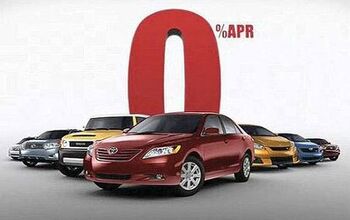

When GMAC took a bath on leasing, it raised its rates and, effectively, got out of the business. This didn’t help GM. Now that “normal” auto loans are also a drug on the market, Chrysler-controlled GMAC has decided to shore-up the sinking ship by tightening-up its credit requirements. Which won’t help GM. As in all the dealers are, out of necessity, switching out of GMAC to survive. BUT the damage has been done. While Toyota’s hyping zero percent finance deals, GM has developed a rep for not being able to offer people car loans. So…

GM has decided to promote the fact that GM customers can still get attractive finance rates… with someone other than GMAC. Automotive News [sub] reports the GM yes-you-can-still-get-a-deal’s going down. “General Motors, in the wake of lending restrictions by its partially owned finance unit, will begin an advertising campaign reminding consumers that they can still finance vehicles through GM dealerships. GM’s national dealer council learned about the plans during a 30-minutes conference call with GM officials today….

“The upcoming campaign puts GM in the position of steering dealer customers to financing channels other than its 49-percent owned GMAC affiliate.” Talk about splitting the difference between a rock and a hard place. If GMAC can’t get a hold of federal bailout bucks to save its skin, and goes belly-up, even GM’s 40 percent ownership is enough to take The General down with them. Correct me if I’m wrong.

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Daniel J Cx-5 lol. It's why we have one. I love hybrids but the engine in the RAV4 is just loud and obnoxious when it fires up.

- Oberkanone CX-5 diesel.

- Oberkanone Autonomous cars are afraid of us.

- Theflyersfan I always thought this gen XC90 could be compared to Mercedes' first-gen M-class. Everyone in every suburban family in every moderate-upper-class neighborhood got one and they were both a dumpster fire of quality. It's looking like Volvo finally worked out the quality issues, but that was a bad launch. And now I shall sound like every car site commenter over the last 25 years and say that Volvo all but killed their excellent line of wagons and replaced them with unreliable, overweight wagons on stilts just so some "I'll be famous on TikTok someday" mom won't be seen in a wagon or minivan dropping the rug rats off at school.

- Theflyersfan For the stop-and-go slog when sitting on something like The 405 or The Capital Beltway, sure. It's slow and there's time to react if something goes wrong. 85 mph in Texas with lane restriping and construction coming up? Not a chance. Radar cruise control is already glitchy enough with uneven distances, lane keeping assist is so hyperactive that it's turned off, and auto-braking's sole purpose is to launch loose objects in the car forward. Put them together and what could go wrong???

Comments

Join the conversation

I've never bothered with financing a car before, but I was always under the assumption that it was smarter to get a loan through a bank or credit union anyway.

truthbetold37: My wife’s GM lease ran out and I had to replace her vehicle. Couldn’t lease through GMAC. Third party leases cost almost as much as buying. Ended up financing at our credit union at 4.5%APR. Was it a GM car? If it was then, at least in your case, this works for GM. If not, then not so much...