#Mexico

Used Car of the Day: 1996 Volkswagen Derby

Today we bring you a car that wasn't, to my knowledge, sold new in the United States. It's a Mexican-spec Volkswagen Derby. Which was basically a rebadged SEAT Cordoba.

Mexico Won't Offer EV Incentives to Chinese Automakers

Chinese automakers are expanding into Mexico, with companies like BYD opening dealerships across the country. Even so, the Mexican government isn’t rolling out the red carpet due to pressure from the United States. Automotive News reported that the country would not offer tax incentives or land discounts to Chinese automakers. It noted that the U.S. government believes that they should not be able to enter North America without paying tariffs.

Why Did Trump Propose a 100-Percent Tariff on Mexican Auto Imports?

Earlier this week, Donald Trump suggested that he would impose a 100 percent tariff on select automobiles manufactured in Mexico — sending the industry into a minor tizzy.

Having done some digging into the matter, Trump only appears to be targeting Chinese vehicles being manufactured south of the border. The statement was made during the “Buckeye Values PAC” rally in Dayton, Ohio, and comes after Chinese automaker BYD announced plans to build a production facility in Mexico. While most of the resulting vehicles are assumed to be electric, BYD has stated its intention is not to sell them within the United States.

China’s BYD Says Prospective Mexican Plant Won’t Export to U.S.

Chinese automaker BYD has been seeking to build an automotive plant in Mexico, with the company’s regional chief executive confirming the plan on Wednesday. CEO Stella Li has stated that BYD has yet to decide upon a final location. But that plan is for the site to boast a production capacity of 150,000 vehicles annually, with none being slated for export to the United States.

Senate Bill Seeks to Tariff Chinese Vehicles Out of Existence

This week, Senator Josh Hawley (R-MO) is introducing legislation to increase tariffs on imported Chinese vehicles this week with the stated goal of dealing with the “existential threat posed by China.”

The bill seeks to raise the base tariff rate from 2.5 percent to 100 percent, including vehicles owned by Chinese-based automakers that are assembled in places like Mexico. With Chinese exports already under a 27.5 percent tariff, the changes would effectively make those products prohibitively expensive.

Report: BYD Plotting New EV Factory in Mexico

China’s BYD is reportedly prepared to set up a new production facility in Mexico with the alleged plan to use the locale as an export hub for the United States.

Mexico has long been a convenient venue for automakers vying to sell products within the Western Hemisphere without having to pay the kind of salaries commensurate with higher living standards. American brands love sending jobs to Mexico, as does every other company interested in moving high volume models through North and South America. With BYD having previously voiced its global aspirations, setting up shop in El Águila Real seems like an obvious play.

Report: China’s Chery Considers U.S. Market Yet Again

Chinese state-owned automaker Chery is reportedly still looking to the United States as a possible point of expansion. But this isn’t the first time the brand has said so.

Chery had plans to break into our market back in 2005 and supposedly had things lined up to import a limited supply of its Exeed crossover in 2020 before the world went haywire. Things have been left intentionally vague this time around, with the company only saying that it would like to move product here eventually.

Tesla Heads South of the Border With Confirmed Mexico Gigafactory

Tesla just wrapped its annual Investor Day, where the automaker invites fans and shareholders to hear it brag about its accomplishments and future products. At yesterday’s event, Tesla confirmed the poorly-held secret that a Gigafactory is coming to Mexico.

Mexico’s President Says Tesla Building Mexican EV Plant

On Tuesday, Mexican President Andres Manuel Lopez Obrador announced that Tesla will be building a plant south of the border. Confirmation comes following a call with CEO Elon Musk – held on Monday – with promises that the American company would be issuing a series of commitments designed to address regional water scarcity. The alleged plant is said to be located in Monterrey, which has historically struggled to cope with drought.

U.S. Asks Mexico to Investigate Stellantis' Labor Practices

The United States has requested that Mexico investigate worker rights violations that were alleged to have taken place at one of the parts factories owned by Stellantis. Officials are curious about what’s been happening at Teksid Hierro de Mexico, a facility located in the border state of Coahuila that’s responsible for manufacturing iron casings, in regard to unionization. According to U.S. officials, this is the fourth such complaint under the United States-Mexico-Canada Agreement (USMCA).

Having supplanted the North American Free Trade Agreement (NAFTA) signed into law by the Clinton administration in 1993, USMCA sought to rebalance trade laws the Trump administration believed had disadvantaged the United States. However, it also sought to advance worker protections in Mexico and give employees an easier pathway toward unionization.

