House Of Saud Offers Crude Boost

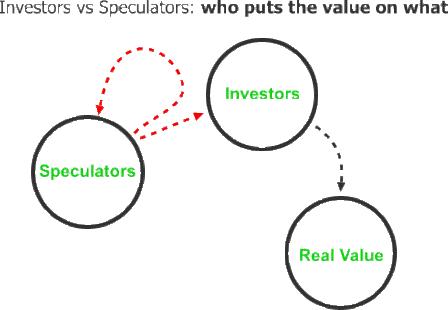

USA TODAY reports Saudi Arabia offered to boost crude oil production by over 9.7m barrels per day (bpd) in July. That's if– and only if– the market requires it. Anyway, say the Saudis, under-supply isn't the problem. "I am convinced that supply and demand balances and crude oil production levels are not the primary drivers of the current market situation," Saudi Oil Minister Ali al-Naimi announced at the global energy summit in Jiddah. King Abdullah joins both John McCain and Barack OBama in blaming "speculators who play the market out of selfish interests." The Saudis remind us that they have already boosted production twice this year (by 300k bpd in May, and 200k bpd in June), and neither increase has had much effect on climbing prices. American and British diplomats expressed disappointment with the Saudi position, having hoped for a promise of specific production increases. Echoing US sentiments, British PM Gordon Brown said that with a clear production increase "instead of uncertainty and unpredictability, there is greater certainty, and instead of instability, there is greater stability." But the Saudis aren't alone in looking away from production levels for the cause of high oil prices. The joint statement issued by the Jiddah summit is deliberately vague, reflecting deep divisions over the causes of the oil price shock– and the cure.

More by Edward Niedermeyer

Comments

Join the conversation

James Hamilton has weighed in on the issue and concluded that speculation can't really be responsible for most of the price rise. Also, from a commenter there:

I was finally convinced that "speculation" was a bogus hobgoblin by this argument: Refiners are willing to pay $135 for a barrel of oil. They do this because they believe that they will be able to sell the refined products for a profit. If they were wrong, the gasoline market would be glutted, and gas prices would have to fall until the market cleared. Refiners (or someone downstream, gas wholesaler/retailer) would be taking huge losses on every barrel. They aren't."PCH, We agree again, so we must be right, or some astronomical bodies are aligned or something. M1EK, Your commenter is off. US refining margins have been so slim for months that they are really negative. The reason they can do this is because almost all refiners are also oil producers, or they also refine in other markets, or they have contracts for oil at below market rates they are still using, or they know they will make it up when the price of oil goes down, so they are playing along rather than selling out their facilities. I know that doesn't jive with the perception of "Big Oil", but that's what is going on. If they tried to maintain their historic average margins right now, demand would drop to the point they would be shutting down refineries (or at least that is their fear).

Landcrusher, that's a pretty flimsy argument - relying on essentially a conspiracy theory among actors who have no incentive to play well together.

It's no conspiracy at all. It's a market acting just like markets do. Gas prices may be inelastic over the whole, but they are REALLY elastic right now for each player. I would say that a few years ago, most people were rarely motivated by a couple pennies a gallon to switch stations. Right now, if your price is a penny over the one across the street, you may not be getting any customers in to by coffee, soda, and cigarettes (where the REAL money is). You either keep your prices low, or you will be losing market share faster than you can sell off assets. Like I said, sell low, or shut down. (Note: if the government owned the refineries, the price would be higher because they would presumably have a set margin). It's the opposite case that requires a smoke filled room of oil men all agreeing to to raise prices that is the standard "Big Oil" conspiracy theory. Which brings us back to domestic production. The price of oil is set by OPEC and others like them because the free peoples of our planet presently control very little of the production. Dictators and Autocrats control the price of OIL (because they control the supply), the market still controls the margins for gasoline refining. Big oil does a helluva job playing in this mess.