#demand

Volkswagen Temporarily Cutting Production of European EVs

Volkswagen intends to temporarily limit production of the SEAT Cupra Born and its very own ID.3 EV in October. The company has cited market forces as the cause, noting that its Zwickau and Dresden plants in Germany would be throttled down for a couple of weeks.

The Great Used Car Buyup of 2021

With automakers having a difficult time keeping production schedules thanks to COVID restrictions nuking demand and upending supply chains, 2021 arrived with plenty of problems. Desperate to replenish fleets they had sold off while everyone was locked indoors, rental agencies went on a used car buying spree. But it wasn’t just rental fleets that needed to be restocked, dealerships are also finding themselves with fewer models on the lot than they’re accustomed to — which is a bad position to be in when surveys have revealed consumers are now willing to pay stupidly high prices for automobiles.

They’re reportedly going to great lengths to acquire used cars as the great buyup of 2021 continues.

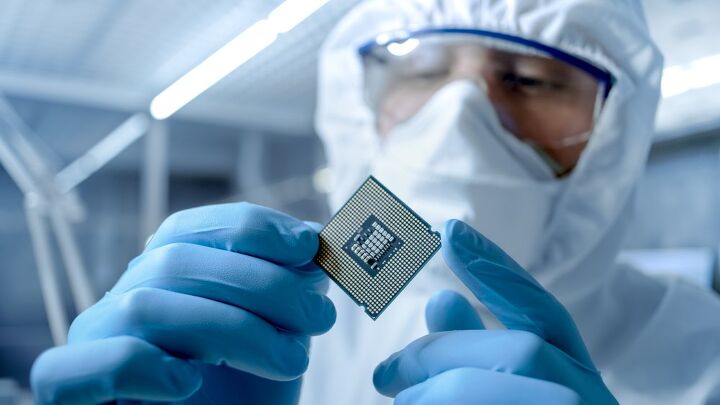

Semiconductor Shortage By the Numbers, Looks Bad

The global shortage of semiconductor chips has really done a number on the industry and it’s just one of several major supplier issues created by our response to the pandemic. Years from now, people will look back and use the benefit of hindsight to come up with the perfect solution to a problem that has since evaporated. But all we can manage in the present is an up-to-date tally on how much product is being lost and wait for better news.

AutoForecast Solutions (AFS) has been keeping tabs on the situation and recently updated its numbers through the week of April 30th. Production schedules in North America are now reportedly 121,000 vehicles shy of where they’re supposed to be. Though we need to pull back and take a gander at what the whole industry was facing ahead of the latest figures to have a more complete understanding of this particularly dire automotive quagmire.

Pass the Chips: VW Group Demands More Semiconductors for Europe

Chip Shortage Expands, GM Forced to Idle Factories

While the Great Semiconductor Shortage of 2021 probably isn’t going to the defining historical topic of the modern era, it’s presently doing a number on the automotive industry. Volkswagen Group, Ford, Mazda, Nissan, Subaru Corp., Toyota, and Stellantis have all reported the need to scale back production this year.

On Wednesday, General Motors said that it would also have to handle the issue by closing down four plants next week. Affected sites include Kansas’ Fairfax Assembly, Ontario’s CAMI Assembly, and Mexico’s San Luis Potosí Assembly. GM Korea will likewise be operating Bupyeong 2 at half capacity, according to Reuters.

U.S. Vehicle Inventories Exceptionally Lean Going Into Fall

Not that it should be any surprise with pricing creeping up, but U.S. vehicle inventories are some of the lowest we’ve seen in roughly a decade. Unfortunately, it’s difficult to get a solid estimate on supplies as many automakers no longer have the balls to conduct monthly reports, at least not any they’re willing to share. The few that still do have been a little light on the lot, however.

Going into fall, we’d expect to see supplies around the 60-day mark with about a quarter of those vehicles representing the upcoming model year. Mainstream brands seem to be running with a lot fewer cars this month. On Monday, Automotive News estimated that September was probably representing the lightest industry-wide supply of vehicles since October of 2011. Meanwhile, Cox Automotive has the industry sitting on 56 days worth of cars — noting that national inventories shrank to 2.26 million vehicles, or about 870,000 fewer from the year before.

Tight Inventory Stands to Hamper July Sales, At Least for Some

Fall holiday discounts aside, the height of summer is typically a good time to head out and buy a car. The weather’s good, new models are rolling into dealers, and markdowns are appearing on older stock taking up precious space. Yet 2020 is anything but a normal year.

