#Production

Sedan Down: Subaru Halts Legacy Production

If yer looking for a midsize sedan with all-wheel drive, the list of choices is about to get smaller. Subaru has announced production of the Legacy will end early in the 2025 calendar.

Cool It: Hyundai Testing Innovative Window Film

Applying tint to window glass is hardly a new way to keep the cabin of one’s car cool in direct sunlight – but Hyundai claims there remains innovations to explore in the field of beating the summer heat.

Tesla Cybertruck Deliveries Paused While Ford F-150 Lightning Deliveries Resume

Following a nine-week hold on F-150 Lightning allocations to dealers, Ford has announced it will be resuming shipments. Meanwhile, Tesla reportedly delayed Cybertruck deliveries. The rumor is that it needed to address some quality concerns. But the reasons assumed vary and the company hasn’t said anything about the issue, and likely won’t since it disbanded its PR department years ago. However, this may not be the victory for Blue Oval that it appears.

Italian Government Upset Alfa Romeo ‘Milano’ Will Be Built in Poland

The Italian Minister for Business has criticized Stellantis for manufacturing the Alfa Romeo Milano outside of the country, suggesting that the automaker had likely violated the law.

Senate Bill Seeks to Tariff Chinese Vehicles Out of Existence

This week, Senator Josh Hawley (R-MO) is introducing legislation to increase tariffs on imported Chinese vehicles this week with the stated goal of dealing with the “existential threat posed by China.”

The bill seeks to raise the base tariff rate from 2.5 percent to 100 percent, including vehicles owned by Chinese-based automakers that are assembled in places like Mexico. With Chinese exports already under a 27.5 percent tariff, the changes would effectively make those products prohibitively expensive.

Audi R8 Endures Delayed Demise to Satisfy Demand

While Audi had previously confirmed 2023 as the last year of the R8, production of the model has continued into 2024. The automaker will reportedly be keeping the mid-engine coupe around through March to satisfy demand.

Maserati Delays Quattroporte Folgore

Maserati has delayed the launch of the seventh-generation Quattroporte, citing concerns that the model needs to adhere to a certain level of performance outlined by the manufacturer. However, the benchmarks the brand intends on reaching are largely a mystery and the company has already expressed some troubles related to transitioning its lineup toward all-electric vehicles.

Final Camaro Rolls Off Assembly Line

It’s the end of the line (again) for the Chevy Camaro. According to reports, the brand has wrapped up production of the model entirely, a few weeks past its best-before date thanks to delays partially brought on by UAW strike action earlier this year.

Honda E Ending Sales in Europe

It may have been cuter than a first-generation Civic but Honda’s entirely electric supermini didn’t last very long. Introduced in 2020, the Honda e is being pulled from the European market just one year after it was discontinued in its native Japan.

Report: Chinese Export Rule Changes Could Impact EV Battery Production

China has reportedly decided to place restrictions on exports of graphite, which could spell trouble for American EV manufacturers. Starting this month, the Chinese government requires permits for certain graphite products being exported. This includes synthetic and natural graphite meeting the necessary thresholds to be used on electric vehicle batteries.

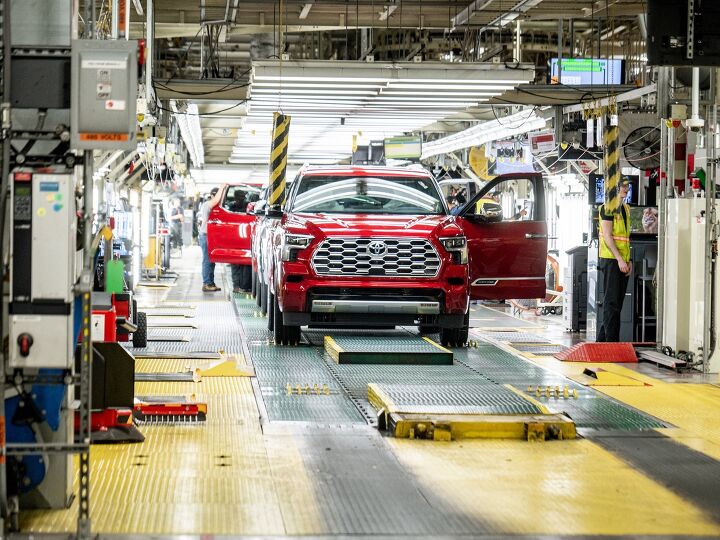

Toyota Assembly Plant in Texas Turns Twenty

Whilst we don’t generally run news of this sort, it is worth noting that this month represents a full two decades since Toyota put shovels in the ground to build what would become their San Antonio truck plant, a spot which currently cranks out Tundra and Sequoia machines.

Chevrolet Equinox EV and GM Electrified Pickups Delayed

Following news that production of the Chevrolet Silverado EV would be delayed, General Motors has announced that the Chevy Equinox EV would likewise be arriving behind schedule.

The postponement was announced as part of GM’s earnings report, with CEO Mary Barra citing improvements the company would like to make to the product as well as some market challenges. Some of that revolves around using the time to better manage capital investment related to EV demand (or lack thereof) while the rest seems to apply to engineering changes that might make the vehicles more profitable.

UAW Broadens Strike to Target Stellantis Truck Plant

On Monday, United Auto Workers (UAW) members went on strike at Stellantis's biggest assembly plant. The move is part of the union’s plan to gradually ramp up pressure against all three of the American-based automakers the UAW is presently in contract negotiations with.

We’ve recently seen the union targeting increasingly important facilities after talks appear to have stagnated. Less progress seems to have been made in recent weeks, with unions ramping up pressure and corporations hoping to sway public opinion via the media.

Is Rivian Still Spending Billions Now to Make Billions Later?

Rivian lost an estimated $33,000 on every pickup it sold in the second quarter of this year, which is kind of impressive considering the cheapest model it sells still goes for a sizable $73,000. Considering its lofty initial public offering (IPO) and enviable product specifications, some are wondering why the company isn’t in better shape.

Though Rivian is hardly alone in selling cash-hemorrhaging electric pickups and SUVs. Ford is on track to lose $4.5 billion on EVs by year's end and is supposed to be underwater by more than $32,000 per average all-electric transaction. Frankly, it doesn’t look like any brand other than Tesla has managed to find a way to make volume electrification work in its favor.

Volkswagen Temporarily Cutting Production of European EVs

Volkswagen intends to temporarily limit production of the SEAT Cupra Born and its very own ID.3 EV in October. The company has cited market forces as the cause, noting that its Zwickau and Dresden plants in Germany would be throttled down for a couple of weeks.

Recent Comments