#shares

Nissan Dumping Stake in Daimler

On Tuesday, Nissan Motor Co. announced that it would be selling its shares of Daimler AG. The Japanese firm owns about 1.5 percent of Germany’s oldest automaker and the move is something many were predicting after Renault did the same in March.

Nissan’s offloading will mimic its partners and likewise use an accelerated bookbuild offer that basically means dumping shares as quickly as possible with help from an underwriter. Investors were to expect shares to be priced around 69.85 euros apiece, netting the automaker at least $1.2 billion if everything goes smoothly.

Aston Martin Has a Few Problems

Keen to expand into new segments and redefine itself as an auto brand, Aston Marin is now a publicly traded company with a crossover vehicle on the horizon. The plan, established by CEO Andy Palmer and about as novel as dirt, was due for a checkup last week. Sadly, the automaker was not released with a clean bill of health. Aston reported a pre-tax loss of £78.8 million ($92 million) in the six months ending in June.

Speaking with the media, Palmer argued that the company had done well in the first quarter but claimed economic conditions and dwindling dealer interest had hurt the business in Europe, the Middle East and Africa. The United States performed comparatively better — possibly due to the marque bringing on Tom Brady as a brand ambassador, even though at least two of the cars built with the athlete’s name on them have already passed through the secondhand market $100,000 below sticker. Unfortunately, minor victories weren’t nearly enough to keep the firm’s share price from tumbling downward like an allegedly deflated football.

Report: Second Chinese Automaker Amassing Big Daimler Stake

A year after Chinese automaker Geely announced the purchase of a nearly 10-percent stake in auto giant Daimler AG, a second carmaker from the People’s Republic is reportedly interested in acquiring a piece of the German company’s action. A stealthy accumulation of shares could already be underway.

Chinese Automaker Geely Snapping Up a Near 10-percent Stake in Daimler: Report

Is a seemingly unstoppable Chinese automaker slowly amassing a significant ownership stake in Germany’s Daimler AG? That’s what sources tell Bloomberg.

According to the news outlet, sources claim Geely Auto Group, which owns the Volvo, Lotus, and the mysterious Lynk & Co. car brands, is steadily acquiring a $9.2 billion stake in the German giant. That would give the Chinese a near 10-percent stake in the maker of Mercedes-Benz vehicles.

Are we witnessing the birth of a new alliance?

Tesla's New Strategy Includes 'Not Paying' Elon Musk and an Astronomical Share Price

Tesla Motors has announced that its CEO, Elon Musk, won’t be paid unless its already high stock valuation blasts into the stratosphere. The executive’s compensation is now tied to a dozen operational milestones. The first of these requires bringing the company’s current market cap to $100 billion, followed by 11 more set at $50 billion increments.

Agreeing to the program, Musk now has to stay with Tesla until 2028 as both its executive chair and product officer. While this does allow him to bring in another CEO sometime in the future, the company is likely hoping to dispel any speculation that he would abandon the position. It’s good to see Musk putting some serious skin into the game but, as a multi-billionaire, his not being paid unless Tesla’s stock valuation climbs isn’t the biggest threat to his financial security.

Michigan Doesn't Allow Tesla Sales, But Keeps Buying More Tesla Stock

Michigan doesn’t want its residents to order a Tesla, but it sees no problem in owning $72 million in stock to bolster its state retirement fund.

According to The Detroit News, the Michigan Department of Treasury bought a further $48 million in Tesla shares in the second quarter of this year, boosting its stake to 339,623 shares — more than triple the amount it owned in March. Meanwhile, Michigan won’t budge on laws that prevent Tesla from selling vehicles in the state.

Elon Musk's Company Wants to Buy a Company Founded and Chaired by Elon Musk

Founded with the intent of finding energy solutions (and profit) in the power of the sun, SolarCity’s photovoltaic energy business has grown in leaps and bounds since 2006. Now, as the company poises itself for bigger profits, a very familiar man wants to acquire the operation.

Tesla Motors published a note on its website yesterday stating its intention to acquire SolarCity. The offer, made by Tesla, would see the electric automaker trade shares with the San Mateo, California-based company, bringing the business into its fold.

Tesla founder and CEO Elon Musk is no stranger to SolarCity’s operation — he co-founded it with cousins Lyndon and Peter Rive (CEO and CTO of Solar City), and serves as the company’s chairman.

Sausage Fight! Decadent Daimler Shareholders Tangle in Bratwurst Brouhaha

Sometimes, stereotypes exist for a reason.

Things got heated yesterday at a Daimler AG shareholders meeting in Germany, where a fight broke out over lengthy, plump sausages, Bloomberg has reported.

