GMAC's NA "Plan B" Getting Clearer

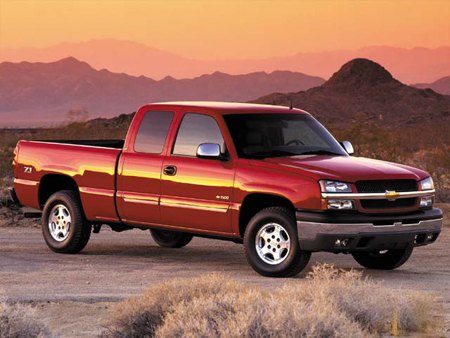

You may be wondering why the mainstream automotive press hasn't carried our story about GMAC's exit from the GM leasing biz. I've re-checked with my sources. Although there's a lot of confusion out there– at the corporate and dealer level– we stand by our story. In Canada, GMAC leases are dead. In the U.S., GM and GMAC will avoid a media shitstorm by "refocusing" its dealer finance products away from leasing. In that regard, GM will do whatever it takes to keep monthly payments roughly even on a finance versus a lease contract. They will promote longer term finance contracts with subvented rates on most lines, and combine that with "finance cash." Or they will offer customers cashbacks for use in cash deals or financing/leasing by third party sources such as a bank or finance company. (For example, a GM half-ton truck will receive zero percent financing for up to 72 months plus finance cash of $3K or a cashback incentive of $5,000.) We hear that GM will support leasing until Thursday night; the full changeover of finance/cash incentives will not hit until first thing Friday morning. (Just in time to get lost over the weekend, as usual.) Dealers speculate there will be a lot of fiddling with the incentive programs over the next few months to see what has the most customer appeal. But incentives there will be, and LOTS of them. [hat tip to you-know-who-you-are]

More by Robert Farago

Comments

Join the conversation

monkeyboy: At the risk of a flame war, my statement that Cerberus "OWNS" The General is based on the fact that GMAC finances a huge portion of GM's production through customer financing/leasing, and through dealer floor plans. Cerberus can effectively shut down GM by turning off leasing and tightening credit standards at GMAC. While a lot of the business will go to third party indirect financing, it would put a big hurt on GM's sales and any profits at GMAC, which GM needs. For example, 0% financing through GMAC is dependent on Cerberus' approval of such plans. If they balk, GM is in a bind. GM may have told Cerberus to go pound sand when Cerberus asked for a cash infusion at GMAC, but the fact is that GM needs GMAC more than Cerberus needs GM. I'm mostly trying to draw attention to the fact that Cerberus' contol over financing at two of the Big 2.5 gives them enormous power over both GM and their wholly-owned Chrysler LLC. Cerberus can use thier power to drive business to Chrysler. I used the Silverado/Ram example, but it could be any vehicle. My point is that Cerberus can use this leverage to their advantage at Chrysler, and there's nothing GM can do about it.

When you can buy a worktruck for $15k, you buy, not lease.

Watch Caddy's sales (well, "units shipped") figures in particular plument. People lease Caddys. The rest, I dunno. But this just gives the customer another reason not to shop for a GM (or Chrysler) product.

Dear Robert Why would GMAC make a distinction between Canada and U.S. markets? Answer: they wouldn't. Still, we're waiting for this shoe to drop… Why, because there is a disparity in the MSRP between most Cdn and US models. This disparity turns in to air once the vehicle enters the used market. Also the Cdn Asset backed paper market is in shambles, there is no place to borrow money for Cdn leases. The U.S. asset backed paper market is still functioning because of the Fed's injection of huge amounts of liquidity to keep the U.S. markets functioning. But, ALL of the car companies are going to get out of leasing everything but luxury vehicles and those leases will be usurious. Why, cause leasing toasters is not profitable. It did not take a genius to predict these moves. The big win in leasing for the leasor is the depreciation that they can claim on their taxes that the regular schmoe can't on their canadian taxes. You folks in the U.S. had the ability to bury it in your mortages till you scr###d that whole industry up. But now that the Cdn dollar has effectively screwed up the MSRP difference to the U.S (and the residual on every car leased in the last 4 years) the lease portfolio's are under water, the financing is unavailable so the only choice for the Cdn arm is to bail. The same thing may happen in the U.S. but it will be for different reasons, specifically the hit on pickups and SUV's. Related but not the same. See this is a very complicated business and simple observations and broad statements may sound good, but when you dig into the facts the picture some times changes. Bottomline: All the car companies will run from leasing because if they don't they will get all that business and then 3 to 4 years from now there is a tidal wave of used cars that sink their residuals, and their bottom lines over night.