As the industry struggles to regain the volume it once enjoyed, threadbare inventories continue to plague automakers, though not everyone’s equal in this exercise.

Long Road to Recovery: Supply Chain Troubles Impact Industry Relaunch

As predicted, supply issues are hampering the automotive industry’s relaunch. The good news is that practically everyone on the planet understood this would be a problem, but it’s undercut by the preliminary damage created by coronavirus lockdowns.

While automakers had sizable cash reserves with which to endure an economic shutdown, many suppliers did not. Small part suppliers have struggled with liquidity as larger equipment manufacturers try to figure out how to ramp up production and address their own supply headaches. As it turns out, shutting down an entire economic sector is a lot easier than restarting one after it’s been kneecapped.

Forget Sex and Adventure - Fear Could Be the Big New Sales Motivator

It’s something we’ve touched upon in the recent past: the fact that, in these pandemic times, a private vehicle is the safest way to get around (from a contagion standpoint). It seems we’re not the only one to rethink the attributes of a personal car. Japanese driving schools are suddenly doing a booming business. Cars.com reports a sudden surge in non-car-owning visitors.

According to data accumulated from numerous countries, automakers could find a slew of newfound buyers once the strictest lockdown measures end.

Suppliers Have More Lithium Than EV Manufacturers Currently Need

The lithium industry — essential for the production of battery electric vehicles — has run into a problem. It’s currently amassing more of the metal than it needs. Despite automakers like Tesla suggesting there will be upcoming global shortages of metals like copper, nickel, and lithium, the only element that battery suppliers appear to be truly desperate for is cobalt, which is largely the fault of where and how it’s mined ( the Congo, often by children).

Demand for the brittle, bluish metal skyrocketed this year, but not lithium. The latter metal’s global supply currently exceeds demand by about 5 percent, according to data from Canaccord Genuity.

Bloomberg: Subaru "has to Decide What Kind of Company It Wants to Be"

Subaru has a problem, though it’s a problem many other automakers would love to have. The small Japanese automaker is growing at a rapid rate and it’s fully expected to run out of capacity to fulfill demand sooner rather than later. Most automakers would simply expand and flood the market with more units to feed the sales rush, but for Subaru it might mean becoming the opposite of the market position and perception they’ve taken years to cultivate.

As Bloomberg‘s Kyle Stock puts it, “Being small, though, is the reason Subaru has become such a big deal. With manufacturing capacity maxed out, it now has to decide what kind of company it wants to be.”

Peak Oil, Meet Plateauing Demand

TTAC is no stranger to the topic of Peak Oil, but the theory has fallen by the wayside with the recent explosion in unconventional oil and gas. A study by the British think tank Chatham House argues that the biggest issue facing oil and gas producers in the coming century isn’t Peak Oil, but Peak Demand ( summary here).

Global EV Demand Stuck At 2%-4%. Unless…

Of all the persistent questions faced by the auto industry in these tumultuous times, perhaps the most pressing is: how many consumers would actually consider buying an electric car? There’s no single answer to this question, but we do have one new perspective on it today, courtesy of a study by Deloitte [ PDF] which analyzed potential EV demand around the world through some 13,000 survey respondents. The major takeaway?

The reality is that when consumers actual expectations for range, charge time, and purchase price (in every country around the world included in this study) are compared to the actual market offerings available today, no more than 2 to 4 percent of the population in any country would have their expectations met today based on a data analysis of all 13,000 individual responses to the survey.

That assessment is well in line with other studies we’ve seen, most of which estimate global EV demand at somewhere between one and five percent of the market. But because potential EV demand has a lot of moving parts, from government regulations to the state of EV technology, there’s more to the study than that conclusion alone…

Pent-Up Demand AWOL: Less Than 13 Million Sales Expected For This Year

U.S. auto sales will probably come in lower than 13 million this year, Ford’s CFO Lewis Booth told Bloomberg. That’s below the low end of Ford’s estimate.

Please Wait: Germany's Carmakers Swamped By Sudden Demand

Carmageddon? What carmageddon?

Germany’s auto industry has a huge problem: Way too many customers. “We have that fattest order books of all times,” said Esther Bahne of Audi to Germany’s Spiegel magazine. Result: Customers have to wait months for their cars. Sometimes longer than ever before, says Der Spiegel.

Recent Comments