This, despite the fact the lucky shareholders were told they’d be receiving the biggest dividend in the company’s history — 3.25 euros ($3.70) per share. You’d think the windfall would have tempered flare-ups, but you’d be wrong.

So Musk Now Owns 22 Percent of Tesla, But Does It Matter?

The automotive and tech blogs are aflutter Saturday with news that Elon Musk has gobbled up another chunk of Tesla stock — this time at a discount.

Musk exercised and held a stock option this week that saw the multi-billionaire increase his ownership of Tesla Motors by 532,000 shares. In total, those shares are worth over $101 million as of the last closing price of $191.20/share.

Here’s where the discount comes in: Musk’s option dictated a price pegged to the share value as of Dec. 4, 2009, before the automaker went public, of $6.63/share — or just over $3.5 million.

Sounds like Elon got a stellar deal. But does any of it matter? Is owning 1/5th of Tesla a big deal?

Report: Nissan, French Government Strike Deal in Renault Spat

Nissan and the French government struck a deal Friday to end a dispute over how much influence the state has over the carmaking alliance between the Japanese automaker and Renault, according to Renault.

The French government will cap its voting rights between 17.9 percent and 20 percent in non-strategic shareholder decisions, and will preclude “interference” by the government in Nissan by Renault. Renault, which is partially state-owned, is Nissan’s largest shareholder.

Earlier this year, France passed a law that would have given the government increased voting rights in the alliance, perhaps in an attempt to forge a stronger partnership between the two automakers.

Suzuki Will Spend $3.9 Billion to Buy Itself Back From Volkswagen

Suzuki, while at Frankfurt showing off its new Baleno hatchback and next-generation Vitara, is dealing with a financial problem of sorts.

In order to buy itself back from Volkswagen, the Japanese automaker will have to shell out 471.74 billion yen — or $3.9 billion USD. Suzuki plans to purchase as many of those shares back as possible during off-hours trading, before the bell rings Thursday morning.

Suzuki: "I Feel Refreshed" After Win Against Volkswagen

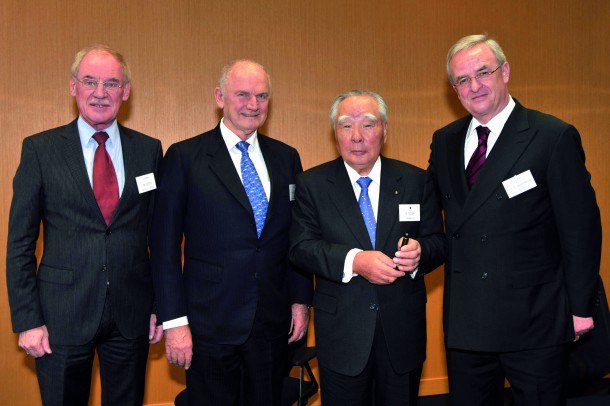

Osamu Suzuki (middle right), chairman of Suzuki Motor Corporation, can finally celebrate his biggest win. After a failed alliance with Volkswagen put Suzuki — the chairman and company — on the back foot for almost four years, the International Court of Arbitration of the International Chamber of Commerce in London has decided in the Japanese company’s favor. Suzuki will purchase back their own stock from Volkswagen.

Suzuki received news of the ruling Saturday and filed the information with the Tokyo Stock Exchange on Sunday.

“It’s good that a resolution came. I feel refreshed. It’s like clearing a bone stuck in my throat,” said to reporters gathered at a news conference in Tokyo, reports Automotive News. “I’m very satisfied with the resolution. Through it, Suzuki was able to attain its biggest objective.”

Further Renault-Nissan Integration Blocked By French Government In Power Play

An attempt to bring further integration within Renault-Nissan resulted in the French government tightening its hold on Renault against CEO Carlos Ghosn.

GM Seeks Aid From NASA, Issues New Ignition-Related Recall

Autoblog reports 2.19 million of the same vehicles under the current General Motors ignition recall are under a new ignition-related recall, as well. The new recall warns of a problem where the key can be removed without the switch moved to the “off” position. According to GM, the automaker is aware of “several hundred” complaints and at least one roll-away accident resulting in injury, and is instructing affected consumers to place their vehicles in park or, in manuals, engage the emergency brake before removing the key from the ignition until repairs are made.

Treasury Won't Sell GM Stock, Hopes For Pick-Up

Throwing investment advice of eminent experts such as the LA Times editorial board and former GM CEO Ed Whitacre in the wind, the Treasury will not sell its holdings in GM as recommended, but hold on to the stock. Why? For the same reasons that prompt smaller scale investors to hold on: The Treasury “expects the stock to rise in the future due to a roll-out of several new vehicles,” people familiar with Treasury’s thinking told Reuters.

Recent Comments