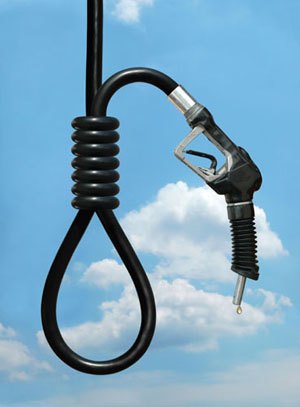

Department of Energy: Gas Prices Will Peak in June

The Department of Energy's predicts that soaring U.S. gas prices will reach their zenith in June. After adjusting for increased ethanol use [gag], the DOE expects oil prices to decline to $110 a barrel this year, with a resulting drop in pump prices. That's $9 more than the agency's previous prediction– and down $11.84 from yesterday's price. As The New York Times points out, this supposed peak will occur just before the summer driving season begins. The aluminum foil hat-wearers amongst you might wonder how the price of anything can peak immediately prior to a large increase in demand (not to mention soaring foreign use), and play connect-the-dots with the American tourist industry/carmakers/presidential election, but I couldn't possibly comment. In any case, the Lehman Brothers reckon this is gonna hurt. “In the past, high prices could be offset by borrowing or making more money,” said analyst Adam Robinson. “It’s really when you have the triple bite — a weaker economy, less access to credit, and higher prices — that you see the consumer recoil.” Recoil? Maybe. Drive less? For sure. See lower gas prices? Not likely. The Old Gray Lady leaves us with "analysts’ forecasts for the price of gasoline over the next few years run as high as $7 a gallon."

More by Robert Farago

Comments

Join the conversation

-

You are able to find 50 fools among the world’s analysts and economists, and some liars among the producers. This is NEWS to you? Man, we gotta talk. I have a garage full of stuff you need to buy… Well said, but I think markets and economists over the long term will prove to be correct. There IS a ton of uncertainty out there... You've got (potentially) very high demand from India/China... Poor to crackhead-insane degrees of transparency in reserve/production numbers from the Saudis to the Venezuelans. The fed's preference to Earnhardt the dollar in order to prop up sheeple who couldn't understand the phrase 'variable-rate'. Potential large political gains in the US for the more protectionist and economically illiterate party. Weather. We're due for a production disrupting storm in the gulf again - and while I don't wear a global warming foil hat - a bad 'cane this year could make gas hit $6/gallon.

Ihatetrees

on May 07, 2008

Ihatetrees

on May 07, 2008

-

-

Johnster

on May 07, 2008

Johnster

on May 07, 2008

AKM : In any case, I’m amazed by how my commute traffic has changed lately (I live in northern NJ): within one year, it has gone from 50-55% trucks/45-50% cars to 60-65% cars/35-40% trucks. Never saw a change happen that fast. It’s an area where people buy new vehicles pretty often, so I guess a full 20% of the cars have their lease/loan expire every year. Agreed. It's the same thing in the Denver area. And I'm amazed at all of the rusty old beat-up Geo Metros that have suddenly reappeared on the streets again.

-

-

Jacob

on May 08, 2008

Jacob

on May 08, 2008

The oil market can't be regulated by our government. The oil prices are determined globally, not in the united state. Some economists also doubt that the high oil price is supposedly a result of speculation. The theory goes that if the high prices are a result of speculation, then there should be plenty oil in the inventories, but most oil producers and traders have all time low inventories. Of course, the OPEC could maintain its inventory of oil in the ground, but then that's not the issue of oil speculation. That's the issue of a good old cartel tactics that OPEC had been using for price gouging for a long time now. And in the end, if the consumers are buying up all the oil available, then the current price is _indeed_ a result of demand and supply interaction. Why should producers and traders be willing to charge less if people still buy gas at the current prices. My personal view is that no additional regulation is necessary. Though, the United States could increase the refining capacity, and make sure that all states have the same fuel standards and formulas, thus making the refinery business more competitive. However, that would still shave off only a few cents off the prices. At least 70% of the price people pay for gas at the pump is the price of oil used to make that gas.

-

-

Stein X Leikanger

on May 08, 2008

Stein X Leikanger

on May 08, 2008

The world should have cracked 90 million barrels per day to keep pace with growth prognostications. It's getting more and more likely that we'll never crack that ceiling. The producers aren't able to deliver. By 2020, depending upon which econ-forecaster you trust, we should be producing at least 120 million per day ... to use the much abused autoextremist phrase: aintgonnahappen. And this is driving oil prices. We're inside the largest shift in energy allocation ever experienced, due to the sheer complexity of modern civilization. We have, literally, hundreds of millions of units that need to run every day for things to work, worldwide, and that are dependent upon cheap and easily available petroleum products. And that definitely aintgonnahappen - which means we'll be seeing some serious changes. Don't you wish your politicians had spent more time preparing for that, and less time trying to micromanage your personal lifestyle? BTW - no reason to believe his policies will end up any different, but at least he does tell people the truth. I liked this message, because it shows up the Clinton/McCain holiday gas tax reduction for the stupidity it is: http://www.youtube.com/watch?v=fHtFSi99shk

-

Ford GT RIP