#FederalHighwayTrustFund

White House May Propose Gas Tax Holiday [Updated]

National fuel prices are currently averaging right around $5.00 per gallon in the United States. However, there are plenty of states with stations listing gasoline well above $6.00 per gallon with diesel being driven even higher. This has started to wreak havoc on the trucking industry, which is now seeing companies pausing shipments to renegotiate contracts, and infuriated consumers who remember a gallon of gas being $2.17 during the summer of 2020.

Earlier this year, Congress and the White House suggested suspending the federal fuel tax to alleviate the financial burden. But the notion was walked back, as prices were relatively low at the time (roughly $3.50 per gallon) and criticisms swelled that this simply exchanged one problem for another. Four months later and things are looking rather desperate, with the Biden administration revisiting the premise of pausing fuel tax to help soften the blow of record-breaking prices at the pump.

Suspending Federal Fuel Tax Pitched By Senate, White House

President Joe Biden and Democratic lawmakers have suggested ending the federal gas tax until 2023 as a way to offset fuel prices that are nearing record levels and possibly appease some on-the-fence voters ahead of midterm elections. Senators Mark Kelly (D-AZ) and Maggie Hassan (D-NH) recently pitched the bill in Congress. While the White House has not made any official endorsements, it’s offered tacit support by saying it didn’t want to limit itself in terms of finding new ways of easing the financial burdens Americans are facing during a period of high inflation.

“Every tool is on the table to reduce prices,” White House assistant press secretary Emilie Simons said in regard to a possible gas tax holiday. “The president already announced an historic release of 50 million barrels from the Strategic Petroleum Reserve, and all options are on the table looking ahead.”

House Democrat Introduces Bill to Raise Federal Gasoline Tax by 15 Cents Per Gallon

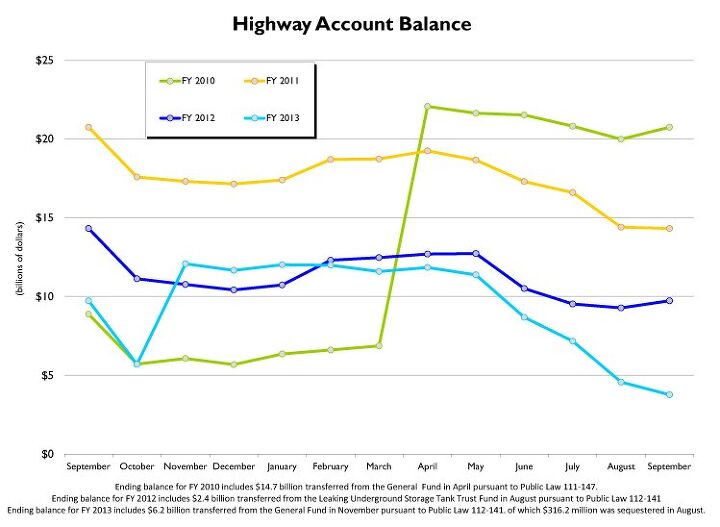

Federal taxes on highway fuels haven’t been raised in 20 years. Because of inflation and better fuel economy, the Highway Trust Fund, into which those taxes flow and out of which transportation funding is dispersed, faces a shortfall. Standing next to labor, construction and business leaders, Rep. Earl Blumenauer (D-Ore.) announced that he has introduced legislation that would raise the federal tax on gas to 33.4 cents per gallon and on diesel to 42.8 cents.

“Every credible independent report indicates that we are not meeting the demands of our stressed and decaying infrastructure system — roads, bridges and transit,” Blumenauer said. “Congress hasn’t dealt seriously with the funding issue for 20 years,” the congressman continued. “With inflation and increased fuel efficiency, especially for some types of vehicles, there is no longer a good relationship between what road users pay and how much they benefit. The average motorist is paying about half as much per mile as they did in 1993.”

Begun, The Bike-Car Wars Have

The DOT policy is to incorporate safe and convenient walking and bicycling facilities into transportation projects. Every transportation agency, including DOT, has the responsibility to improve conditions and opportunities for walking and bicycling and to integrate walking and bicycling into their transportation systems. Because of the numerous individual and community benefits that walking and bicycling provide — including health, safety, environmental, transportation, and quality of life — transportation agencies are encouraged to go beyond minimum standards to provide safe and convenient facilities for these modes.

Having spent most of his tenure chiding distracted drivers and hunting down demon-possessed Toyotas, Transportation Secretary Ray LaHood appears to be over the whole car thing. The policy statement above was just one element of his push to put bicycling and other car alternatives on an equal footing to cars in transportation planning, which he recently announced at the National Bike Summit.

![White House May Propose Gas Tax Holiday [Updated]](https://cdn-fastly.thetruthaboutcars.com/media/2022/07/10/8870350/white-house-may-propose-gas-tax-holiday-updated.jpg?size=720x845&nocrop=1)

Recent Comments