Setting the Stage? Mexican Auto Employees Elect Independent Union

When the United States-Mexico-Canada Agreement (USMCA) was being floated as a possible replacement for the North American Free Trade Agreement (NAFTA), one of the biggest selling points was the inclusion of new labor protections for Mexican workers. The Trump administration wanted to ensure serious labor reform took place south of the border to ensure union business was conducted responsibly and wages would increase. As a byproduct, USMCA is supposed to encourage North American synergies while gradually discouraging U.S. businesses from blindly sending jobs to Mexico to capitalize on poverty tier wages.

That theory will now be tested in earnest after General Motors employees from the Silao full-size truck plant voted overwhelmingly to dump the Confederation of Mexican Workers (CTM) for the Independent Syndicate of National Workers (SINTTIA).

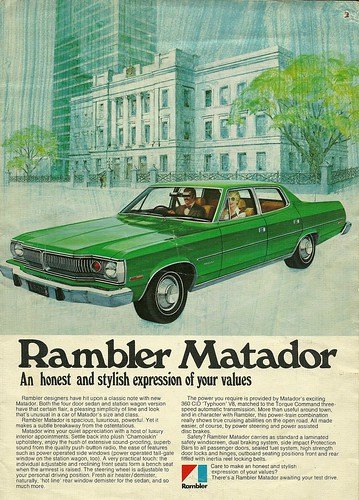

Rare Rides Icons: The AMC Matador, Medium, Large, and Personal (Part IV)

We finish up our Rare Rides Icons coverage of the AMC Matador today by spending some time abroad. The Matador maintained a few different passports as it donned new branding and nameplates for its various international adventures. And unlike many domestic cars of the period, AMC saw sales success when its midsize arrived in other markets.

Canada Joins Mexico in Trade Dispute Against United States

Mexican and Canadian officials have been dropping hints that they’re not all that enthusiastic about the United States-Mexico-Canada Agreement (USMCA) since before Enrique Peña Nieto, Donald Trump, and Justin Trudeau all sat down to sign it in 2018. But just getting to that point required months of formal negotiations that rarely looked to be all that productive.

Sadly, things don’t seem to have changed now that the USMCA is in full effect. Last week, Mexico requested a dispute settlement panel under the terms of the trade pact to help resolve disagreements about the surprisingly contentious automotive content stipulations that determine whether or not vehicles and parts will be slapped with tariffs. Under the previous North American Free Trade Agreement (NAFTA), 62.5 percent of the vehicle’s components had to be sourced from member nations to be considered tax-exempt. In an effort to spur localized production, USMCA increased that number to 75 and not everyone is thrilled with the updated content requirements with Mexico claiming it’s not even sure how to apply them. Canada now intends to formally sign onto Mexico’s complaint against the U.S. over their divergent interpretation of rules.

Mexico Gives Amnesty to Illegal American Cars

Last week, Mexican President Andrés Manuel López Obrador made a pledge to legalize millions of vehicles being illegally imported from the United States. While it sounds like a phenomenal way to help the nation to contend with product shortages that are driving up vehicle prices around the globe, all of the cars had been smuggled previously and many were presumed to have been stolen.

This has created a lot of tension. Despite there being evidence that these vehicles frequently end up becoming workhorses for criminal cartels, illegally imported beaters also provide a cheap alternative to poorer residents right when automotive prices (new and used) have started to disconnect from reality. Times are tough and destitute families aren’t going to care where a car comes from when it’s the only one they can afford. So López Obrador has officially launched a new regularization program designed to bring these automobiles into the fold.

U.S. and Mexico Can't Come Together On Light Vehicle Rules

When the United States abandoned the North American Free Trade Agreement (NAFTA) to embrace the United States-Mexico-Canada Agreement (USMCA), it did so under the premise of crafting a better trade arrangement for itself. Established in 1994, NAFTA created a trilateral trade bloc that encouraged commerce between nations. But critics have accused it of encouraging the offshoring of U.S. jobs and dramatically suppressing wages — particularly within the automotive and manufacturing sectors.

Signed in 2018, and revised the following year, the USMCA was supposed to remedy those issues. But it’s been difficult to get all parties on board, especially when it comes to those persnickety rules of origin that stipulate how much of a vehicle’s hardware needs to be sourced from member nations.

Recent Comments